- United States

- /

- Software

- /

- NasdaqGS:CRWD

How New AI Partnership and Product Launches at CrowdStrike (CRWD) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, CrowdStrike announced a sweeping partnership with CoreWeave to power secure AI cloud foundations, alongside new product launches such as Falcon for XIoT innovations and Charlotte Agentic SOAR to orchestrate AI-powered cybersecurity operations.

- These developments put CrowdStrike at the center of the AI-driven cybersecurity transformation, enabling faster, more resilient protection for complex cloud, industrial, and operational environments.

- We'll explore how CrowdStrike's CoreWeave collaboration and evolving agentic security platform could reshape its investment outlook and growth drivers.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

CrowdStrike Holdings Investment Narrative Recap

To be a CrowdStrike shareholder today, you need conviction in the company's ability to lead the AI-powered cybersecurity shift, driving adoption of its expanding platform across cloud, operational, and industrial domains. While CrowdStrike's partnership with CoreWeave and new Falcon product launches could support key catalysts, like accelerating platform adoption and AI leadership, the immediate implications for near-term revenue or margin volatility appear limited as competitive pressures and execution risks remain watchpoints.

Among the recent announcements, the Charlotte Agentic SOAR launch arguably stands out. As the engine of CrowdStrike’s agentic platform, it exemplifies how the company is pushing automation and AI-driven orchestration as a catalyst for customer stickiness and long-term ARR growth, even as competitors continue to innovate and pressure the market.

Yet in contrast, investors should be aware that competition and rising costs in cloud security could weigh on operating margins if...

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' narrative projects $7.9 billion revenue and $691.1 million earnings by 2028. This requires 22.1% yearly revenue growth and a $988.1 million increase in earnings from -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $505.91 fair value, a 6% downside to its current price.

Exploring Other Perspectives

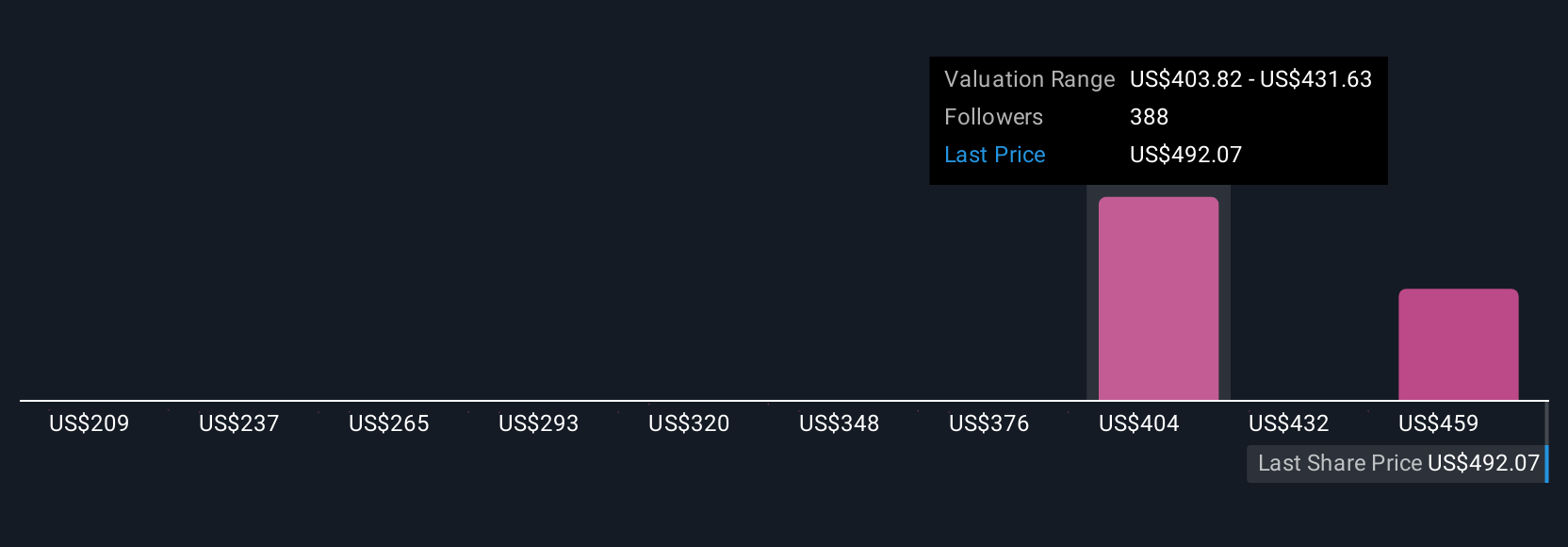

Fair value estimates by 28 Simply Wall St Community members span a wide US$277 to US$600.50 per share. If execution risks in CrowdStrike’s product roadmap persist, these diverging outlooks highlight why it is important to weigh multiple viewpoints before making decisions.

Explore 28 other fair value estimates on CrowdStrike Holdings - why the stock might be worth 49% less than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives