- United States

- /

- Software

- /

- NasdaqGS:CRWD

Did CrowdStrike's (CRWD) AI-Powered SMB Push with BT and NVIDIA Just Shift Its Cloud Security Trajectory?

Reviewed by Sasha Jovanovic

- BT Group recently announced a partnership with CrowdStrike Holdings to launch BT Business Antivirus Detect and Respond, a new AI-powered cybersecurity service for UK small and medium-sized businesses, as well as CrowdStrike's collaboration with NVIDIA to develop autonomous, continuously learning AI agents for cybersecurity across diverse environments.

- This expansion underscores CrowdStrike’s commitment to strengthening its European presence and driving AI innovation in cybersecurity, creating new opportunities to address the needs of resource-constrained businesses and advancing protection at the edge.

- We'll explore how CrowdStrike's expanded AI partnerships and new SMB offerings may impact its long-term cloud security growth trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

CrowdStrike Holdings Investment Narrative Recap

To be a CrowdStrike shareholder, you need to believe in ongoing cloud security adoption, the effectiveness of AI-powered defense, and CrowdStrike’s ability to turn scale into sustainable profit growth. Recent news around the BT and NVIDIA partnerships aligns closely with these themes, offering expanded AI defenses and new customer segments, but it does not fundamentally change the near-term catalyst, which remains execution of Falcon Flex and consistent ARR growth. The biggest risk continues to be whether new product and partnership launches, including for SMBs, convert quickly enough to offset high operational costs.

Among recent announcements, the partnership with BT to launch AI-driven cybersecurity for UK small and medium-sized businesses stands out. It directly addresses a fast-growing, underserved segment, reinforcing CrowdStrike’s urgency to drive expansion through accessible, easy-to-deploy solutions, supporting its top-line growth catalysts in new markets. Contrasting this, investors should also be mindful of the underlying risk if new products and partnerships fail to generate the anticipated revenue lift...

Read the full narrative on CrowdStrike Holdings (it's free!)

CrowdStrike Holdings' narrative projects $7.9 billion in revenue and $691.1 million in earnings by 2028. This requires 22.1% yearly revenue growth and a $988.1 million increase in earnings from the current level of -$297.0 million.

Uncover how CrowdStrike Holdings' forecasts yield a $498.91 fair value, a 8% downside to its current price.

Exploring Other Perspectives

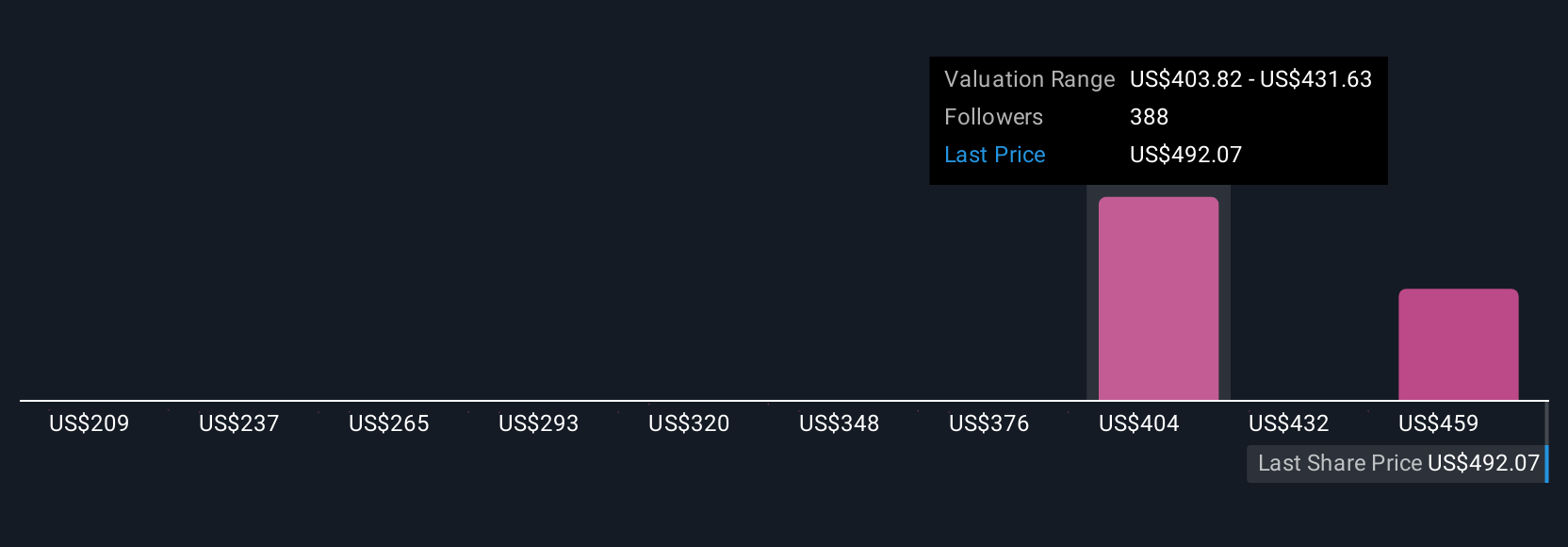

Within the Simply Wall St Community, 29 fair value estimates for CrowdStrike range from US$277 to US$600.50 per share. These wide views underscore how growth opportunities from AI and cloud security, as well as execution risks, leave plenty of room for differing outlooks, explore these varied perspectives to inform your own.

Explore 29 other fair value estimates on CrowdStrike Holdings - why the stock might be worth 49% less than the current price!

Build Your Own CrowdStrike Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CrowdStrike Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CrowdStrike Holdings' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives