- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike (CRWD) Valuation in Focus Following AI Product Launches, Strategic Partnerships, and Bold Growth Targets

Reviewed by Kshitija Bhandaru

For investors tracking CrowdStrike Holdings (CRWD), the buzz this week is hard to ignore. Fresh off its Fal.Con 2025 conference, the company delivered a slew of announcements, rolling out new AI-powered products like Threat AI and Falcon Data Protection, and unveiling deeper partnerships with heavyweights including NVIDIA, Salesforce, AWS, and KPMG. This stream of developments feeds right into today’s conversations around cybersecurity, AI, and vendor consolidation, challenging anyone watching the sector to reassess where CrowdStrike could go next.

Amid this wave of innovation and strategic deals, CrowdStrike’s shares have picked up meaningful momentum over the past month, gaining nearly 14%. That continues a strong run for investors: the stock is up 68% over the past year and has notched a 192% total return in the past three years. With partners and customers voicing above-average satisfaction, and analysts shifting into a more supportive stance, the story here is one of sustained growth and shifting expectations. It is also a case of markets grappling with how much future success is already in the price.

So after such a rapid run-up, and with the bar now set high, is CrowdStrike still offering a buying opportunity, or has the market more or less factored in all of this future growth?

Most Popular Narrative: 11.6% Overvalued

The most widely followed narrative on CrowdStrike’s valuation suggests the stock is currently trading above fair value, primarily because its future growth, while robust, may already be reflected in the price. According to the narrative by Tokyo, the company’s modular cloud-based approach, strong ARR trajectory, and recent transition to profitability have fueled high investor expectations, but at a valuation that is seen as ambitious.

The falcon suit already covers 20 different modules. CRWD is very active in acquisitions, so the suit will be extended continuously. This is perfect for customers because all modules are interconnected, so no silos anymore. In my opinion they have the perfect product, similar to Netflix.

Is CrowdStrike’s “perfect product” really priced for perfection? Curious about the math that sets this fair value? The narrative’s bold valuation hinges on aggressive assumptions about future recurring revenue and the company’s unique modular business model, but the specific financial levers remain behind the curtain for now. Keep reading to uncover what powers the premium embedded in this price target.

Result: Fair Value of $431.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected recurring revenue growth or a negative customer response to product updates could quickly challenge the premium built into CrowdStrike’s current valuation.

Find out about the key risks to this CrowdStrike Holdings narrative.Another View: SWS DCF Model Perspective

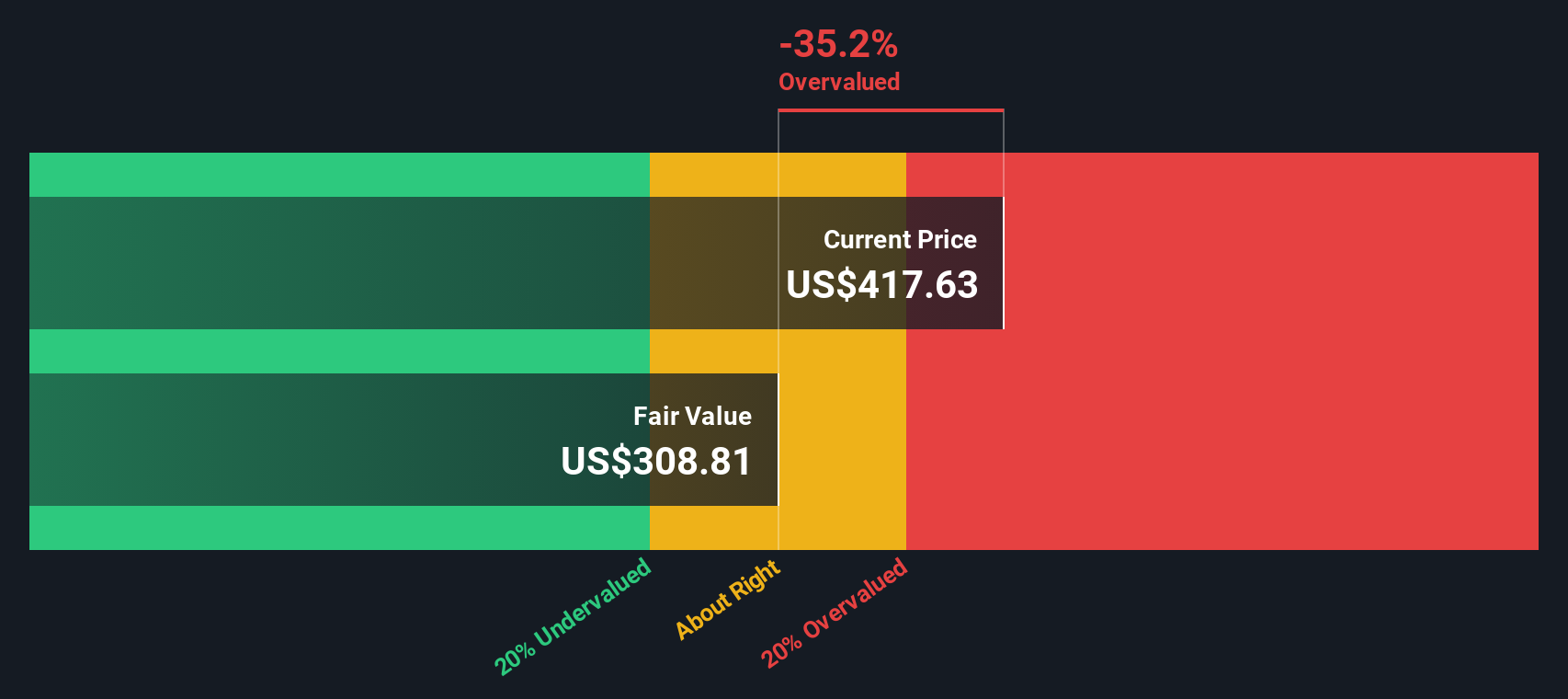

Looking at the numbers through the lens of our SWS DCF model, we see a similar story. CrowdStrike’s current share price also lands above what the discounted cash flow suggests is fair value. Might the market’s optimism be running too far ahead, or is there an overlooked factor boosting sentiment?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CrowdStrike Holdings Narrative

If you have a different perspective or want to dig into the details firsthand, you can quickly craft your own CrowdStrike narrative with just a few clicks. Do it your way

A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your growth story. Use the Simply Wall Street Screener to uncover companies that fit your ambitions and turn today’s insights into tomorrow’s success.

- Kickstart your search for true value champions by scanning for stocks that stand out as undervalued stocks based on cash flows because of strong cash flows and hidden potential.

- Fuel your portfolio with innovation by targeting AI penny stocks that harness artificial intelligence for tomorrow’s breakthroughs and competitive edge.

- Grab income opportunities by focusing on dividend stocks with yields > 3% which consistently deliver high yields and reliable returns for serious income seekers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives