- United States

- /

- Software

- /

- NasdaqGS:CORZ

How Investors May Respond To Core Scientific (CORZ) AI Hosting Revenue Surge and Shift Beyond Bitcoin

Reviewed by Sasha Jovanovic

- Following Nvidia’s blockbuster third-quarter earnings report, Core Scientific saw increased interest as its AI hosting business experienced 45% revenue growth and expanded high-power contracts, benefiting from sector-wide demand for computing capacity.

- This momentum highlights Core Scientific’s transition from a sole focus on Bitcoin mining to a broader role in supporting the artificial intelligence infrastructure build-out, particularly as it capitalizes on long-term hosting contracts with clients like CoreWeave.

- Next, we’ll explore how Core Scientific’s rapid AI hosting revenue growth could reshape its investment outlook and risk profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Core Scientific Investment Narrative Recap

To own Core Scientific stock today, an investor needs confidence in the company’s ability to accelerate its transition toward AI hosting and high-performance computing (HPC) services, offsetting the declining Bitcoin mining revenue. The recent surge in AI hosting revenues, following Nvidia’s strong results, may offer a short-term catalyst, but it does not materially reduce the major near-term risk of Core Scientific’s concentrated customer exposure to CoreWeave and still-evolving profitability profile.

Of the company’s recent announcements, the terminated merger agreement with CoreWeave stands out as especially relevant. Its conclusion leaves Core Scientific independent, reinforcing how much the company’s growth opportunity and risk profile now depend on attracting additional large-scale hosting clients, beyond CoreWeave, to support the next stages of revenue diversification.

In contrast, investors should be aware that despite strong AI momentum, concentration risk tied to CoreWeave remains unresolved and…

Read the full narrative on Core Scientific (it's free!)

Core Scientific's narrative projects $1.5 billion revenue and $334.4 million earnings by 2028. This requires 60.9% yearly revenue growth and a $929.6 million earnings increase from -$595.2 million.

Uncover how Core Scientific's forecasts yield a $27.65 fair value, a 82% upside to its current price.

Exploring Other Perspectives

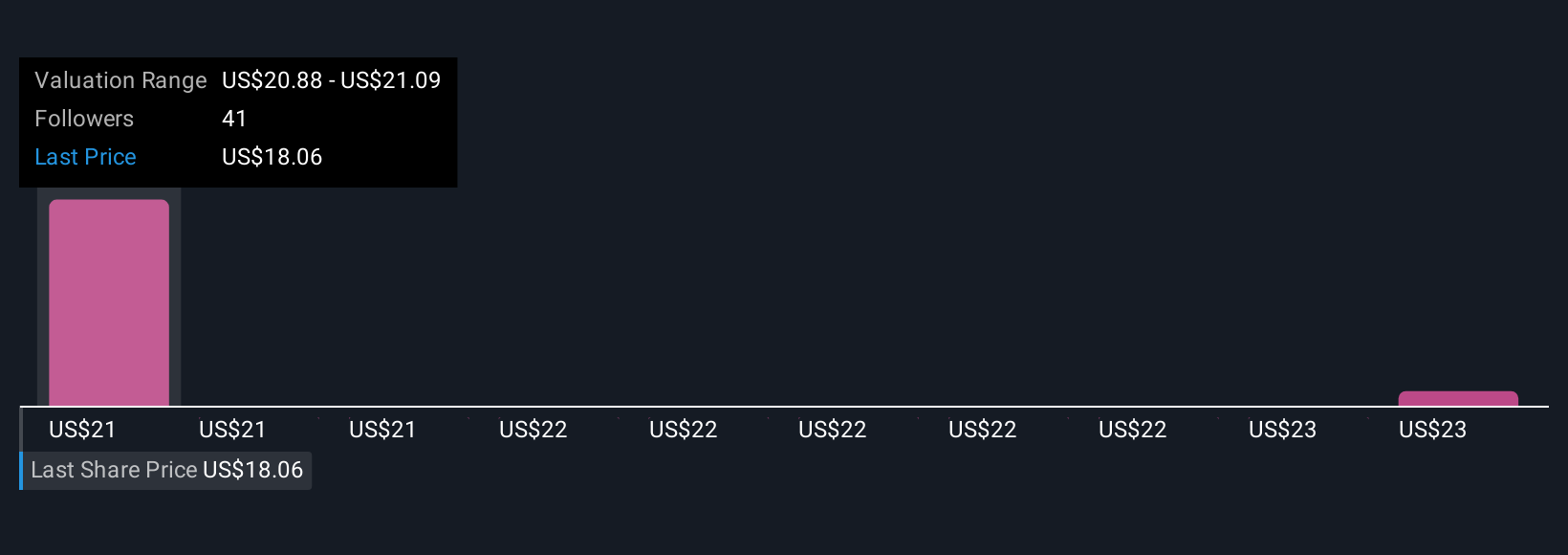

Three members of the Simply Wall St Community estimated Core Scientific's fair value between US$23.00 and US$27.65 per share, reflecting a wide spectrum of expectations. While this range signals a variety of outlooks, the heavy reliance on a single client for revenue remains a key issue influencing future financial stability.

Explore 3 other fair value estimates on Core Scientific - why the stock might be worth just $23.00!

Build Your Own Core Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Core Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core Scientific's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives