- United States

- /

- Software

- /

- NasdaqGS:CORZ

Core Scientific, Inc.'s (NASDAQ:CORZ) Revenues Are Not Doing Enough For Some Investors

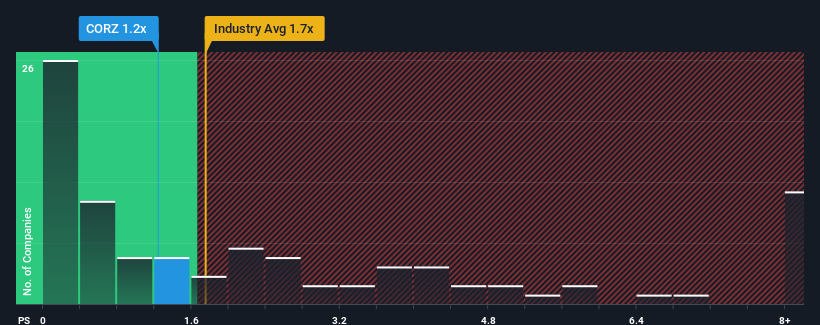

With a price-to-sales (or "P/S") ratio of 1.2x Core Scientific, Inc. (NASDAQ:CORZ) may be sending bullish signals at the moment, given that almost half of all the IT companies in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Core Scientific

How Has Core Scientific Performed Recently?

While the industry has experienced revenue growth lately, Core Scientific's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Core Scientific.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Core Scientific would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.9% as estimated by the four analysts watching the company. With the industry predicted to deliver 9.1% growth, that's a disappointing outcome.

With this information, we are not surprised that Core Scientific is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Core Scientific's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Core Scientific's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Core Scientific's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Core Scientific (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives