- United States

- /

- Software

- /

- NasdaqGS:CORZ

Core Scientific (CORZ) Valuation Spotlight Follows Cancelled Sale and Bullish Growth Upgrades

Reviewed by Simply Wall St

Core Scientific (CORZ) shares are drawing attention after the company’s planned sale to CoreWeave was terminated. With this decision, Core Scientific will remain a public company and continue trading on the Nasdaq exchange.

See our latest analysis for Core Scientific.

After the canceled sale, Core Scientific’s share price has seen big swings, including a 22% jump over the past month and a 54% share price return in the last 90 days. While the stock is off a bit after its recent highs, long-term momentum is still firmly positive. A one-year total shareholder return of nearly 67% suggests the market is warming up to its renewed independence and growth prospects.

If you’re keeping an eye on fast-moving names with changing fortunes, now is the perfect moment to widen your search and see fast growing stocks with high insider ownership.

After a dramatic run-up and a string of analyst upgrades, the big question now is whether Core Scientific’s strong momentum still leaves room for fresh gains, or if the market has already priced in its next stage of growth.

Most Popular Narrative: 13.9% Undervalued

Core Scientific’s most popular market narrative points to a fair value of $25.25 per share, a premium over its last close at $21.74. This has drawn significant attention, as it reflects optimism that the company’s post-merger growth story is just getting started.

Core Scientific’s significant power portfolio, combined with strong demand for high performance computing and artificial intelligence infrastructure, positions it favorably within the digital infrastructure sector. Analysts anticipate continued positive re-ratings for companies with robust energy and data center resources. This suggests Core Scientific could benefit from broader sector tailwinds.

Want to know what’s fueling such a strong valuation for this once-controversial name? Hint: The narrative is banking on dramatic expansion in both top-line growth and profitability, with ambitious targets for Core Scientific’s future earnings. Want to uncover the financial forecasts and the sector dynamics that justify this bullish price? Find out what numbers and market bets analysts are really making in this evaluation.

Result: Fair Value of $25.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing execution risks and Core Scientific’s reliance on a single major client could quickly challenge the upbeat outlook if conditions change unexpectedly.

Find out about the key risks to this Core Scientific narrative.

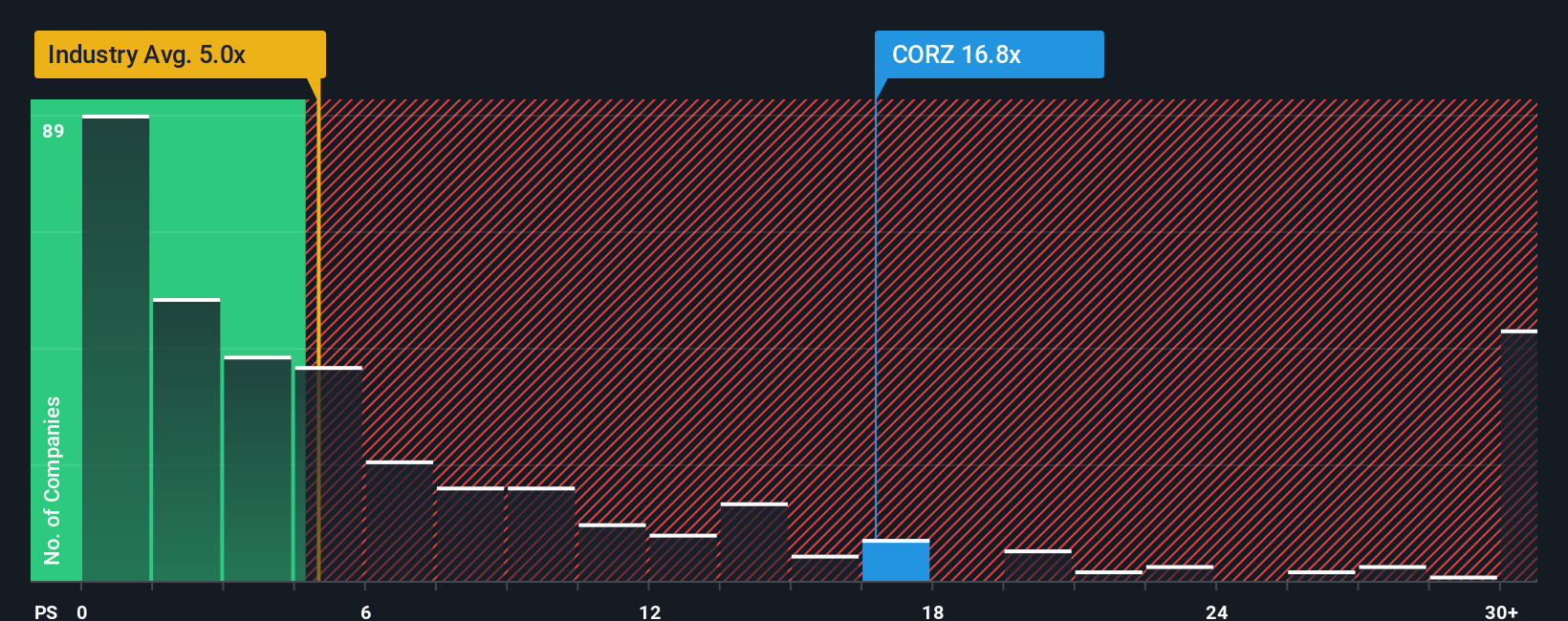

Another View: Multiples Suggest a Valuation Disconnect

Looking at Core Scientific through the lens of price-to-sales, the company trades at 20.2x, making it significantly more expensive than both peers (6.2x) and the US software industry average (5.3x). The fair ratio sits at just 7x. This high premium could point to heightened expectations or valuation risk. Are investors banking too much on future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If you want to dig deeper or challenge the prevailing view, you can explore the numbers yourself and build a narrative in just minutes. Do it your way

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay ahead by broadening their horizons. Don’t limit your potential; tap into exclusive opportunities that others might overlook using these powerful screeners:

- Accelerate your growth strategy by targeting these 840 undervalued stocks based on cash flows built on solid financials and strong future prospects.

- Collect consistent income by choosing these 20 dividend stocks with yields > 3% featuring stable yield above 3% for dependable portfolio returns.

- Step into the future and seize opportunities with these 26 AI penny stocks powering innovation across tomorrow’s hottest tech frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives