- United States

- /

- Software

- /

- NasdaqCM:CLSK

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

The market has been flat in the last week but is up 20% over the past year, with earnings forecast to grow by 15% annually. In this context, identifying high-growth tech stocks that can capitalize on these positive trends becomes crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.81% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 248 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bitdeer Technologies Group (NasdaqCM:BTDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bitdeer Technologies Group operates as a technology company specializing in blockchain and computing, with a market cap of $785.37 million.

Operations: The company generates revenue primarily from data processing, amounting to $420.89 million. Bitdeer Technologies Group focuses on blockchain and computing solutions.

Bitdeer Technologies Group's recent initiatives highlight its dynamic approach in the tech sector. The company is forecasting a revenue growth of 26% per year, significantly outpacing the US market's 8.6%. Despite being unprofitable, Bitdeer's earnings are projected to grow by an impressive 98.9% annually. Their R&D expenditure underscores their commitment to innovation, with $150 million allocated for advanced AI and ML infrastructure development, enhancing scalability and efficiency across operations.

- Click to explore a detailed breakdown of our findings in Bitdeer Technologies Group's health report.

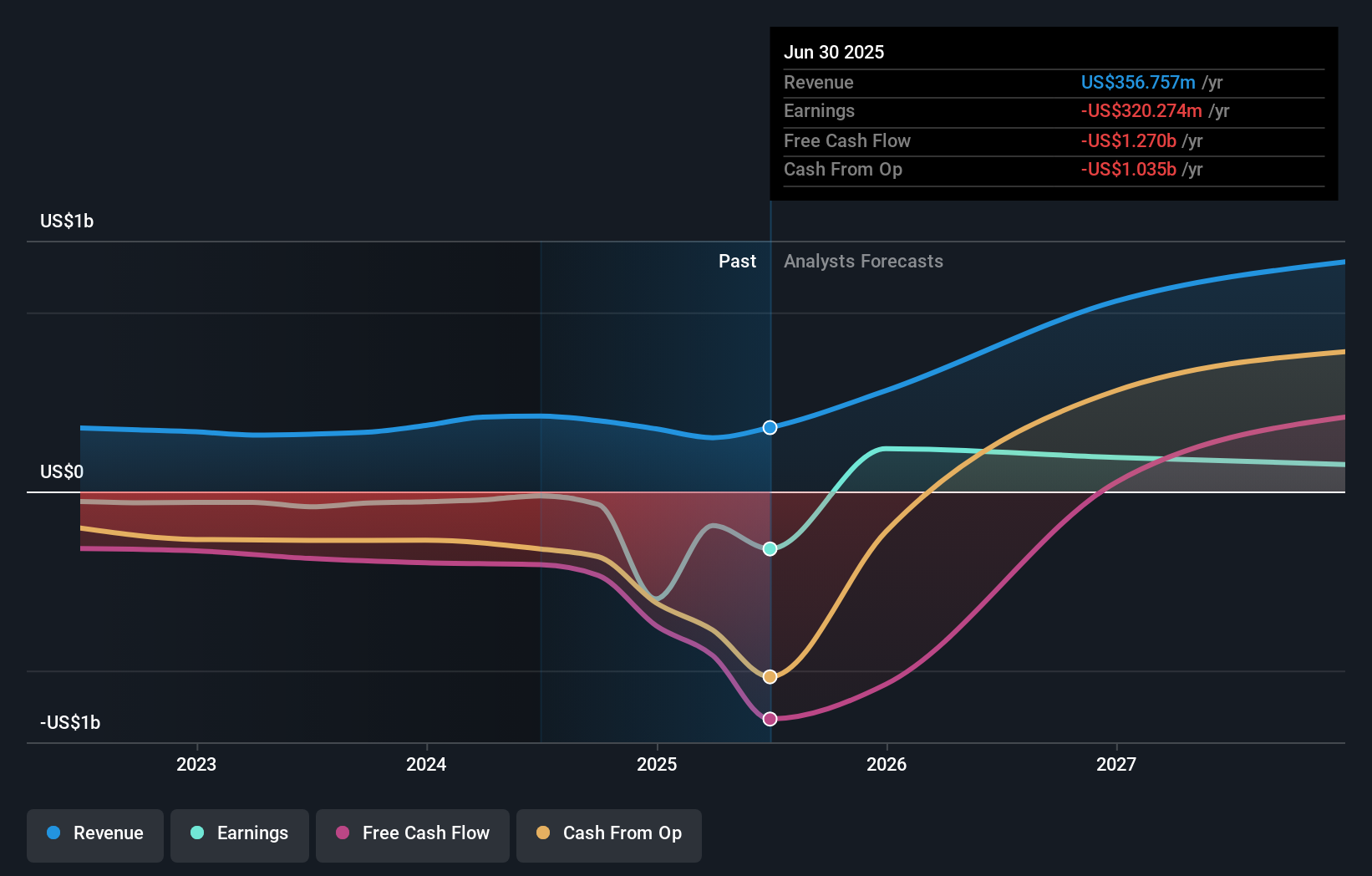

CleanSpark (NasdaqCM:CLSK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CleanSpark, Inc. operates as a bitcoin miner in the Americas and has a market cap of $2.21 billion.

Operations: CleanSpark, Inc. generates revenue primarily from its bitcoin mining operations, amounting to $342.21 million. The company focuses on leveraging advanced technologies to optimize its mining efficiency and profitability within the cryptocurrency sector.

CleanSpark's recent developments underscore its dynamic approach within the tech sector, particularly in Bitcoin mining. The company reported a remarkable revenue growth of 41.3% annually, significantly outpacing the US market's average of 8.6%. Despite a net loss of $236.24 million for Q3 2024, CleanSpark mined 494 bitcoins in July alone and executed power contracts to expand its operational capacity by an additional 75 MW. Their R&D expenditure highlights commitment to innovation with $189 million allocated towards advanced AI infrastructure development enhancing scalability and efficiency across operations.

- Dive into the specifics of CleanSpark here with our thorough health report.

Evaluate CleanSpark's historical performance by accessing our past performance report.

Iris Energy (NasdaqGS:IREN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Iris Energy Limited owns and operates bitcoin mining data centers, with a market cap of approximately $1.35 billion.

Operations: Iris Energy Limited generates revenue primarily from building and operating data center sites dedicated to bitcoin mining, with annual revenue of $188.76 million. The company's market cap is approximately $1.35 billion.

Iris Energy's robust growth trajectory is evident with a 42.4% annual revenue increase, outpacing the US market's 8.6%. Despite an annual net loss of $28.96 million for FY2024, the company reported significant sales of $184.09 million, up from $75.51 million last year. The company's commitment to innovation is underscored by its R&D expenditure aimed at enhancing AI and Bitcoin mining infrastructure, achieving a notable operational hashrate of 9,008 PH/s in July alone.

- Click here and access our complete health analysis report to understand the dynamics of Iris Energy.

Assess Iris Energy's past performance with our detailed historical performance reports.

Taking Advantage

- Click here to access our complete index of 248 US High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

High growth potential and good value.