- United States

- /

- IT

- /

- NasdaqGS:KC

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 1.5% in the last week and increasing by 12% over the past year, with earnings projected to grow by 14% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.18% | 60.67% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.64% | 61.12% | ★★★★★★ |

| Ascendis Pharma | 35.14% | 60.18% | ★★★★★★ |

| Lumentum Holdings | 22.86% | 103.97% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

CleanSpark (CLSK)

Simply Wall St Growth Rating: ★★★★★☆

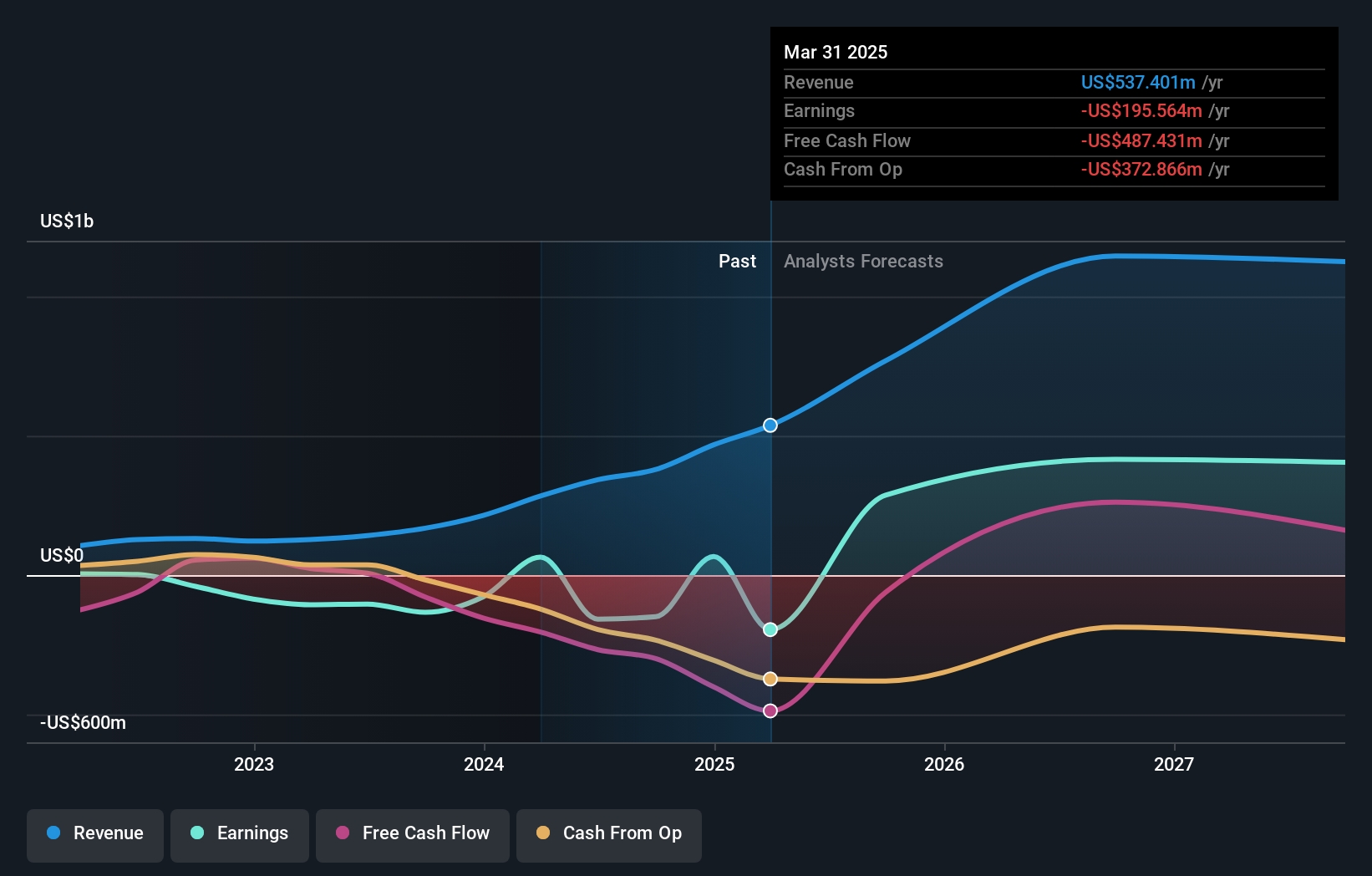

Overview: CleanSpark, Inc. is a bitcoin mining company operating in the Americas with a market cap of $2.75 billion.

Operations: The company generates revenue primarily through its bitcoin mining operations, with the Bitcoin Mining Business contributing $537.40 million.

CleanSpark's recent performance underscores its potential in the high-growth tech sector, despite current unprofitability. With an impressive forecasted annual revenue growth of 33.1%, the company is set to outpace the US market average significantly. Additionally, CleanSpark's strategic focus on Bitcoin production is evident from its monthly output increase and sales results, such as selling 293.5 Bitcoin at approximately $102,254 each in May 2025. This approach not only highlights its adaptability within the cryptocurrency segment but also aligns with broader financial trends favoring digital assets. The firm's R&D commitment further positions it to capitalize on evolving tech demands, although specific spending figures were not disclosed in the provided data.

- Take a closer look at CleanSpark's potential here in our health report.

Explore historical data to track CleanSpark's performance over time in our Past section.

Kingsoft Cloud Holdings (KC)

Simply Wall St Growth Rating: ★★★★☆☆

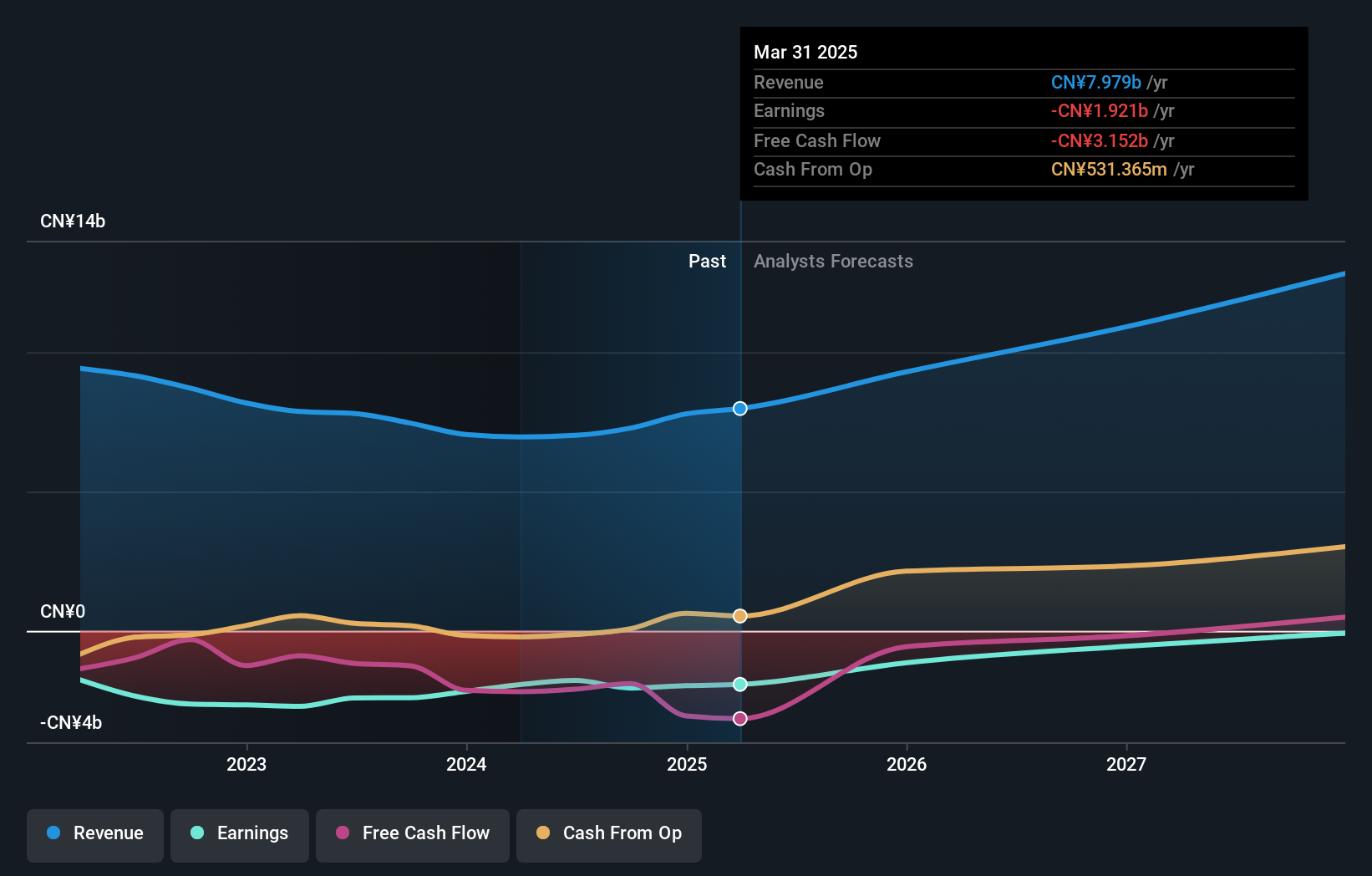

Overview: Kingsoft Cloud Holdings Limited offers cloud services to businesses and organizations mainly in China, with a market capitalization of approximately $3.01 billion.

Operations: Kingsoft Cloud Holdings generates revenue through its Internet Software & Services segment, which reported CN¥7.98 billion. The company focuses on providing cloud services primarily to businesses and organizations in China.

Despite its current unprofitability, Kingsoft Cloud Holdings is navigating a path toward profitability with an expected earnings growth of 81.7% per year. The company's recent revenue growth at 15.3% annually surpasses the US market average of 8.6%, indicating robust potential in a competitive tech landscape. Furthermore, strategic investments in R&D are pivotal for Kingsoft, as evidenced by its significant spending which aligns with its innovation-driven approach to capturing market share in cloud services—a sector witnessing exponential demand growth. This focus on high-margin cloud solutions, coupled with a promising shift towards profitability, positions Kingsoft Cloud favorably within the tech industry's dynamic environment.

- Navigate through the intricacies of Kingsoft Cloud Holdings with our comprehensive health report here.

Learn about Kingsoft Cloud Holdings' historical performance.

Snap (SNAP)

Simply Wall St Growth Rating: ★★★★☆☆

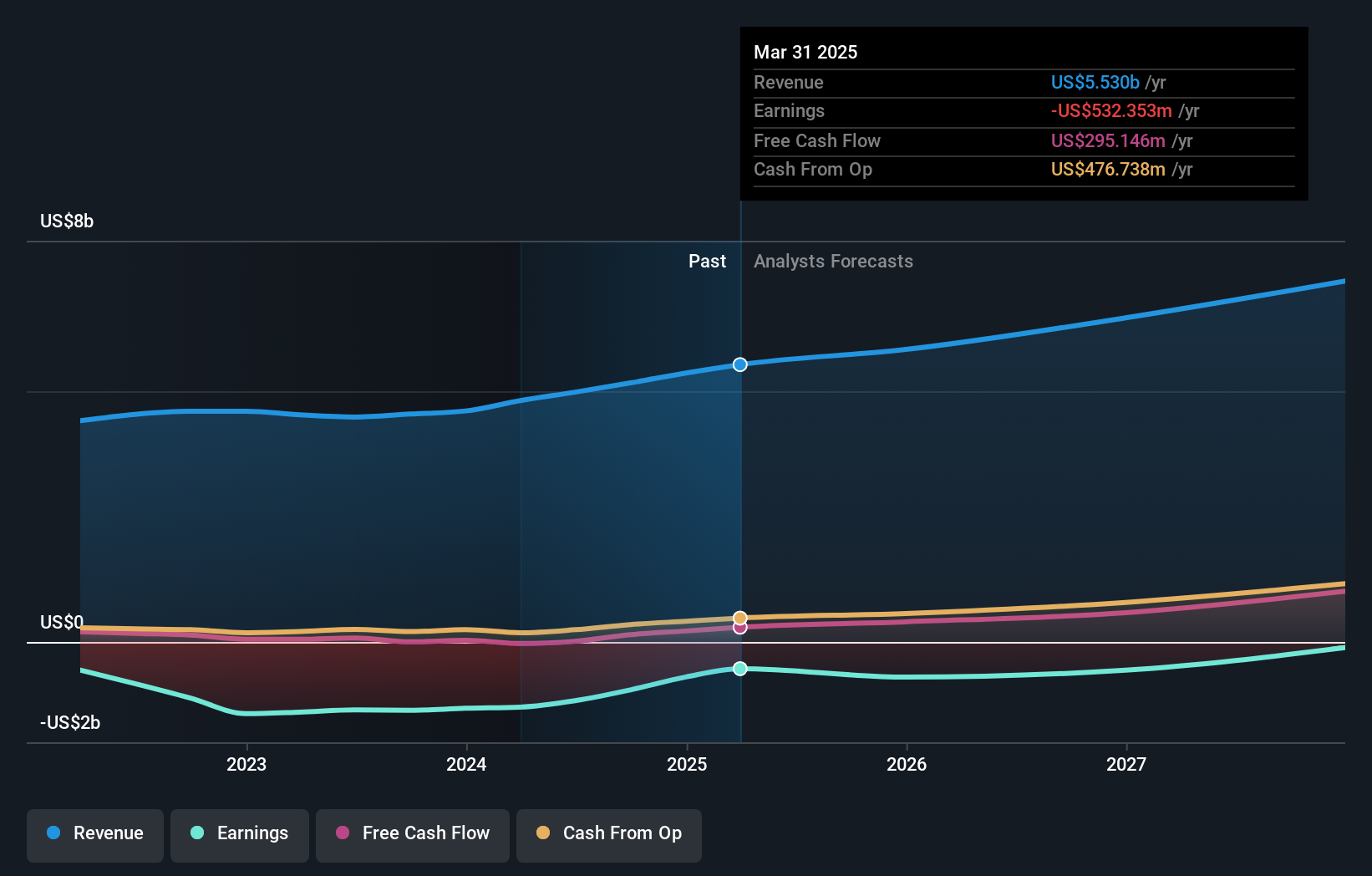

Overview: Snap Inc. is a technology company that operates globally, focusing on multimedia messaging and social networking services, with a market cap of approximately $13.82 billion.

Operations: Snap generates revenue primarily through its software and programming segment, totaling $5.53 billion. The company focuses on multimedia messaging and social networking services across North America, Europe, and other international markets.

Snap, while currently unprofitable, is on a trajectory to shift its financials positively within the next three years, with an anticipated profit growth of 46.48% annually. This potential turnaround is supported by a solid revenue increase forecast at 9.4% per year, outpacing the U.S. market average of 8.6%. Notably, Snap's commitment to innovation is evident in its strategic R&D investments and recent active participation in industry conferences such as MAU Vegas and the Milken Institute Global Conference, signaling ongoing efforts to enhance its market position and product offerings. Additionally, the company has demonstrated confidence in its future by repurchasing shares worth $257.1 million earlier this year, underscoring a proactive approach to capital management amidst evolving industry dynamics.

- Delve into the full analysis health report here for a deeper understanding of Snap.

Review our historical performance report to gain insights into Snap's's past performance.

Seize The Opportunity

- Take a closer look at our US High Growth Tech and AI Stocks list of 229 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft Cloud Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KC

Kingsoft Cloud Holdings

Provides cloud services to businesses and organizations primarily in China.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives