As of December 2025, the U.S. stock market has been experiencing a positive trend with major indices like the S&P 500 and Dow Jones Industrial Average nearing record highs, driven largely by advances in tech shares and AI-related stocks. In this climate of robust technological growth, identifying high-growth tech stocks involves looking for companies that not only capitalize on emerging technologies but also demonstrate resilience and adaptability amidst evolving market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Palantir Technologies | 28.00% | 32.57% | ★★★★★★ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.08% | 84.58% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Cellebrite DI | 15.29% | 20.24% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Cellebrite DI (CLBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cellebrite DI Ltd. provides digital intelligence solutions for legally sanctioned investigations across various global regions, with a market cap of $4.70 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $455.90 million.

Cellebrite DI's strategic acquisition of Corellium not only expands its technological capabilities but also incorporates top-tier talent into its leadership, signaling a robust approach to maintaining market dominance in digital intelligence. With an expected annual revenue growth of 15.3% and earnings growth forecast at 20.2%, the company is outpacing the US market projections significantly. The firm's recent guidance anticipates revenues between $470 million to $475 million for the year, reflecting a solid upward trajectory bolstered by advanced virtualization software and legal expertise additions that are crucial for navigating complex regulatory landscapes. This blend of strategic acquisitions, strong financial forecasts, and enhanced operational capabilities positions Cellebrite DI favorably within the high-growth tech sector.

Amphenol (APH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amphenol Corporation, with a market cap of approximately $165.60 billion, is a global leader in designing, manufacturing, and marketing electrical, electronic, and fiber optic connectors across various international markets including the United States and China.

Operations: The company generates revenue primarily from three segments: Communications Solutions ($10.65 billion), Harsh Environment Solutions ($5.61 billion), and Interconnect and Sensor Systems ($4.97 billion).

Amphenol's recent strategic moves, including a substantial fixed-income offering totaling over $7.5 billion across various maturities, underscore its robust financial management and market confidence. This fiscal prudence is mirrored in its impressive third-quarter performance with sales soaring to $6.19 billion, up 53% year-over-year, and net income more than doubling to $1.24 billion. The company also boosted shareholder returns through a significant 52% dividend increase and continued share repurchases amounting to nearly $192 million within the quarter. These financial maneuvers not only reflect Amphenol's operational excellence but also enhance its competitive stance in the high-tech sector, promising sustained growth amidst dynamic market conditions.

- Click here to discover the nuances of Amphenol with our detailed analytical health report.

Examine Amphenol's past performance report to understand how it has performed in the past.

Circle Internet Group (CRCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Circle Internet Group, Inc. operates as a platform, network, and market infrastructure for stablecoin and blockchain applications with a market cap of $20.28 billion.

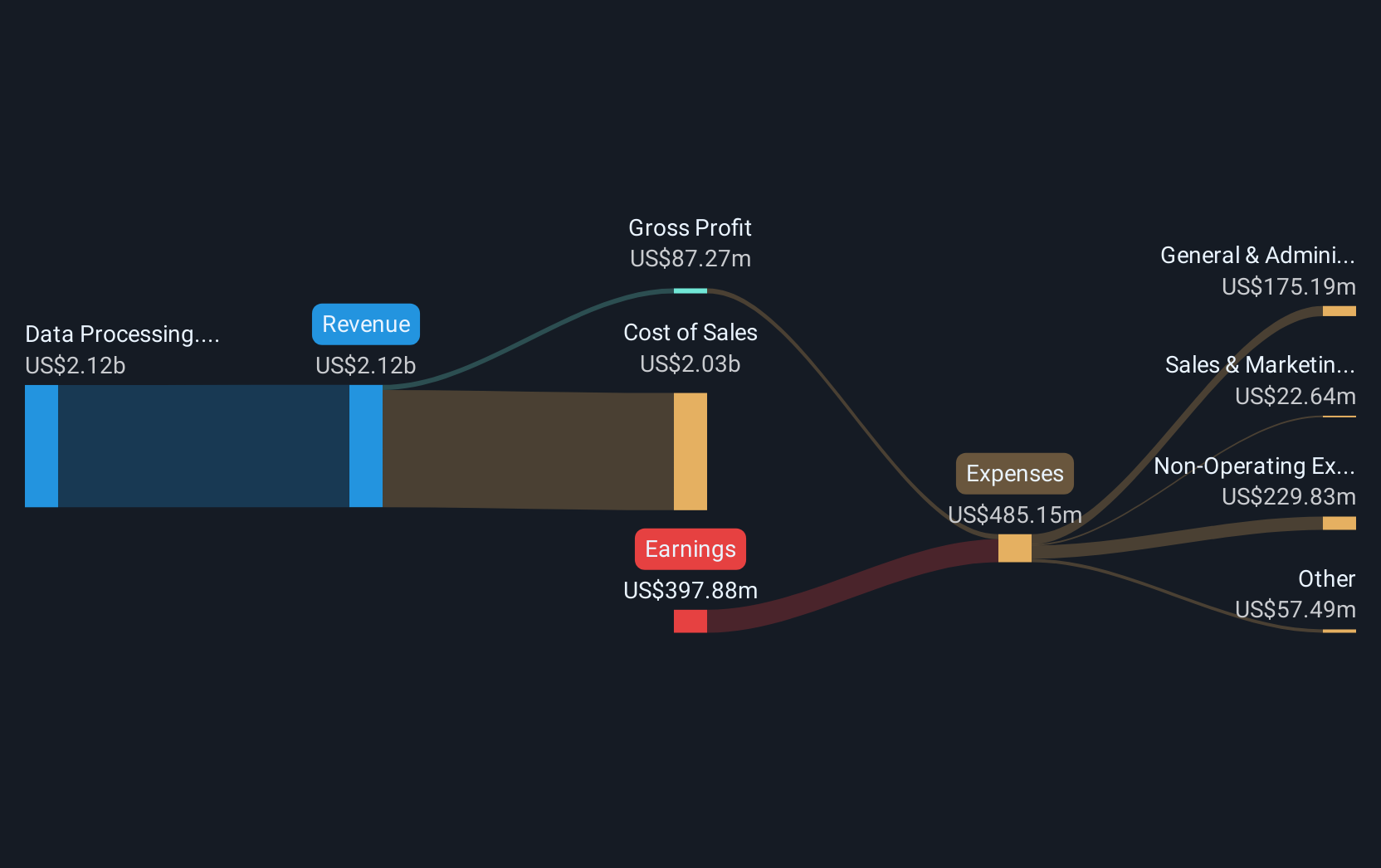

Operations: Circle Internet Group generates revenue primarily from data processing, amounting to $2.41 billion.

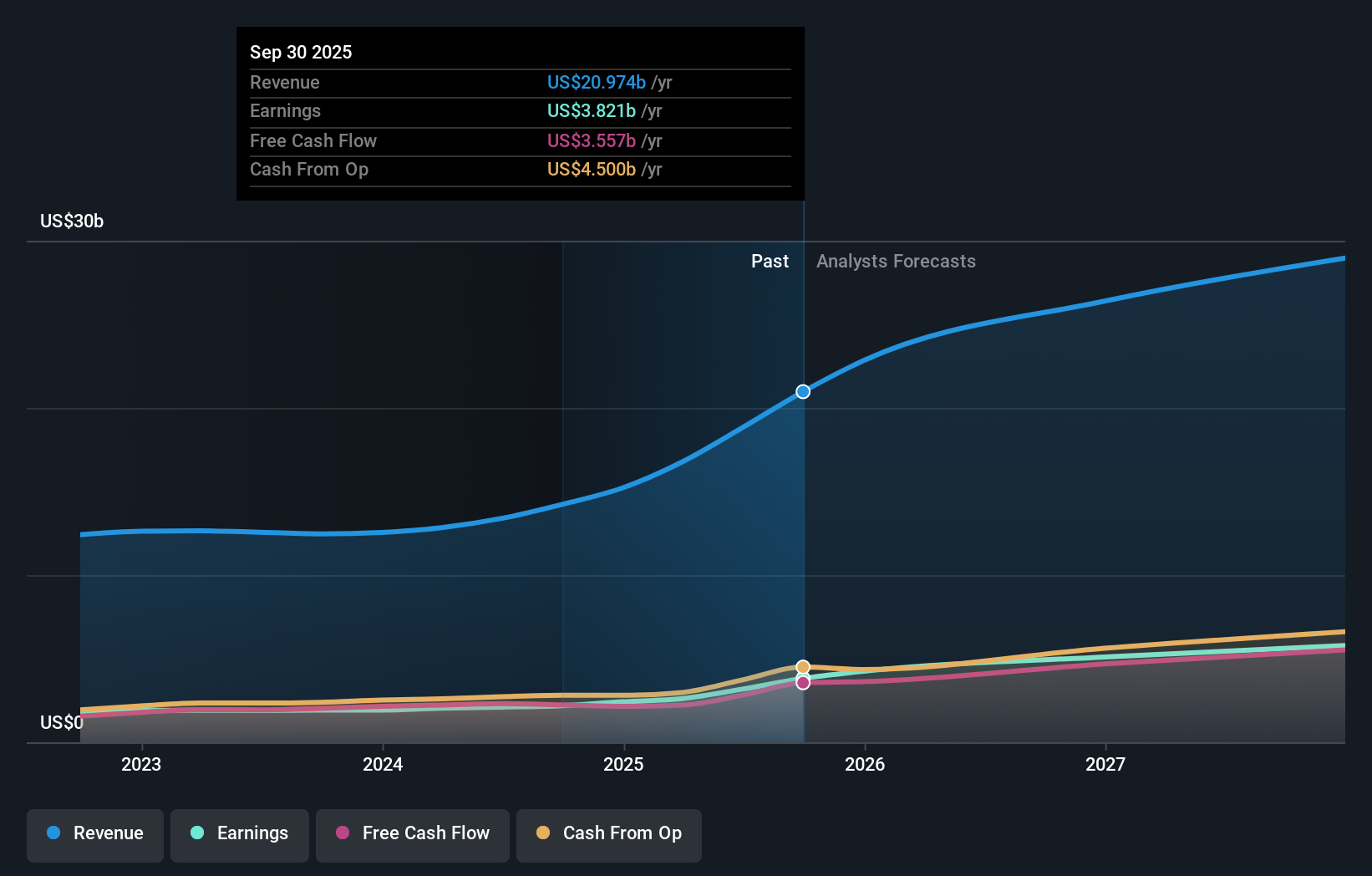

Circle Internet Group, experiencing a 23.1% annualized revenue growth, is outpacing the US market's average of 10.7%, signaling robust expansion within the tech sector. Despite current unprofitability, projections show an impressive 84.6% potential increase in earnings annually over the next three years, indicating strong future profitability. The company's strategic partnership with Intuit to integrate stablecoin technology into financial services showcases innovative use of blockchain for enhancing transaction efficiency and security across platforms. This collaboration not only diversifies Circle's business model but also strengthens its position in digital financial solutions amidst growing market demand for reliable and scalable financial technologies.

- Take a closer look at Circle Internet Group's potential here in our health report.

Gain insights into Circle Internet Group's past trends and performance with our Past report.

Taking Advantage

- Embark on your investment journey to our 75 US High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APH

Amphenol

Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion