- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining Turns To AI And Cloud With Amazon AWS Deal

- Cipher Mining (NasdaqGS:CIFR) announced an agreement to provide 300 megawatts of capacity to Amazon Web Services.

- The deal marks a shift from a pure bitcoin mining focus toward AI and cloud infrastructure.

- The agreement links Cipher Mining with Amazon as a high profile customer in the broader technology sector.

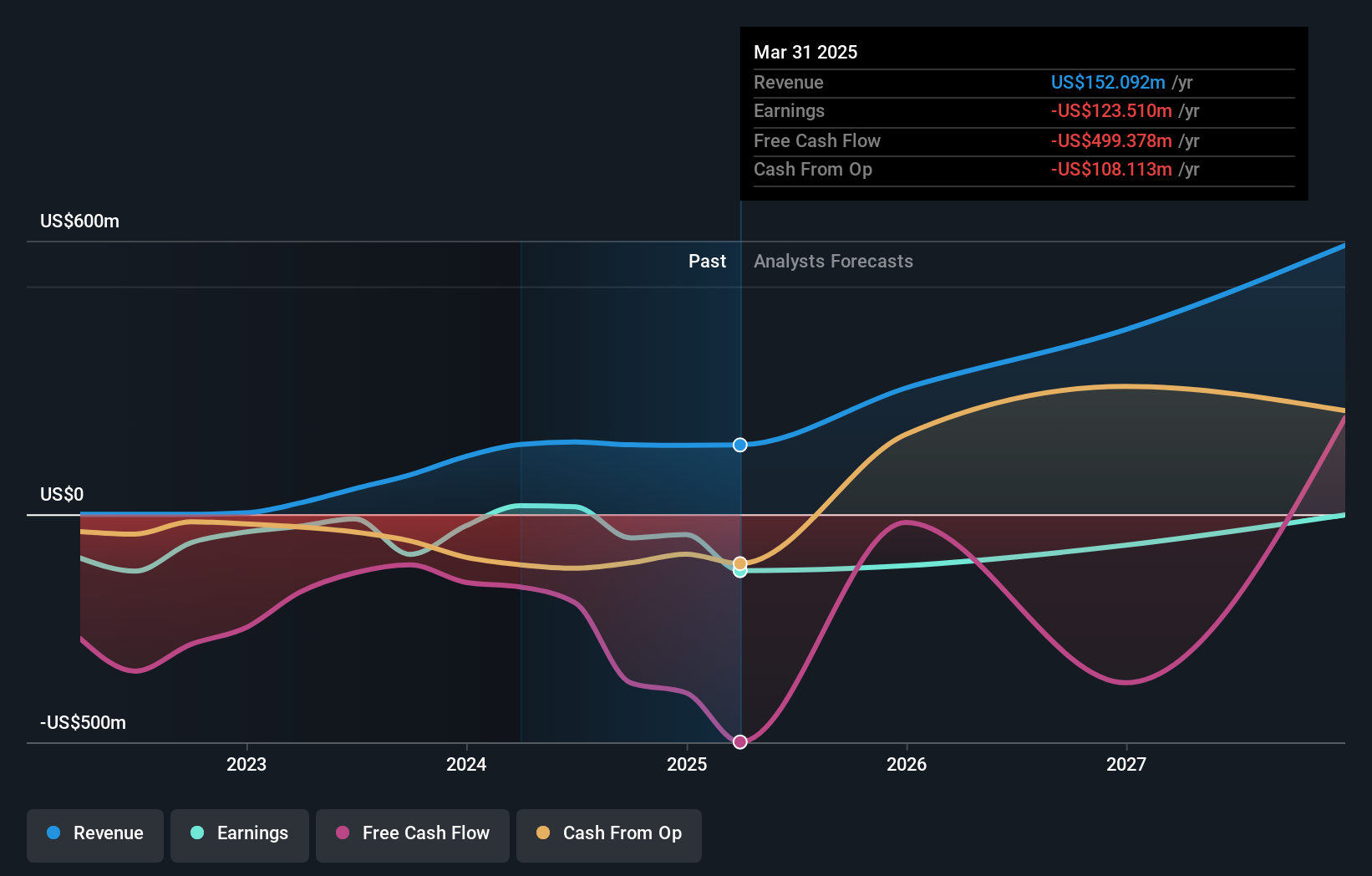

Cipher Mining has been known mainly as a bitcoin mining operator, so this new agreement with Amazon Web Services signals a change in how the business may use its power capacity. For investors, it connects a crypto infrastructure player to demand for AI compute and cloud data centers, which have become central themes across the tech sector.

Investors may watch how the 300 megawatt commitment affects Cipher Mining's revenue mix, capital needs, and contract structure with Amazon. The agreement also raises questions about how the company balances bitcoin mining plans with new AI and cloud related opportunities.

Stay updated on the most important news stories for Cipher Mining by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cipher Mining.

How Cipher Mining stacks up against its biggest competitors

Investor Checklist: What This Means For Cipher Mining

Quick Assessment

- ✅ Price vs Analyst Target: At US$18.97 versus a US$27.32 analyst target, the share price sits about 31% below consensus.

- ⚖️ Simply Wall St Valuation: The valuation status is listed as unknown, so there is no clear under or overvaluation signal from this model.

- ✅ Recent Momentum: A 30 day return of 25.80% shows strong short term momentum into the AWS deal.

Check out Simply Wall St's in depth valuation analysis for Cipher Mining.

Key Considerations

- 📊 The AWS capacity agreement ties Cipher’s data centers to AI and cloud demand, which may diversify away from pure bitcoin exposure.

- 📊 Watch how the AWS contract influences revenue mix, capital spending for extra infrastructure, and any updates to analyst targets around US$27.32.

- ⚠️ Recent comments flag volatile trading and insider selling as risks, so entry timing and position size may matter more with this stock.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Cipher Mining analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

The Architect of Sovereignty: Palantir’s Premium Paradox at $149

BYLOT: Re-Rating Potential Tempered by UK Tax Drag and Speculative-Grade Debt Dynamics – Neutral (Hold)

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion