- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining (CIFR) Is Up 12.8% After Landmark 15-Year AI Infrastructure Deal With AWS – What's Changed

Reviewed by Sasha Jovanovic

- Amazon Web Services recently announced a US$5.5 billion, 15-year lease agreement with Cipher Mining to deliver 300 megawatts of turnkey space and power for AI workloads starting in 2026.

- This substantial partnership highlights Cipher's move beyond cryptocurrency mining and its growing presence in high-performance computing and AI infrastructure.

- We'll examine how Cipher’s entrance into a major, multi-year AI infrastructure deal with AWS impacts its long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Cipher Mining Investment Narrative Recap

Shareholders in Cipher Mining are effectively betting on the company’s ability to evolve from a pure bitcoin miner to a diversified digital infrastructure provider, leveraging multi-billion dollar, long-duration AI hosting deals. While the AWS partnership increases long-term revenue visibility, Cipher’s biggest near-term catalyst continues to be fully securing and delivering on its pipeline of AI infrastructure contracts, but execution risk and capital requirements remain important concerns that this announcement does not materially change.

The recently announced joint venture to develop the 1-gigawatt Colchis site in West Texas stands out as particularly relevant, positioning Cipher to supply large-scale, energy-rich data center capacity for future high-performance computing clients. Success in building and leasing this site will be integral to maximizing the benefits of the AWS agreement and realizing revenue diversification.

However, it’s important to weigh these growth opportunities against the risk that significant capital expenditures for AI buildouts may outpace established tenant demand...

Read the full narrative on Cipher Mining (it's free!)

Cipher Mining's outlook anticipates $696.2 million in revenue and $91.1 million in earnings by 2028. Achieving these figures implies a 63.6% annual revenue growth rate and a $245.1 million increase in earnings from the current level of -$154.0 million.

Uncover how Cipher Mining's forecasts yield a $19.88 fair value, a 12% downside to its current price.

Exploring Other Perspectives

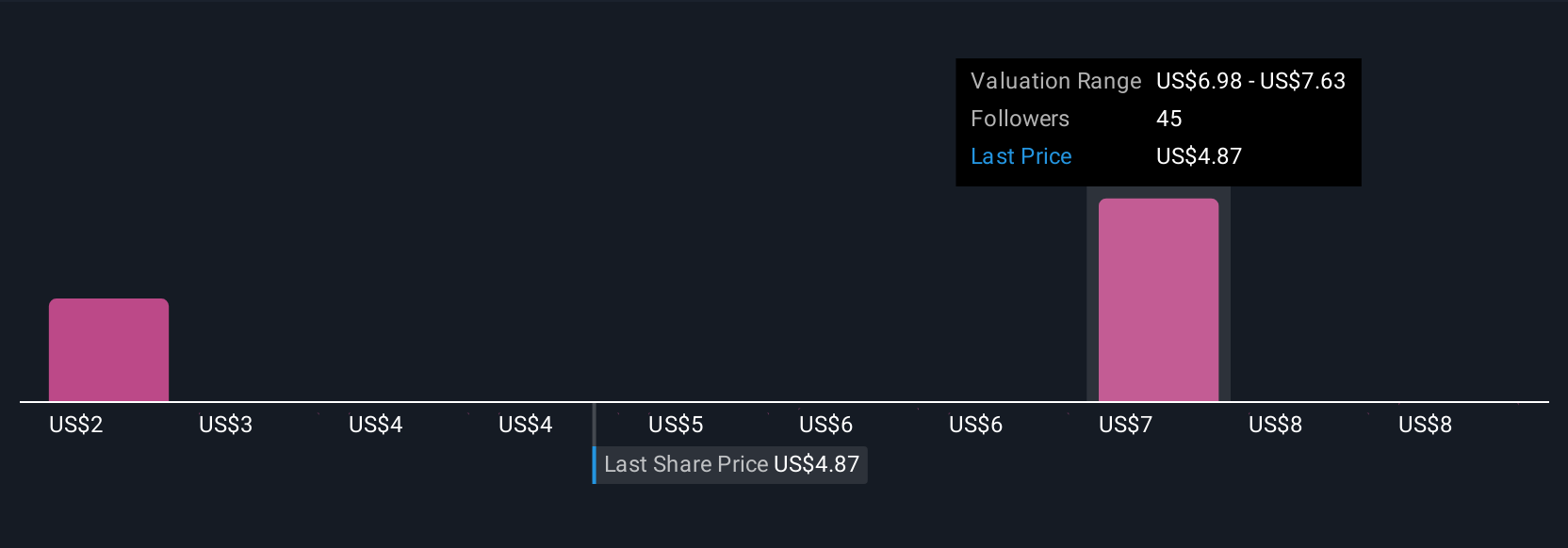

Fair value estimates from 6 Simply Wall St Community members range from US$6 to US$24.12 per share. Many are watching how Cipher’s aggressive infrastructure expansion aligns with actual demand, with investor outlooks diverging on future returns and risk.

Explore 6 other fair value estimates on Cipher Mining - why the stock might be worth less than half the current price!

Build Your Own Cipher Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Cipher Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cipher Mining's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives