- United States

- /

- Software

- /

- NasdaqGS:CHKP

Is Check Point Software Fairly Priced After Recent Product Innovations and 12% Share Price Climb?

Reviewed by Bailey Pemberton

- Wondering if Check Point Software Technologies is a hidden bargain or already fairly priced? You are not alone, as savvy investors have their eye on its value story right now.

- The stock price has climbed 12.3% over the last year, showing solid momentum, even if recent weeks have brought a modest dip of 2.8% for the month.

- Recent news has spotlighted Check Point's ongoing product innovations and a growing emphasis on cybersecurity partnerships, fueling investor interest. Market watchers have also noted that increased threats in the digital world continue to keep Check Point front and center for both customers and shareholders.

- The company's current valuation score stands at 3 out of 6, suggesting some checks point to value but it is not a slam dunk. Let’s break down what that means through various valuation methods, and stick around for an even more insightful way to look at true value by the end of this article.

Approach 1: Check Point Software Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model evaluates a company's worth by forecasting its future cash flows and discounting them to today’s value. This approach aims to estimate what those future inflows are worth in present terms, providing a data-backed assessment of intrinsic value.

For Check Point Software Technologies, the latest reported Free Cash Flow (FCF) stands at $1.14 billion. Analysts project annual growth in FCF, expecting it to reach around $1.42 billion by 2029. The projections for the next decade, based on a blend of analyst estimates and long-term extrapolations, help form the basis for valuing the entire business under the DCF framework, with all figures calculated in US dollars.

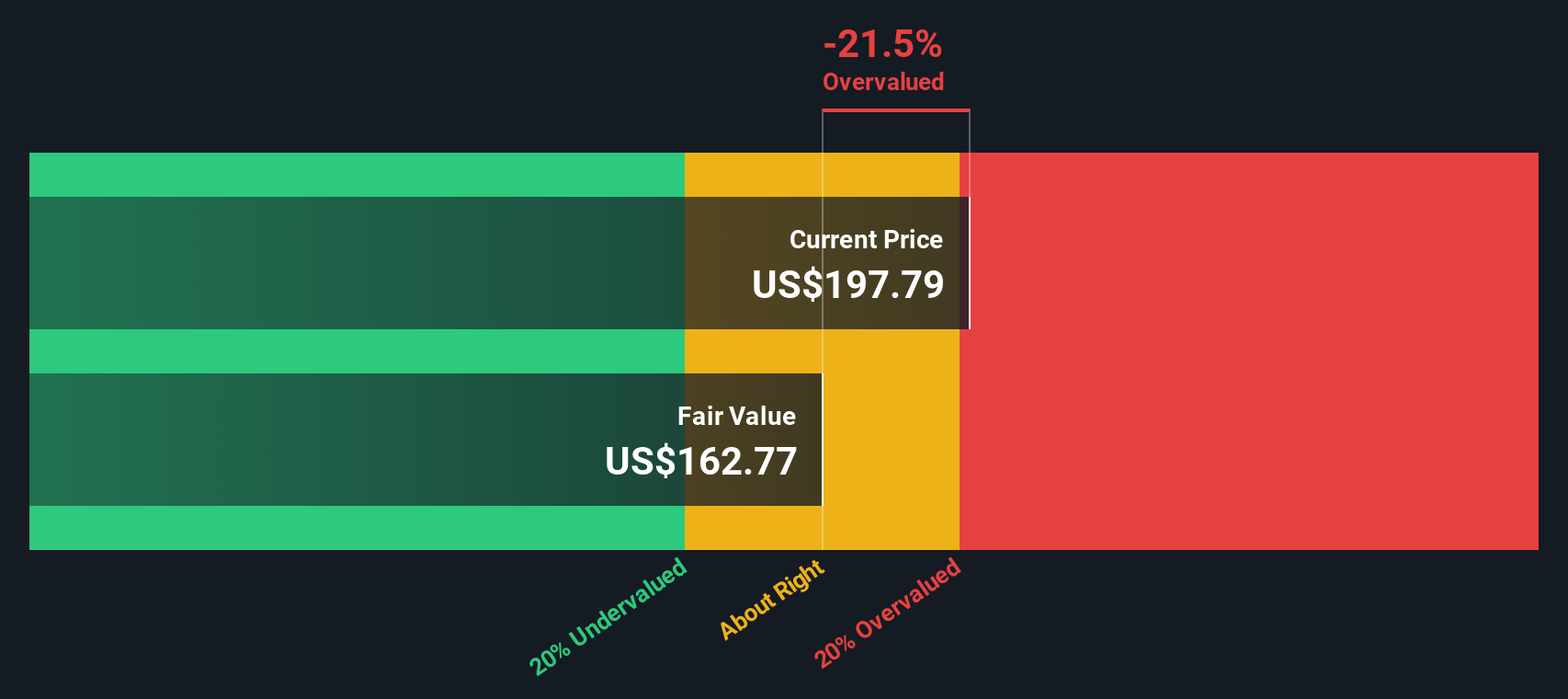

The output of this model points to an intrinsic value of $167.53 per share. Compared to the current market price, the DCF discount indicates the company is approximately 16.6% overvalued. This means the stock is trading somewhat above what its long-term cash generation potential suggests.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Check Point Software Technologies may be overvalued by 16.6%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Check Point Software Technologies Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure, especially for profitable companies like Check Point Software Technologies, because it shows how much investors are willing to pay for a dollar of earnings. It is a quick way to gauge market expectations about growth and profitability.

Growth prospects and company risk levels play a big role in defining a "fair" PE ratio. Firms with faster expected growth or lower perceived risk usually command a higher PE, as investors are willing to pay more now for the promise of better returns in the future.

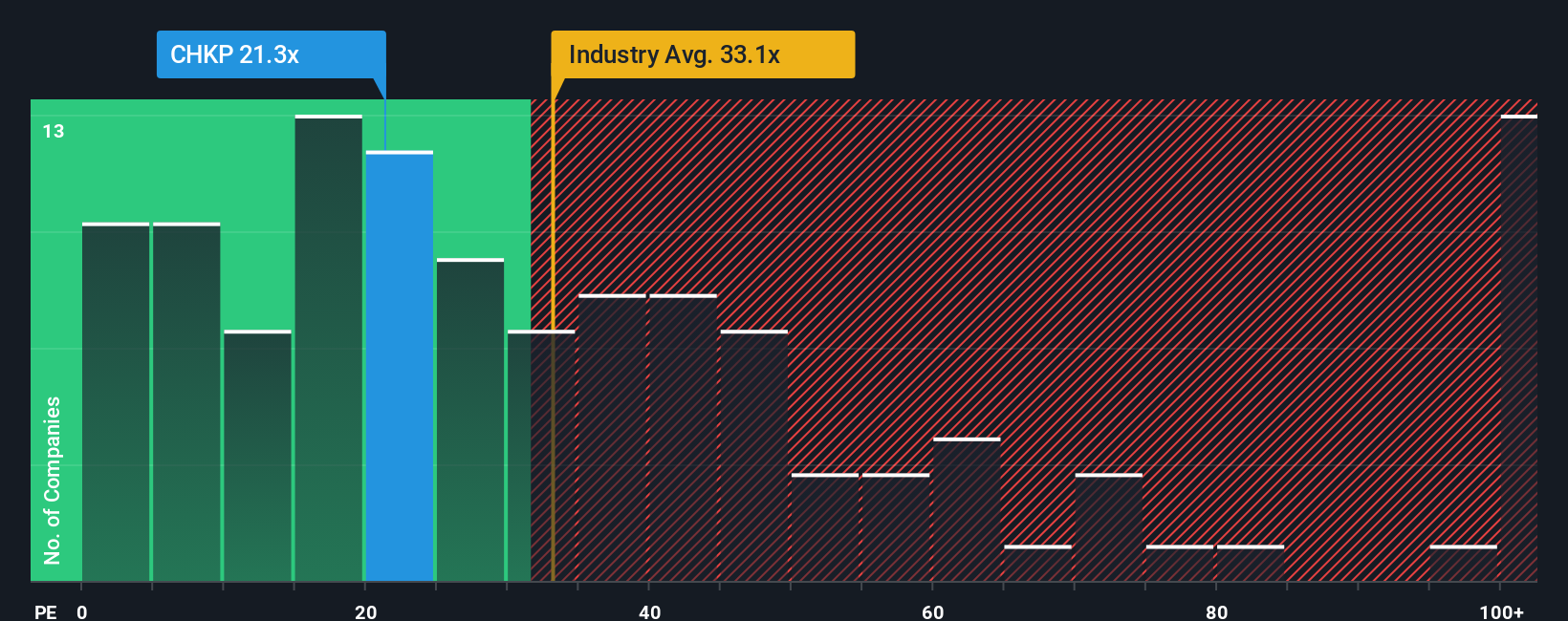

Check Point currently trades at a PE of 20.8x. This is noticeably lower than the industry average of 35.2x and well below the average of its peers at 38.8x. While these benchmarks provide some useful context, they do not always reflect the unique financial profile of the business in question.

That is where Simply Wall St's "Fair Ratio" comes in. This metric goes beyond simple averages by considering factors like Check Point’s earnings growth, profit margins, market size, and risks within its industry. By tailoring the assessment to these characteristics, the Fair Ratio paints a more complete picture of what a reasonable valuation should look like for this specific stock.

Check Point’s Fair Ratio sits at 26.3x. Since its actual PE is 20.8x, the stock is trading noticeably below what would be considered fair value based on its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Check Point Software Technologies Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an investor’s way to add their own story and expectations to a stock’s numbers. It is where your personal perspective shapes your estimates for things like future revenue, profits, and fair value, all based on the information you believe is most important.

Narratives connect the unique business story of Check Point Software Technologies to realistic forecasts and then to a target price, helping you decide if now is the right time to buy or sell. They are available right inside the Simply Wall St Community page, used by millions of investors, and are simple to create, revise, and share.

The real power of Narratives is that they update automatically as new data, earnings, or breaking news hit the market. This means your fair value always stays relevant. For example, some investors might be very optimistic, modeling 9% annual revenue growth and a fair value of $285 per share, while others may take a cautious view with slower growth and a $173 target, all based on their own narrative about the company’s future.

Do you think there's more to the story for Check Point Software Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives