- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies (CHKP) Valuation in Focus Following Gartner Leader Recognition

Check Point Software Technologies (CHKP) just landed a significant industry accolade by being ranked a Leader in the 2025 Gartner Magic Quadrant for Hybrid Mesh Firewalls. If you follow cybersecurity stocks, you know recognition from Gartner carries weight in shaping enterprise buying decisions and setting industry standards. For investors, this endorsement puts the spotlight on Check Point’s AI-powered, highly integrated platform and its broad ecosystem of technology partners as potential differentiators in a fiercely competitive space.

This latest recognition comes at a time when Check Point’s stock performance has shown steady, if not dramatic, movement. Over the past year, the share price is up just 0.3%, while its three- and five-year returns of 64% and 61% tell a clear story of longer-term growth. After a decline in the spring, shares have recovered some ground in the past month. This may indicate a shift in momentum as investor sentiment reacts to news like this and the company’s focus on innovation in critical IT security infrastructure.

With Check Point now in the spotlight, are investors overlooking value, or is the current share price already reflecting this new growth narrative?

Most Popular Narrative: 14.3% Undervalued

According to community narrative, Check Point Software Technologies is seen as undervalued by a margin of 14.3% versus its calculated fair value.

The Infinity platform continues to gain traction, with strong double-digit revenue growth and increased customer adoption. It now accounts for over 15% of total revenue, supporting expectations for revenue growth through enhanced customer retention and cross-selling opportunities.

Looking for the bold forecasts fueling Check Point's fair value? The narrative highlights a unique mix of projected growth, sharp margin insights, and a valuation multiple that diverges from industry norms. Interested in what analysts believe about Check Point’s future growth engine and whether it justifies a higher price? The details behind this undervaluation might be surprising.

Result: Fair Value of $225.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased competitive pressures in AI-driven security and ongoing supply chain challenges could undermine Check Point’s growth outlook if these issues are not carefully managed.

Find out about the key risks to this Check Point Software Technologies narrative.Another View: What Does Our DCF Model Say?

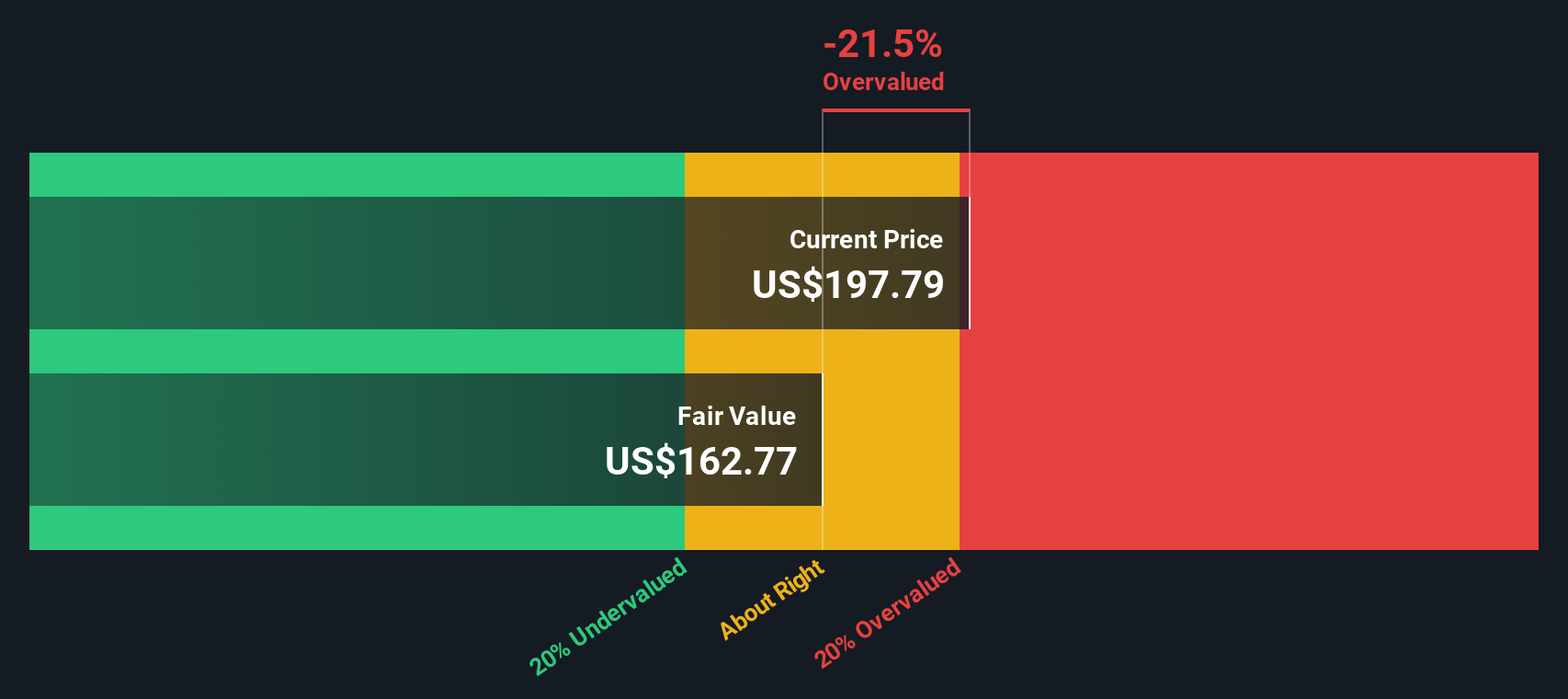

While community sentiment sees Check Point as undervalued, our DCF model, which estimates future cash flows, tells a different story and suggests the stock may be priced above its fair value. Could the answer be somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

Of course, if you have a different perspective or want to dig into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Check Point Software Technologies.

Looking for more investment ideas?

Sharpen your investing strategy and uncover your next big opportunity with some of the standout stock themes gaining attention right now. Don’t just watch from the sidelines while others find their edge. Use these powerful screeners to help spot tomorrow’s potential winners.

- Lock in consistent income by targeting companies that offer strong yields and resilient dividend growth through our dividend stocks with yields > 3%.

- Tap into the surge of artificial intelligence breakthroughs by finding fast-moving innovators with our AI penny stocks.

- Get ahead of the crowd by pinpointing quality stocks currently priced below their true value using our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.