- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies (CHKP) Enhances Cybersecurity With OneLayer Integration For Private Networks

Check Point Software Technologies (CHKP) recently announced a partnership with OneLayer, focusing on enhanced security integration in private cellular and operational technology environments. This development emphasizes improved security management features, such as automated device context synchronization and dynamic access controls, potentially boosting the company's growth outlook. Over the past week, CHKP's share price movement was largely in sync with broader market trends, marked by a recovery amid ongoing economic concerns and mixed earnings reports from major companies. While the specific integration might have added some marginal influence, overall market dynamics likely held more substantial sway.

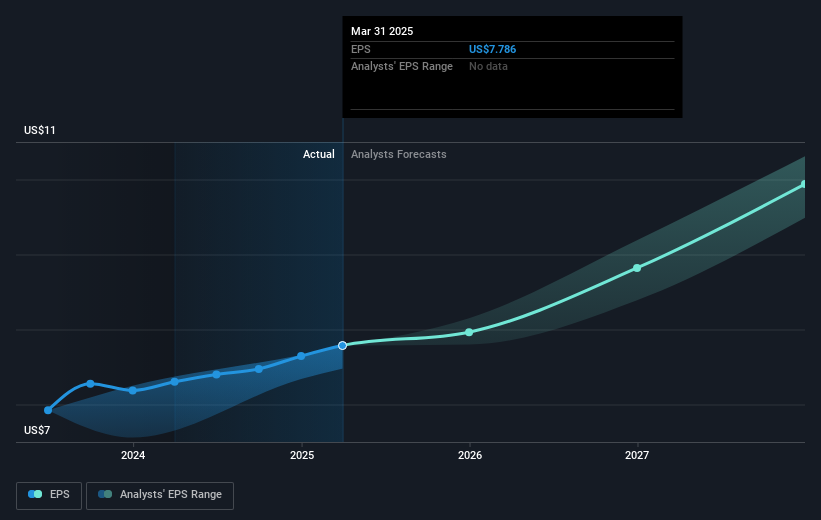

Check Point Software Technologies' recent partnership with OneLayer could positively influence its longer-term objectives, particularly with its focus on AI and SASE integration in cybersecurity. This alliance underscores the company's efforts to enhance device context synchronization and dynamic access controls, key elements that align with its strategic expansion initiatives. Analysts anticipate that the continued investment in such innovations could bolster future revenue and earnings, further supporting the company's growth narrative amid a competitive cybersecurity landscape.

Over the past three years, Check Point's total shareholder return was 53.64%, reflecting a solid longer-term performance. In contrast, the company's one-year performance has underperformed the US Software industry, which returned 39.8%. This broader industry comparison highlights both potential opportunities and challenges facing Check Point as it seeks to capitalize on emerging technologies and market demands.

The current share price of $188.21, compared to the analyst price target of $226.20, indicates a potential upside of approximately 20.2%. The market's reaction to the OneLayer partnership, along with other strategic initiatives aimed at enhancing revenue and earnings, will be crucial for bridging this valuation gap. Analysts expect revenue to reach $3.1 billion over the next three years, contingent upon successful execution of growth strategies and external economic factors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.