- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent (CFLT) Valuation Check After Mixed Returns And Ongoing IBM Acquisition Debate

Why Confluent (CFLT) is on investors’ radar today

Confluent (CFLT) is drawing attention after recent share performance data highlighted contrasting returns, including a gain over the past 3 months and a decline across the past year. This pattern is prompting fresh questions about its valuation.

See our latest analysis for Confluent.

The recent 34.86% 3 month share price return contrasts with a 12.31% decline in 1 year total shareholder return. This suggests that momentum has picked up again, even though longer term holders have yet to see a recovery.

If Confluent’s recent move has you looking beyond a single name, this could be a good moment to size up 58 profitable AI stocks that aren't just burning cash as potential next ideas on your list.

With Confluent trading at US$30.56, only around 1% below the average analyst price target and with a calculated intrinsic value that sits higher than today’s price, you have to ask yourself: is this a chance to buy, or is the market already pricing in future growth?

Most Popular Narrative: 30% Undervalued

Confluent’s most followed narrative pegs fair value at about $30.65, almost level with the last close at $30.56, yet still frames the shares as undervalued.

Analysts trimmed their fair value estimate for Confluent slightly from about $30.77 to $30.65. This reflects a mix of cautious views around the pending IBM acquisition and downgrades, as well as more upbeat commentary on stabilizing cloud growth, improving margins, and ongoing product momentum that supports a lower assumed future P/E multiple.

Recent research has highlighted a split in how professionals view Confluent. Some are focused on execution and product momentum, while others center on the pending IBM takeover and deal mechanics.

Want to see what kind of revenue path, margin lift and future earnings multiple have to come together to support that valuation? The full narrative lays out a very specific growth runway, a profitability shift and a premium future P/E assumption that is far from ordinary. If you are curious which of those inputs does most of the heavy lifting in the model, the details are all there.

Result: Fair Value of $30.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including slower cloud consumption trends and competitive threats from open source or self managed alternatives that could challenge this upbeat scenario.

Find out about the key risks to this Confluent narrative.

Another View: Price Suggests a Richer Story

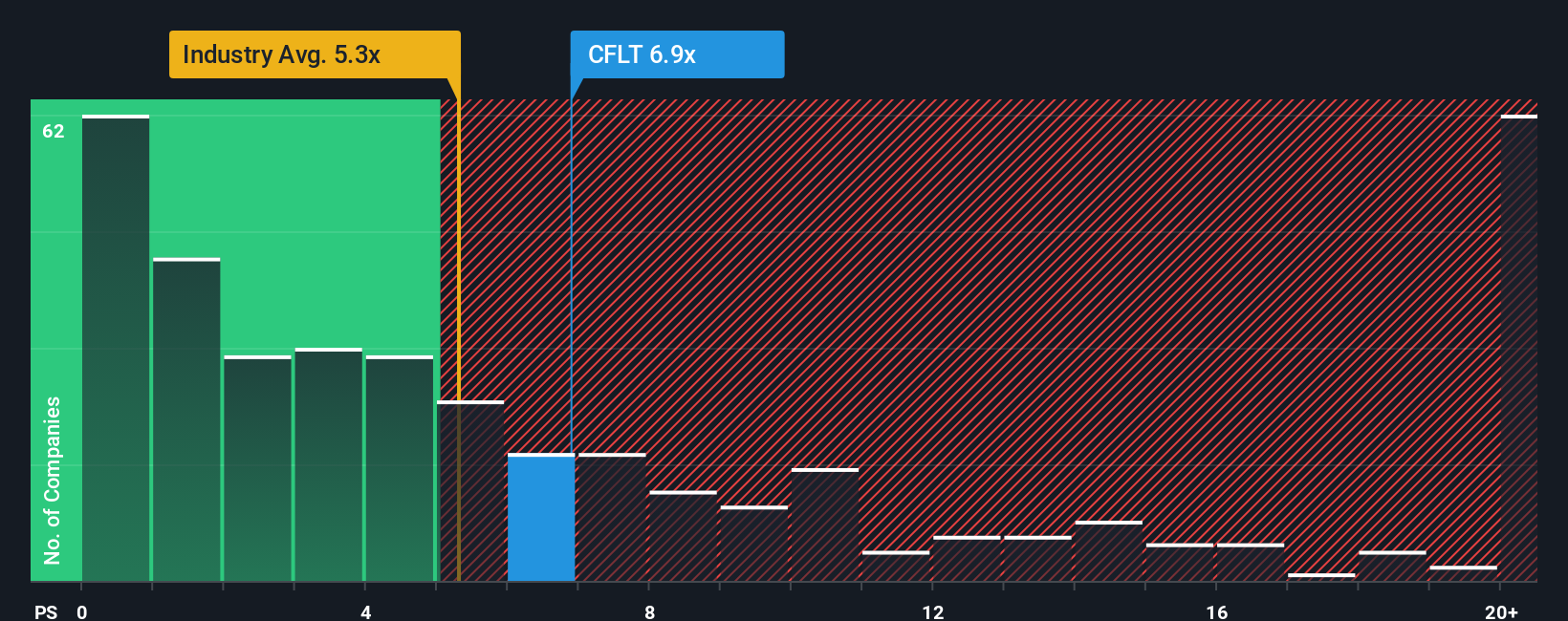

That 30% undervalued narrative sits uncomfortably against how the market is actually pricing Confluent today. On a P/S of 9.4x, the shares trade well above the US Software average of 3.6x, the peer average of 6.4x, and even our fair ratio of 7x. That kind of gap can signal either upside conviction or valuation risk. Which side do you think you are on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Confluent Narrative

If you are not sold on this view or prefer to rely on your own homework, you can develop a custom Confluent thesis in just a few minutes: Do it your way.

A great starting point for your Confluent research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Confluent has sharpened your thinking, do not stop here. Broaden your watchlist with focused screens that surface specific types of opportunities in minutes.

- Target potential mispricings by reviewing companies highlighted in our 54 high quality undervalued stocks and see which ones deserve a closer look on your shortlist.

- Strengthen your focus on resilience by scanning stocks in the 83 resilient stocks with low risk scores and see which names align with a steadier risk profile.

- Spot lesser known opportunities by checking our screener containing 24 high quality undiscovered gems and see which companies might not yet be on everyone else’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

The $200 Billion Gamble: Can AWS Outrun the AI Capex Monster?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.