- United States

- /

- Software

- /

- NasdaqGS:CDNS

Cadence Design Systems (NasdaqGS:CDNS) Partners with NVIDIA for Europe's First Industrial AI Cloud

Reviewed by Simply Wall St

Cadence Design Systems (NasdaqGS:CDNS) saw a 27% price increase last quarter, a move that aligns with significant developments such as their collaboration with NVIDIA for the first industrial AI cloud and the introduction of the Millennium M2000 Supercomputer. These advancements highlight the company’s expansion in AI technology and simulation capabilities, responding well to the tech sector's growth trends. Concurrently, broad market movements saw the S&P 500 rise close to record highs, influenced by optimism around trade deals and strong corporate earnings, which collectively contributed positively to Cadence's stock performance within the tech-heavy Nasdaq where it is listed.

Find companies with promising cash flow potential yet trading below their fair value.

The recent collaboration between Cadence Design Systems and NVIDIA is a pivotal development that aligns closely with Cadence's strategy to enhance its AI-driven design and simulation capabilities. Such advancements are anticipated to bolster Cadence's revenue and earnings forecasts, particularly as demand for AI solutions continues to expand within the tech sector. The introduction of their Millennium M2000 Supercomputer further underscores Cadence's commitment to innovation, potentially driving future growth in revenue as these technologies gain traction.

Over the past five years, Cadence's total shareholder return was a considerable 230.07%. This long-term performance underscores the company's ability to capitalize on growth trends within the tech industry. However, in the past year, Cadence underperformed the US Software industry, which posted an 18.5% return, compared to the broader US market return of 11.2%. This discrepancy highlights recent challenges despite the overall positive trend.

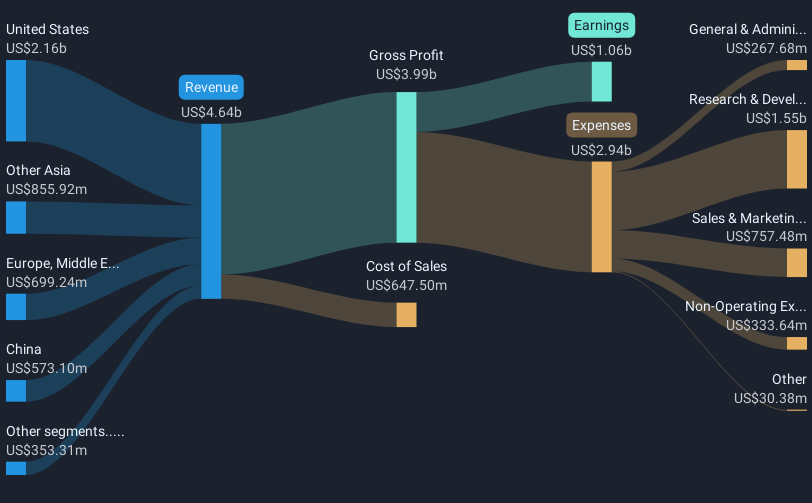

The recent price movements, driven in part by the company's technological advancements, align with analysts' price target of US$319.32, which is 4.2% above the current share price of US$305.78. This indicates a market view of near-fair value and suggests that further growth hinges on the successful execution of AI initiatives and maintaining competitive advantages against peers. Additionally, future earnings forecasts, with expectations of revenue reaching US$6.7 billion, are contingent on the company's ability to sustain its innovative trajectory and manage any geopolitical or operational risks that might arise.

Understand Cadence Design Systems' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives