- United States

- /

- Software

- /

- NasdaqGS:CCSI

Why The 29% Return On Capital At Consensus Cloud Solutions (NASDAQ:CCSI) Should Have Your Attention

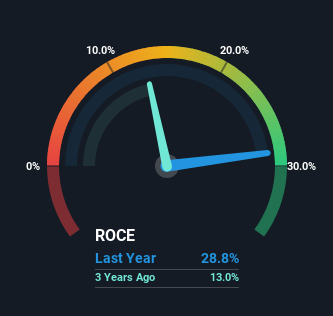

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So when we looked at the ROCE trend of Consensus Cloud Solutions (NASDAQ:CCSI) we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Consensus Cloud Solutions, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.29 = US$152m ÷ (US$608m - US$80m) (Based on the trailing twelve months to June 2024).

So, Consensus Cloud Solutions has an ROCE of 29%. In absolute terms that's a great return and it's even better than the Software industry average of 8.5%.

View our latest analysis for Consensus Cloud Solutions

In the above chart we have measured Consensus Cloud Solutions' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Consensus Cloud Solutions .

What Can We Tell From Consensus Cloud Solutions' ROCE Trend?

Consensus Cloud Solutions has not disappointed in regards to ROCE growth. The figures show that over the last four years, returns on capital have grown by 88%. That's a very favorable trend because this means that the company is earning more per dollar of capital that's being employed. Speaking of capital employed, the company is actually utilizing 58% less than it was four years ago, which can be indicative of a business that's improving its efficiency. Consensus Cloud Solutions may be selling some assets so it's worth investigating if the business has plans for future investments to increase returns further still.

Our Take On Consensus Cloud Solutions' ROCE

In a nutshell, we're pleased to see that Consensus Cloud Solutions has been able to generate higher returns from less capital. Astute investors may have an opportunity here because the stock has declined 26% in the last year. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

If you want to know some of the risks facing Consensus Cloud Solutions we've found 2 warning signs (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CCSI

Consensus Cloud Solutions

Provides information delivery services with a software-as-a-service platform worldwide.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

The Green Consolidator

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion