- United States

- /

- Software

- /

- NasdaqGS:CCSI

Under The Bonnet, Consensus Cloud Solutions' (NASDAQ:CCSI) Returns Look Impressive

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. And in light of that, the trends we're seeing at Consensus Cloud Solutions' (NASDAQ:CCSI) look very promising so lets take a look.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Consensus Cloud Solutions is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.29 = US$149m ÷ (US$602m - US$79m) (Based on the trailing twelve months to December 2024).

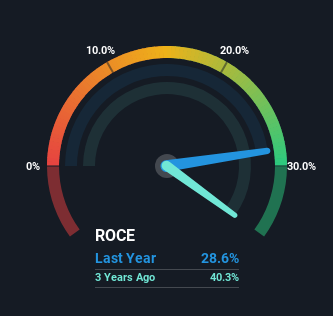

So, Consensus Cloud Solutions has an ROCE of 29%. That's a fantastic return and not only that, it outpaces the average of 9.2% earned by companies in a similar industry.

Check out our latest analysis for Consensus Cloud Solutions

In the above chart we have measured Consensus Cloud Solutions' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Consensus Cloud Solutions for free.

What Can We Tell From Consensus Cloud Solutions' ROCE Trend?

We're pretty happy with how the ROCE has been trending at Consensus Cloud Solutions. We found that the returns on capital employed over the last five years have risen by 87%. That's a very favorable trend because this means that the company is earning more per dollar of capital that's being employed. Interestingly, the business may be becoming more efficient because it's applying 58% less capital than it was five years ago. Consensus Cloud Solutions may be selling some assets so it's worth investigating if the business has plans for future investments to increase returns further still.

What We Can Learn From Consensus Cloud Solutions' ROCE

In a nutshell, we're pleased to see that Consensus Cloud Solutions has been able to generate higher returns from less capital. And since the stock has fallen 61% over the last three years, there might be an opportunity here. So researching this company further and determining whether or not these trends will continue seems justified.

Consensus Cloud Solutions does come with some risks though, we found 2 warning signs in our investment analysis, and 1 of those can't be ignored...

Consensus Cloud Solutions is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CCSI

Consensus Cloud Solutions

Provides information delivery services with a software-as-a-service platform in the United States, Canada, Ireland, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks