- United States

- /

- Software

- /

- NasdaqGS:CCSI

Returns on Capital Paint A Bright Future For Consensus Cloud Solutions (NASDAQ:CCSI)

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at the ROCE trend of Consensus Cloud Solutions (NASDAQ:CCSI) we really liked what we saw.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Consensus Cloud Solutions:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.27 = US$149m ÷ (US$630m - US$73m) (Based on the trailing twelve months to March 2025).

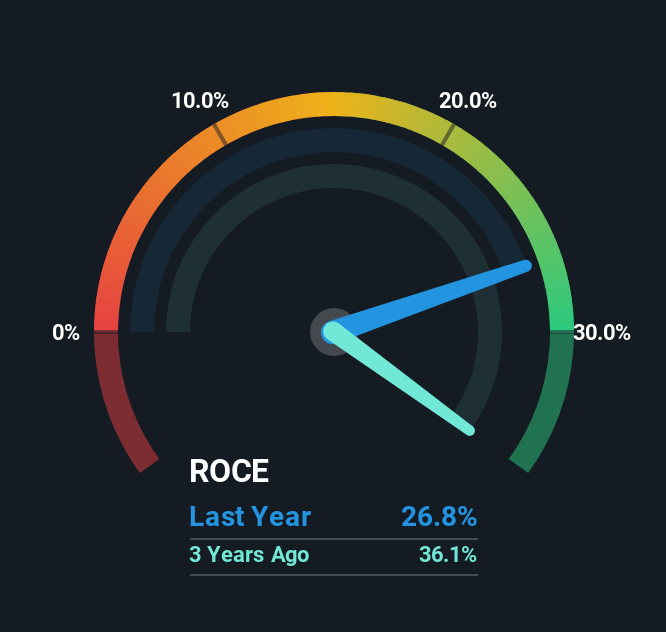

So, Consensus Cloud Solutions has an ROCE of 27%. That's a fantastic return and not only that, it outpaces the average of 9.7% earned by companies in a similar industry.

Check out our latest analysis for Consensus Cloud Solutions

Above you can see how the current ROCE for Consensus Cloud Solutions compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Consensus Cloud Solutions .

So How Is Consensus Cloud Solutions' ROCE Trending?

Consensus Cloud Solutions has not disappointed in regards to ROCE growth. The data shows that returns on capital have increased by 76% over the trailing five years. The company is now earning US$0.3 per dollar of capital employed. Speaking of capital employed, the company is actually utilizing 56% less than it was five years ago, which can be indicative of a business that's improving its efficiency. A business that's shrinking its asset base like this isn't usually typical of a soon to be multi-bagger company.

The Bottom Line

In the end, Consensus Cloud Solutions has proven it's capital allocation skills are good with those higher returns from less amount of capital. Astute investors may have an opportunity here because the stock has declined 56% in the last three years. With that in mind, we believe the promising trends warrant this stock for further investigation.

If you'd like to know more about Consensus Cloud Solutions, we've spotted 2 warning signs, and 1 of them is potentially serious.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CCSI

Consensus Cloud Solutions

Provides information delivery services with a software-as-a-service platform in the United States, Canada, Ireland, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion