- United States

- /

- Software

- /

- NasdaqGS:CCCS

CCC Intelligent Solutions (CCCS): One-Off $16.2 Million Loss Drives Margin Miss, Tests Bull Case

Reviewed by Simply Wall St

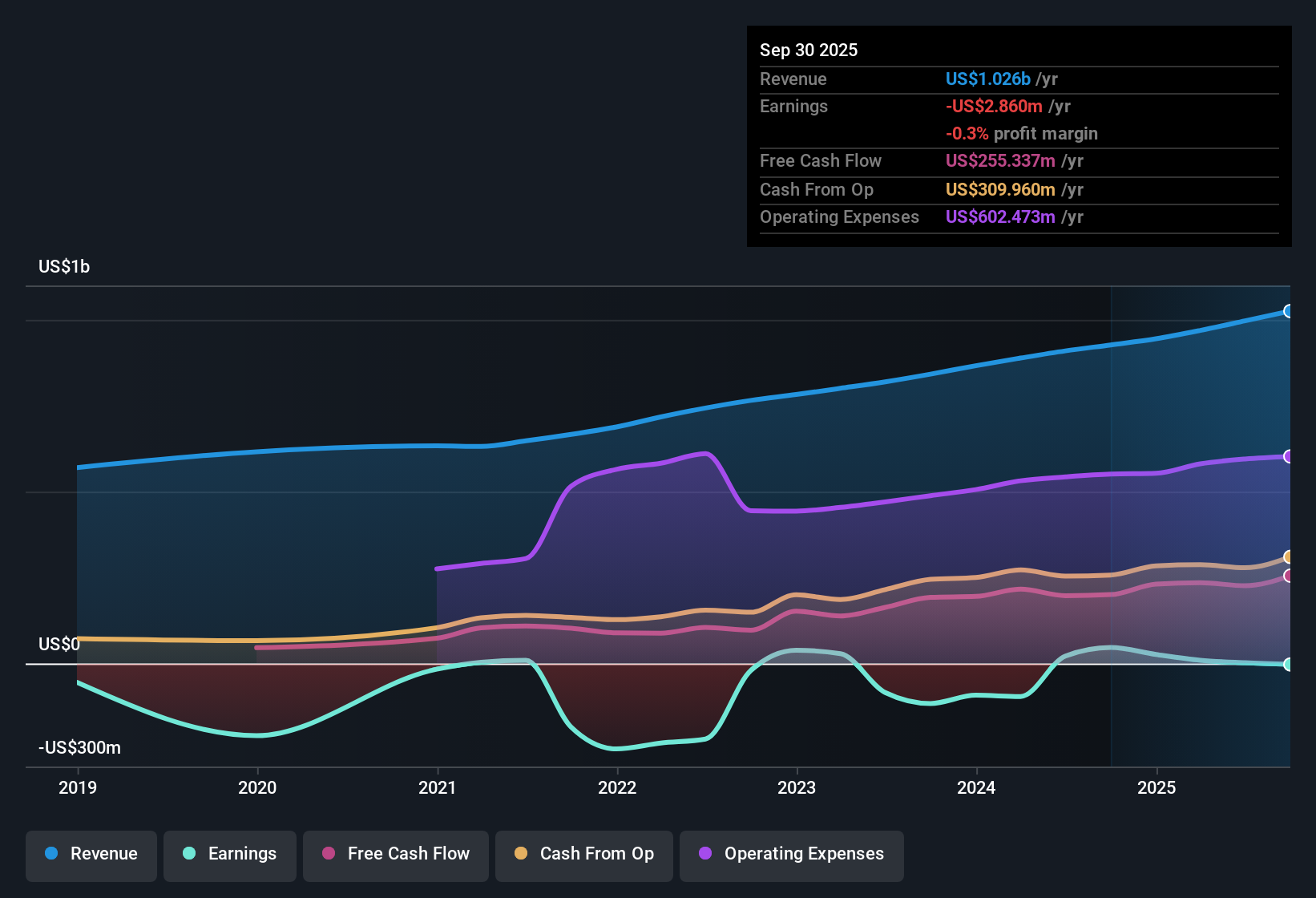

CCC Intelligent Solutions Holdings (CCCS) reported net profit margins of 0.2%, down from last year’s 2.4%, as a one-off loss of $16.2 million weighed on the latest results. While profit margins have compressed, the company has posted five years of profitability, averaging 32.8% annual earnings growth. Forecasts now call for a sharp 70.2% per year earnings increase alongside an 8.5% revenue growth rate. Both points help set the stage for how investors interpret the gap between recent setbacks and expected performance.

See our full analysis for CCC Intelligent Solutions Holdings.Next, we will see how the latest financial results stack up against the prevailing market narratives, revealing where the consensus holds and where surprises might emerge.

See what the community is saying about CCC Intelligent Solutions Holdings

Profit Margins Expected to Rise Sharply

- Analysts project net profit margins will grow from 0.2% today to 14.2% in three years, a dramatic improvement compared to recent results where a one-off $16.2 million loss weighed heavily on performance.

- According to the analysts' consensus view, this margin expansion is anchored in CCC's ability to drive recurring revenue through widespread adoption of AI and automation solutions, supported by:

- 80% of total revenue coming from subscription-based contracts and retention rates holding above 99%. This reinforces visibility even when the broader insurance industry is facing claim volume headwinds.

- On the other hand, the consensus narrative highlights that heavy investment in technology and ongoing integration costs may depress margins if growth initiatives do not scale as quickly as expected.

- With analysts forecasting a leap in margins, see the full consensus narrative for how this might change the story for CCC Intelligent Solutions Holdings. 📊 Read the full CCC Intelligent Solutions Holdings Consensus Narrative.

Trading at a Discount to DCF Fair Value

- Shares trade at $8.75, undercutting the DCF fair value estimate of $11.80, and also using a Price-to-Sales ratio of 5.7x, which is higher than the US software industry average of 5.2x.

- The analysts' consensus view sees the current share price as potentially undervalued, especially if CCC delivers forecasted 9.3% annual revenue growth and scales up to $1.3 billion in revenue by 2028.

- These valuation metrics support the case that discounted cash flow models and analyst price targets (set at $11.96) could provide upside if optimistic growth assumptions play out.

- However, a premium valuation versus peers reflects confidence in recurring revenue quality. It also raises expectations for execution; any misstep in hitting these high-growth forecasts could prompt a rerating.

Customer Concentration Adds Risk

- CCC's revenue streams rely significantly on large insurers and repair shop clients. Insurance industry consolidation and persistent claim volume declines, down 8–9% year-over-year according to the consensus narrative, force investors to weigh the sustainability of top-line growth.

- Consensus narrative warns that reliance on a concentrated customer base brings two material risks:

- Loss or renegotiation of contracts with major clients could directly reduce recurring revenue and market positioning, especially as the company pushes into new SaaS verticals to diversify.

- Competitive threats from insurtechs and the potential for big clients to develop in-house digital claims systems could intensify pricing pressure, putting long-term profit margin forecasts at risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CCC Intelligent Solutions Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Share your perspective and craft your own big-picture narrative in just a few minutes: Do it your way

A great starting point for your CCC Intelligent Solutions Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

CCC Intelligent Solutions Holdings faces pressure from customer concentration, industry headwinds, and the risk that heavy investments may not deliver the consistent growth analysts expect.

If you want steadier prospects, use our screen for stable growth stocks screener (2111 results) to focus on companies consistently delivering stable performance through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCS

CCC Intelligent Solutions Holdings

Operates as a software as a service (SaaS) company for the property and casualty insurance economy in the United States and China.

Slight risk and fair value.

Market Insights

Community Narratives