- United States

- /

- Software

- /

- NasdaqCM:BTDR

Positive Sentiment Still Eludes Bitdeer Technologies Group (NASDAQ:BTDR) Following 33% Share Price Slump

To the annoyance of some shareholders, Bitdeer Technologies Group (NASDAQ:BTDR) shares are down a considerable 33% in the last month, which continues a horrid run for the company. The last month has meant the stock is now only up 7.8% during the last year.

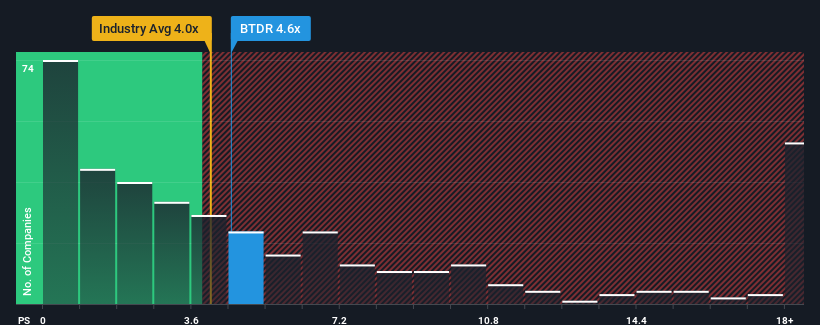

In spite of the heavy fall in price, there still wouldn't be many who think Bitdeer Technologies Group's price-to-sales (or "P/S") ratio of 4x is worth a mention when it essentially matches the median P/S in the United States' Software industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Bitdeer Technologies Group

What Does Bitdeer Technologies Group's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Bitdeer Technologies Group's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bitdeer Technologies Group .How Is Bitdeer Technologies Group's Revenue Growth Trending?

In order to justify its P/S ratio, Bitdeer Technologies Group would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 71% per annum as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 15% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that Bitdeer Technologies Group's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

With its share price dropping off a cliff, the P/S for Bitdeer Technologies Group looks to be in line with the rest of the Software industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Bitdeer Technologies Group's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Bitdeer Technologies Group that you should be aware of.

If you're unsure about the strength of Bitdeer Technologies Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Moderate risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks