- United States

- /

- Software

- /

- NasdaqCM:BTDR

Bitdeer Technologies Group (NASDAQ:BTDR) Stock Catapults 50% Though Its Price And Business Still Lag The Industry

The Bitdeer Technologies Group (NASDAQ:BTDR) share price has done very well over the last month, posting an excellent gain of 50%. The annual gain comes to 201% following the latest surge, making investors sit up and take notice.

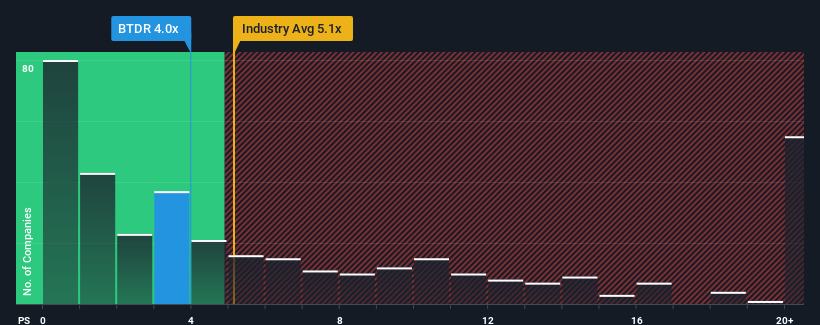

Although its price has surged higher, Bitdeer Technologies Group's price-to-sales (or "P/S") ratio of 4x might still make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 5.1x and even P/S above 13x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Bitdeer Technologies Group

How Bitdeer Technologies Group Has Been Performing

With revenue growth that's superior to most other companies of late, Bitdeer Technologies Group has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bitdeer Technologies Group.How Is Bitdeer Technologies Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Bitdeer Technologies Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The latest three year period has also seen an excellent 30% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the eleven analysts following the company. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

With this information, we can see why Bitdeer Technologies Group is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Bitdeer Technologies Group's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Bitdeer Technologies Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Bitdeer Technologies Group (1 is potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on Bitdeer Technologies Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026