- United States

- /

- Software

- /

- NasdaqCM:BTDR

A Look At Bitdeer Technologies Group (BTDR) Valuation As It Pivots To NVIDIA Powered AI Data Centers

Bitdeer Technologies Group (BTDR) is drawing fresh attention after Bitdeer AI announced the deployment of NVIDIA GB200 NVL72 hardware in Malaysia, along with plans to convert former bitcoin mining sites into GPU focused AI data centers.

See our latest analysis for Bitdeer Technologies Group.

The recent AI push comes after a volatile stretch for Bitdeer, with a 30.09% 7 day and 52.45% 30 day share price return, but a 36.47% 90 day share price decline and a 29.16% 1 year total shareholder return decline. Legal actions linked to past disclosures, weaker third quarter 2025 results, and chip development delays weighed on sentiment earlier. The pivot toward GPU focused AI data centers now appears to be rebuilding short term momentum.

If this AI move has caught your attention, it could be a good moment to see what else is happening across high growth tech and AI stocks as a potential source of new ideas.

With BTDR trading at US$15.26, showing strong recent gains but a 1 year total return decline and an intrinsic discount near 95%, is the market underestimating this AI shift or already pricing in the next leg of growth?

Most Popular Narrative: 53.8% Undervalued

With Bitdeer Technologies Group's last close at US$15.26 and the most followed narrative pointing to fair value at US$33.00, the gap is hard to ignore for anyone tracking the stock.

The planned commercialization of SEALMINER ASICs, coupled with a high demand for energy efficient mining machines, represents a diversification of revenue streams and is likely to enhance revenue growth as Bitdeer becomes a key player in the ASIC market.

Curious how a business with current losses gets to that valuation? The narrative leans heavily on sharp revenue expansion, margin recovery, and a future earnings multiple usually linked with larger software names. Want to see the full chain of assumptions that bridges today’s results to that fair value?

The most followed narrative applies a discount rate of 8.83% to future cash flows, factoring in projected revenue growth, rising profit margins, and a future P/E multiple to arrive at a US$33.00 fair value. It also builds in expectations for share count increases and a shift from current losses to meaningful earnings over the next few years.

Result: Fair Value of $33.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including large reported losses and the class action lawsuit around SEAL04 disclosures, that could challenge this upbeat storyline.

Find out about the key risks to this Bitdeer Technologies Group narrative.

Another View: Market Pricing Sends A Different Signal

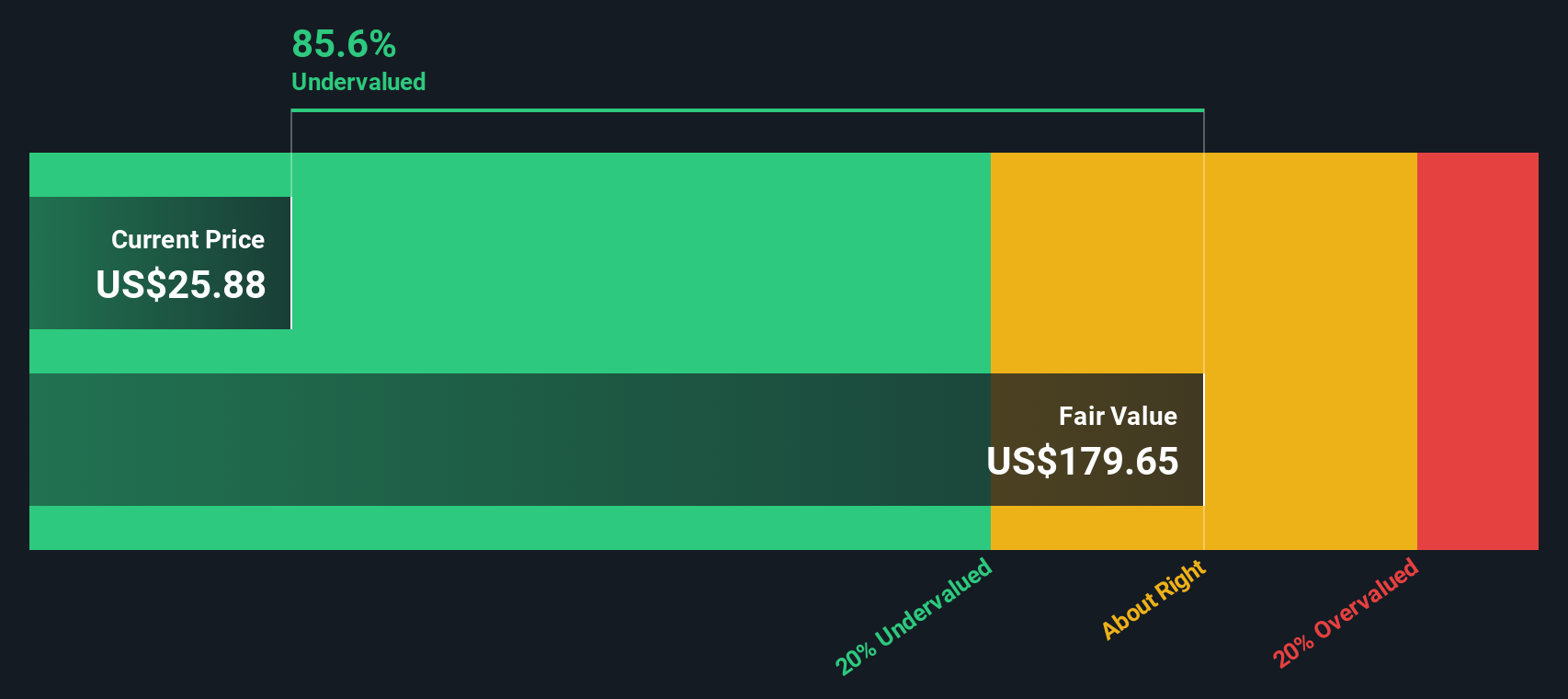

The narrative and our DCF model both point to Bitdeer looking cheap, with the shares trading around 95% below the US$323.29 fair value estimate. That is a very large gap for any stock. Does it flag a rare opportunity or simply show how much needs to go right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bitdeer Technologies Group Narrative

If parts of this story do not sit right with you, or you prefer to stress test the numbers yourself, you can build a customized view in just a few minutes with Do it your way.

A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Bitdeer has raised your interest, do not stop here. Take a few minutes to compare it with other ideas so you are not leaving potential opportunities on the table.

- Spot potential value plays by scanning these 868 undervalued stocks based on cash flows that currently screen well on discounted cash flow metrics.

- Back the next wave of computing by checking out these 23 quantum computing stocks that are working on real world quantum applications.

- Strengthen your watchlist with income focused names using these 12 dividend stocks with yields > 3% that may offer more stable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

QDay is coming - 01 Quantum hold the key

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!