- United States

- /

- Software

- /

- NasdaqCM:BTCT

Lacklustre Performance Is Driving BTC Digital Ltd.'s (NASDAQ:BTCT) 25% Price Drop

Unfortunately for some shareholders, the BTC Digital Ltd. (NASDAQ:BTCT) share price has dived 25% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 33% in the last year.

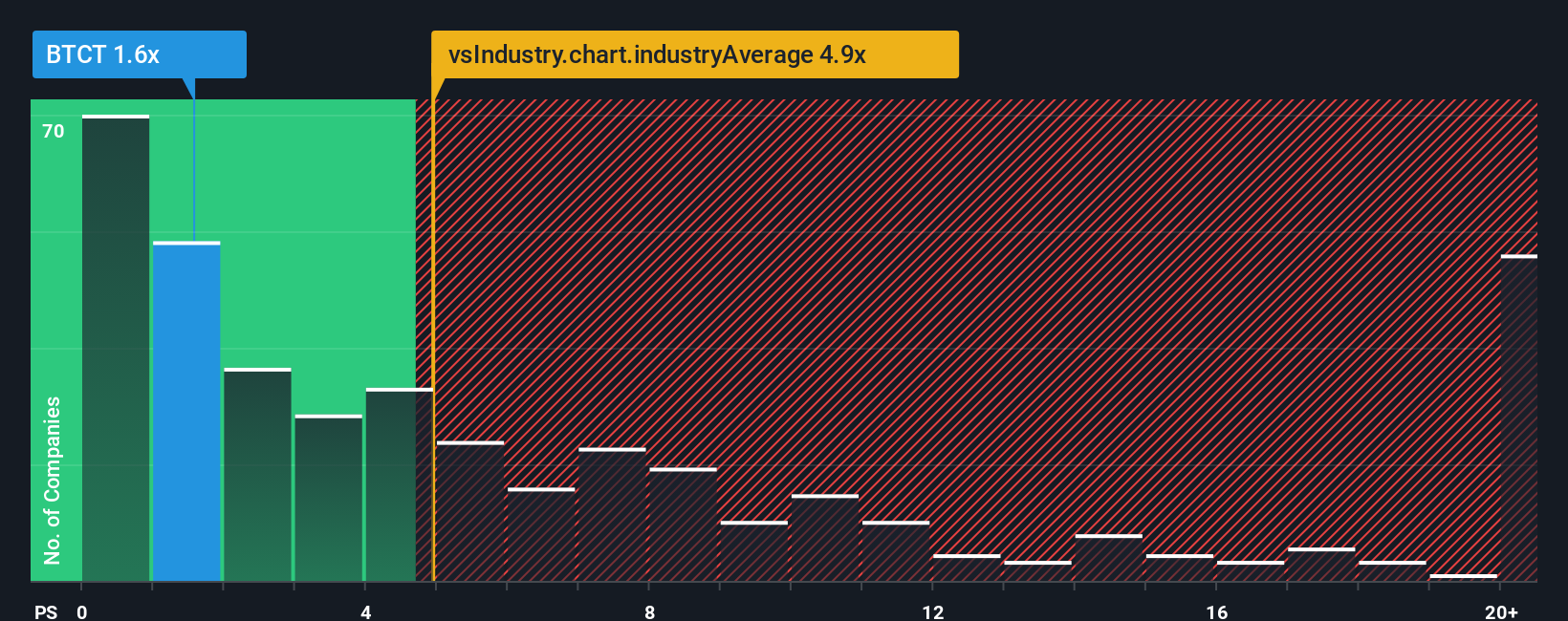

Following the heavy fall in price, BTC Digital's price-to-sales (or "P/S") ratio of 1.6x might make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 4.9x and even P/S above 11x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for BTC Digital

What Does BTC Digital's Recent Performance Look Like?

BTC Digital certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on BTC Digital will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as BTC Digital's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 29% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

With this information, we can see why BTC Digital is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Having almost fallen off a cliff, BTC Digital's share price has pulled its P/S way down as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of BTC Digital's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for BTC Digital (1 is a bit concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BTC Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTCT

BTC Digital

A crypto asset technology company, engages in bitcoin mining business in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success