- United States

- /

- Software

- /

- NasdaqCM:BTBT

We're Keeping An Eye On Bit Digital's (NASDAQ:BTBT) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, Bit Digital (NASDAQ:BTBT) shareholders have done very well over the last year, with the share price soaring by 116%. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given its strong share price performance, we think it's worthwhile for Bit Digital shareholders to consider whether its cash burn is concerning. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Bit Digital

How Long Is Bit Digital's Cash Runway?

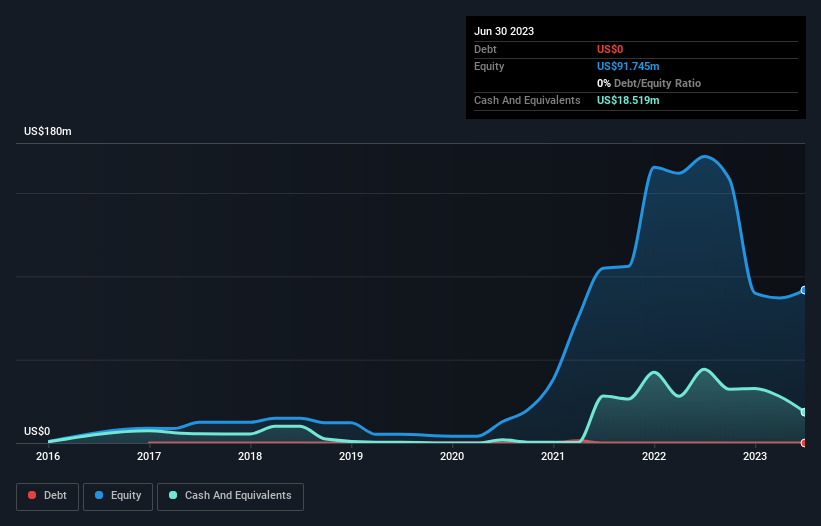

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at June 2023, Bit Digital had cash of US$19m and no debt. Looking at the last year, the company burnt through US$27m. So it had a cash runway of approximately 8 months from June 2023. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Well Is Bit Digital Growing?

Bit Digital managed to reduce its cash burn by 65% over the last twelve months, which suggests it's on the right flight path. But it was a bit disconcerting to see operating revenue down 13% in that time. On balance, we'd say the company is improving over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Bit Digital Raise More Cash Easily?

Given Bit Digital's revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Bit Digital's cash burn of US$27m is about 13% of its US$204m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is Bit Digital's Cash Burn Situation?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Bit Digital's cash burn reduction was relatively promising. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Taking a deeper dive, we've spotted 4 warning signs for Bit Digital you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BTBT

Bit Digital

Engages in the institutional grade ethereum treasury and staking business.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success