- United States

- /

- Software

- /

- NasdaqCM:BTBT

Could Leadership Changes at Bit Digital (BTBT) Strengthen Trust in Its Financial Reporting?

Reviewed by Simply Wall St

- On July 25, 2025, Bit Digital, Inc. announced the appointment of Justin Zhu, previously Senior Vice President of Finance, as its new Chief Accounting Officer, effective immediately.

- Zhu's extensive experience at leading global accounting firms and deep knowledge of public company audits may strengthen Bit Digital's financial reporting and compliance capabilities.

- We’ll explore how bringing in a seasoned financial leader could shape Bit Digital’s investment narrative and the company’s growth trajectory.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Bit Digital Investment Narrative Recap

To be a shareholder in Bit Digital, you need to believe that its pivot from Bitcoin mining to high-performance computing (HPC), including AI infrastructure, will successfully offset its volatile earnings and reliance on key customers. The appointment of Justin Zhu as Chief Accounting Officer is not expected to materially impact the biggest near-term catalyst, HPC growth, but may help mitigate execution risks by strengthening financial controls and reporting, which is important given recent business shifts and ongoing expansion.

Among the recent announcements, Bit Digital's $150 million follow-on equity offering in June 2025 is particularly relevant. Expanding the management team’s financial expertise alongside significant capital raises highlights the company's push to fund HPC scaling and platform partnerships, both central to revenue growth catalysts and efforts to address margin pressures from high upfront costs.

By contrast, investors should be aware that reliance on a handful of large cloud customers means if demand unexpectedly weakens, revenue streams could face abrupt pressure...

Read the full narrative on Bit Digital (it's free!)

Bit Digital's narrative projects $245.0 million revenue and $43.1 million earnings by 2028. This requires 33.9% yearly revenue growth and a $122.6 million earnings increase from -$79.5 million today.

Uncover how Bit Digital's forecasts yield a $5.90 fair value, a 72% upside to its current price.

Exploring Other Perspectives

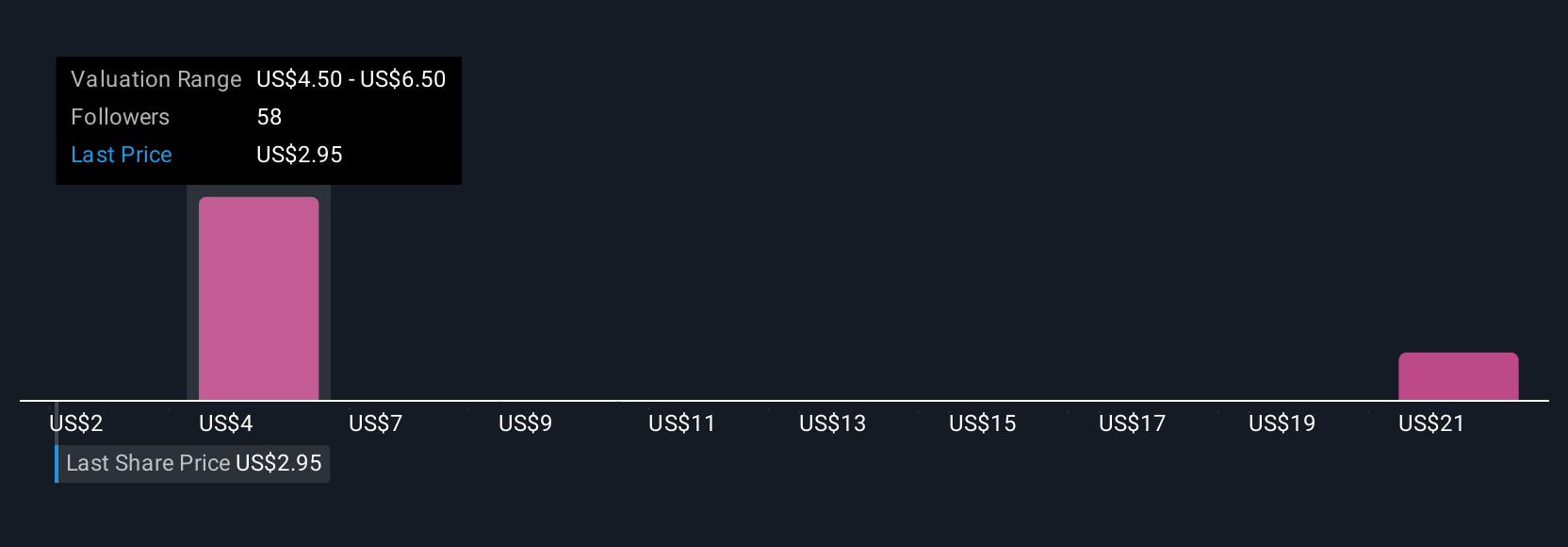

Nine fair value estimates from the Simply Wall St Community range from US$2.49 to US$22.55. With such varied outlooks, keep in mind that ongoing cost pressures from GPU leasing could become a pivotal factor in Bit Digital's future performance; consider these perspectives before making your own assessment.

Explore 9 other fair value estimates on Bit Digital - why the stock might be worth over 6x more than the current price!

Build Your Own Bit Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bit Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bit Digital's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives