- United States

- /

- Software

- /

- NasdaqCM:BTBT

Could Bit Digital’s (BTBT) Expanded Shelf Registration Reshape Its Capital Strategy or Signal Caution?

Reviewed by Sasha Jovanovic

- On October 31, 2025, Bit Digital filed an omnibus shelf registration enabling flexible future issuance of securities, including ordinary shares, preference shares, debt securities, warrants, units, and subscription rights.

- This filing provides Bit Digital with increased agility in capital raising, signaling to the market that the company may consider upcoming financial moves or adjustments to its capital structure.

- We'll explore how this expanded capital-raising flexibility could influence Bit Digital's investment narrative and long-term growth prospects.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Bit Digital Investment Narrative Recap

To be a shareholder in Bit Digital, you really need to believe in the company's vision of building a scalable Ethereum treasury and staking platform. The recent omnibus shelf registration gives Bit Digital the flexibility to raise capital in different ways, but for now, it does not substantially alter the primary short-term catalyst, growth in Ethereum adoption, or the main risk, which is potential shareholder dilution if equity offerings continue.

Among recent announcements, the July 2025 move to increase the authorized share capital stands out. This decision directly relates to the new shelf registration, as it allows Bit Digital to issue more shares when accessing capital markets, which may matter for both fueling expansion and managing dilution concerns tied to future growth initiatives.

On the other hand, investors should stay alert to how additional equity offerings might affect per-share value, particularly if...

Read the full narrative on Bit Digital (it's free!)

Bit Digital's narrative projects $376.7 million revenue and $35.3 million earnings by 2028. This requires 56.4% yearly revenue growth and an $88 million earnings increase from current earnings of -$52.7 million.

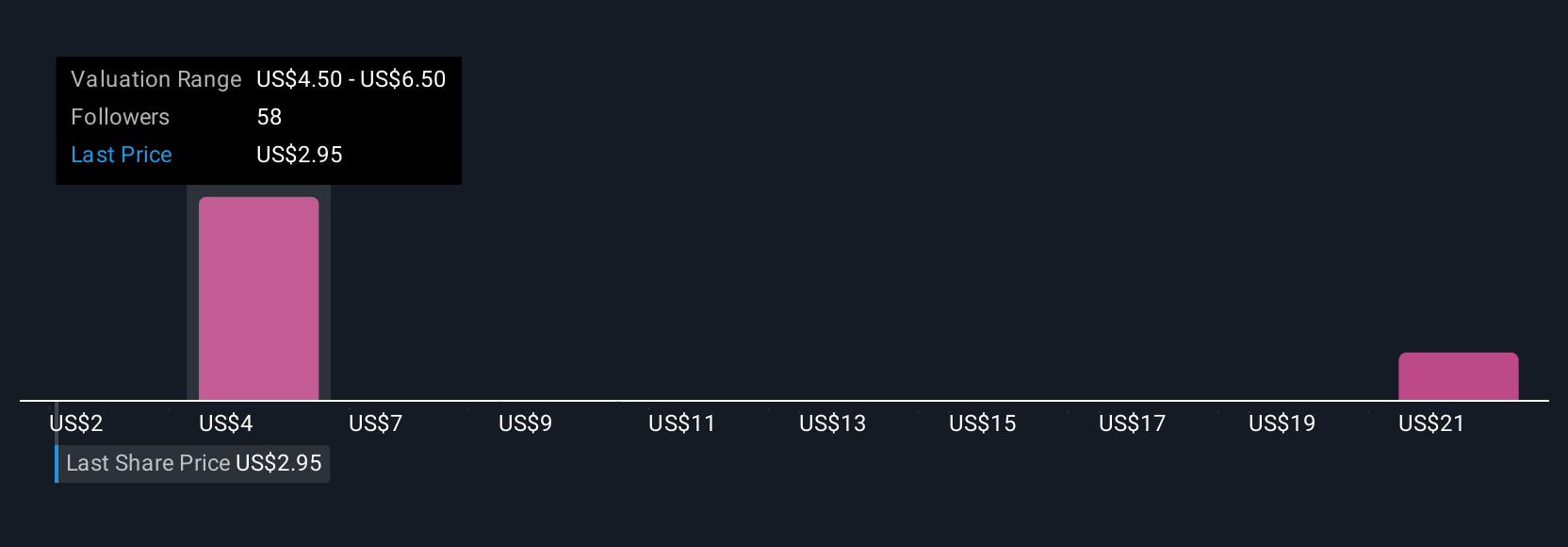

Uncover how Bit Digital's forecasts yield a $5.70 fair value, a 82% upside to its current price.

Exploring Other Perspectives

Twelve individual fair value estimates from the Simply Wall St Community range from US$5 to US$28.32 per share. With future capital raises possibly leading to equity dilution, you can see just how widely investor opinions differ on Bit Digital’s long-term potential, and it is worth considering several alternative views.

Explore 12 other fair value estimates on Bit Digital - why the stock might be worth over 9x more than the current price!

Build Your Own Bit Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bit Digital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bit Digital's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

Bit Digital

Engages in the institutional grade ethereum treasury and staking business.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives