- United States

- /

- Software

- /

- NasdaqCM:BTBT

Bit Digital (BTBT) Initiates Follow-on Equity Offering With Registered Direct Approach

Reviewed by Simply Wall St

Bit Digital (BTBT) has recently filed for a follow-on equity offering, potentially indicating its strategy to raise capital for growth or strengthen its balance sheet. The company's share price soared by 87% over the last quarter. During the same timeframe, the completion of a follow-on equity offering amounting to $150 million likely played a role in this significant price movement. While earnings results revealed a drop in sales and a net loss, the broader market remained flat in the last week and rose 11% over the past year. Bit Digital's performance suggests an upward trajectory, contrasting with the flat market trend.

The recent filing for a follow-on equity offering by Bit Digital could enhance its growth initiatives or balance sheet. Over the past three years, the company's shares have seen a total return of 90.17%. This substantial growth highlights the company's strategic moves and market position. However, in the past year, Bit Digital underperformed, unable to match the broader US market's return of 11.4%. Despite this one-year comparison, the longer-term growth remains a pivotal point of reference for investors evaluating the company's trajectory.

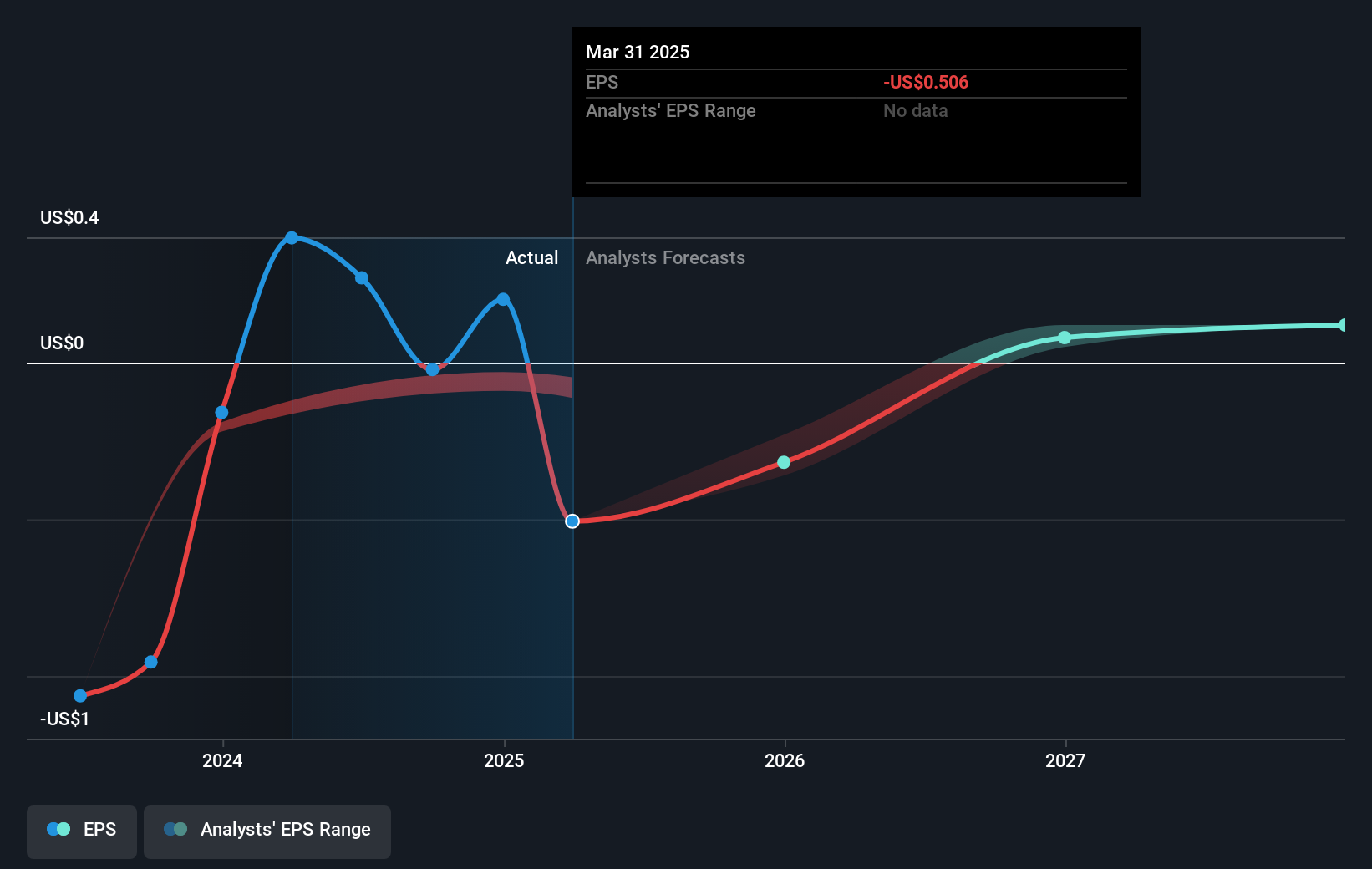

While the recent capital raise is aimed at future growth, investors should note that the company's revenue recently was US$102.04 million with earnings showing a loss of US$79.49 million. These figures offer a mixed outlook in context of potential growth, placing emphasis on how effective the funds from the equity offering will be in improving operations and profitability. Currently, the share price standing at $3.29, situates the price at a discount to the analyst price target of $5.90. This represents a potential increase aligning with future growth expectations. As such, investors should consider how this expected shift in business focus will impact both revenue and earnings forecasts.

Learn about Bit Digital's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives