- United States

- /

- Software

- /

- NasdaqCM:BTBT

Bit Digital (BTBT): Assessing Valuation as Earnings Approach and Analyst Outlook Shifts After Conference Spotlight

Reviewed by Simply Wall St

Bit Digital (BTBT) has caught market attention as it prepares to unveil earnings that are expected to show a sharp jump in EPS from last year. Analysts are watching business momentum closely, particularly following the company’s recent conference appearance.

See our latest analysis for Bit Digital.

Bit Digital has seen some volatility lately, with its share price slipping 29% over the past month as investors weigh recent developments like the company's shelf registration filing and participation in a major Crypto & AI conference. While the stock’s 1-year total shareholder return sits at -39%, its three-year total return paints a very different picture at +156%. This points to an overall growth story for longer-term holders even as momentum has cooled in recent weeks.

If you’re looking to cast a wider net beyond Bit Digital, now’s an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and new earnings on the horizon, investors are left to wonder whether Bit Digital offers overlooked value at today's levels or if the promise of future growth is already priced in.

Most Popular Narrative: 50% Undervalued

With Bit Digital closing at $2.84 and the most popular narrative placing fair value far higher, the stage is set for a heated debate on whether the market is missing a compelling growth story or overestimating the company’s future strength.

The company's structural pivot to become a dedicated Ethereum treasury and staking platform positions it to capitalize on the growing acceptance of Ethereum among institutional investors and asset managers. This is expected to drive future revenue growth through larger scale ETH holdings and increased staking yields.

Curious what bold financial bets and future-focused projections lift Bit Digital's value target so high? There’s a critical set of numbers behind this forecast Think rocket-fueled growth models and margins that flip the script on recent performance. Which surprising assumptions power this narrative and could reset expectations? Get the full story by diving into the complete narrative.

Result: Fair Value of $5.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentration in Ethereum and reliance on third-party partners remain significant risks that could challenge Bit Digital’s ambitious growth projections.

Find out about the key risks to this Bit Digital narrative.

Another View: A Multiples-Based Perspective

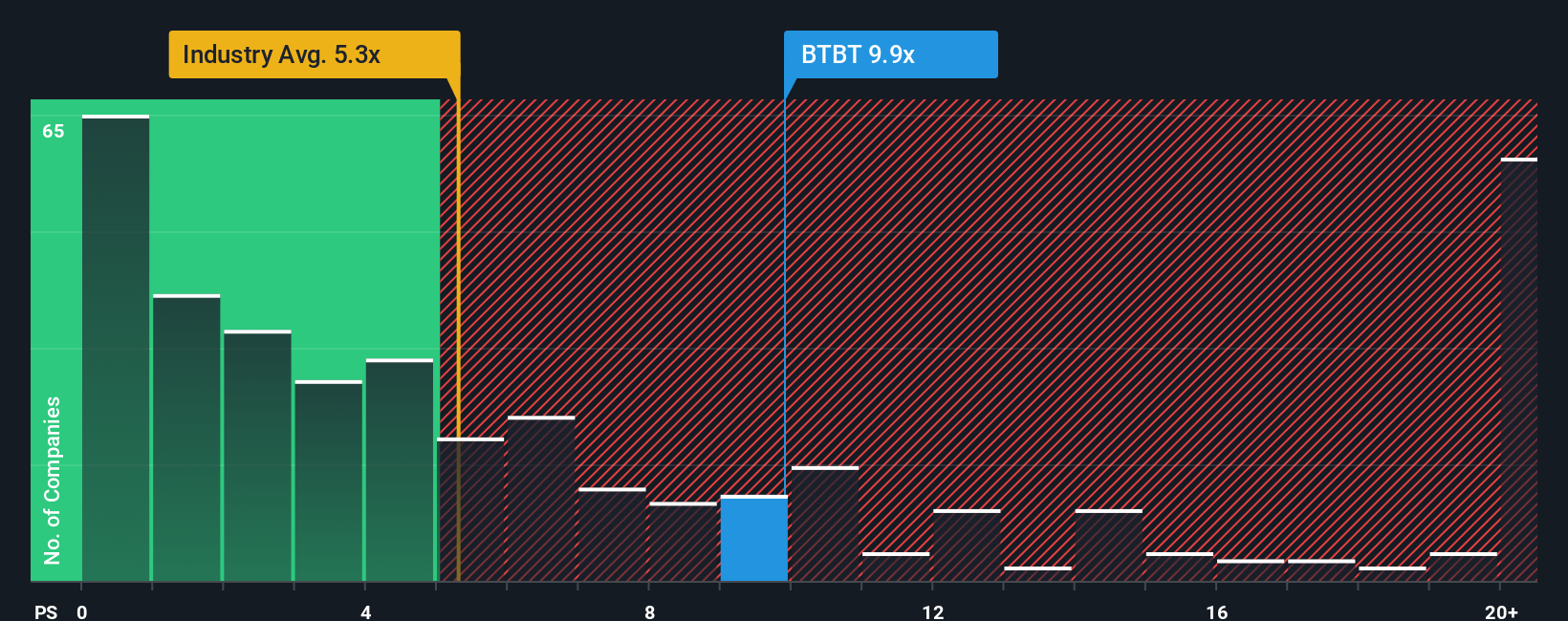

While the fair value points to a sizable upside, looking at price-to-sales tells a different story. Bit Digital trades at 9.3x sales, nearly double the US Software industry average of 4.8x, and just below its fair ratio of 9.5x. This premium suggests investors are expecting outsized growth, but if results disappoint, downside could be significant. Could the market’s optimism be overdone, or is there room left for multiple expansion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bit Digital Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can quickly craft your own view on Bit Digital and shape your own narrative in just a few minutes. Do it your way

A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart investment count by tapping into fresh opportunities before others do. Don’t let standout stocks and winning strategies pass you by.

- Uncover high-yield opportunities by checking out these 14 dividend stocks with yields > 3%, which steadily reward shareholders with impressive payouts.

- Spot the future of healthcare with these 32 healthcare AI stocks, highlighting companies using artificial intelligence to redefine patient care and medical breakthroughs.

- Get ahead of the next big tech leap as you scan these 27 quantum computing stocks, making headlines for innovation in quantum computing and information science.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

Bit Digital

Engages in the institutional grade ethereum treasury and staking business.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives