- United States

- /

- Software

- /

- NasdaqGS:BRZE

Will Braze's (BRZE) Widening Losses Challenge Its Path to Long-Term Margin Expansion?

Reviewed by Simply Wall St

- Braze, Inc. recently reported its second-quarter earnings for the fiscal year ended July 31, 2025, revealing sales of US$180.11 million, up from US$145.5 million a year earlier, and updated its guidance to expect revenue of US$717.0 million to US$720.0 million for the full fiscal year ending January 31, 2026.

- Although revenue increased year-over-year, Braze's net loss and basic loss per share also widened, underscoring ongoing investments and operating challenges even amid heightened demand.

- Next, we'll assess how Braze's upgraded revenue outlook and expanding sales profile may reshape analyst views on its long-term margin potential.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Braze Investment Narrative Recap

To consider Braze as an investment, you need to believe that its AI-driven customer engagement platform can translate strong revenue growth into lasting profitability. The latest quarterly results show improving sales momentum and an upgraded revenue forecast, but expanding losses remain the key short-term risk while demand and integration efforts continue. This news does not fundamentally change the largest catalyst, whether AI-powered offerings like OfferFit can unlock larger deals and move the company toward positive margins amid ongoing operational pressures.

Among recent updates, Braze’s raised full-year revenue guidance following Q2 results stands out as most relevant here. The upgraded outlook suggests continued confidence in topline growth, likely tied to both organic expansion and new AI-focused products, even as the bottom line reflects ongoing upfront investments tied to those innovations.

Yet, with heightened optimism on sales, investors should also be aware of unresolved concerns around net losses, especially if rising costs tied to technology integration or international operations begin to weigh on margins...

Read the full narrative on Braze (it's free!)

Braze's narrative projects $1.0 billion revenue and $133.0 million earnings by 2028. This requires 17.9% yearly revenue growth and a $236.9 million increase in earnings from -$103.9 million.

Uncover how Braze's forecasts yield a $43.72 fair value, a 39% upside to its current price.

Exploring Other Perspectives

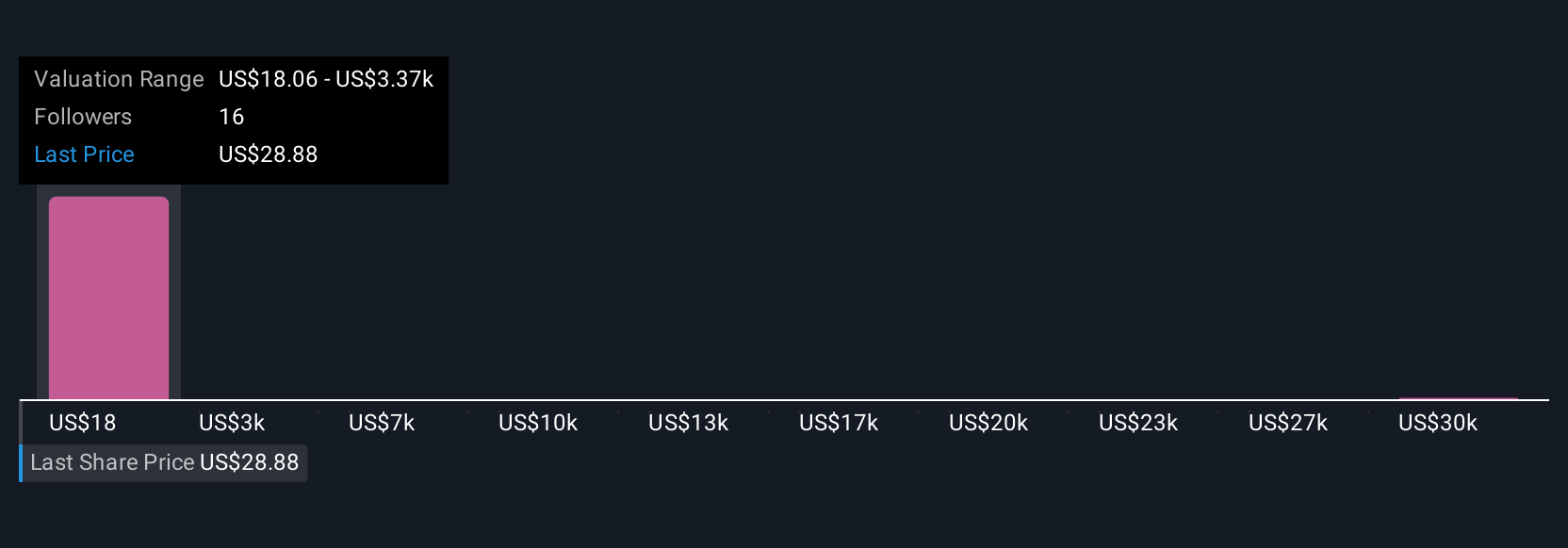

Four individual estimates from the Simply Wall St Community put fair value between US$23.50 and an outlier high of US$33,504.83. While views differ substantially, ongoing net losses and widening margins weigh heavily on expectations for future performance so be sure to review several perspectives.

Explore 4 other fair value estimates on Braze - why the stock might be worth 25% less than the current price!

Build Your Own Braze Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Braze research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Braze research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Braze's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Braze might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRZE

Braze

Operates a customer engagement platform that provides interactions between consumers and brands worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion