Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Benefitfocus, Inc. (NASDAQ:BNFT) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Benefitfocus

How Much Debt Does Benefitfocus Carry?

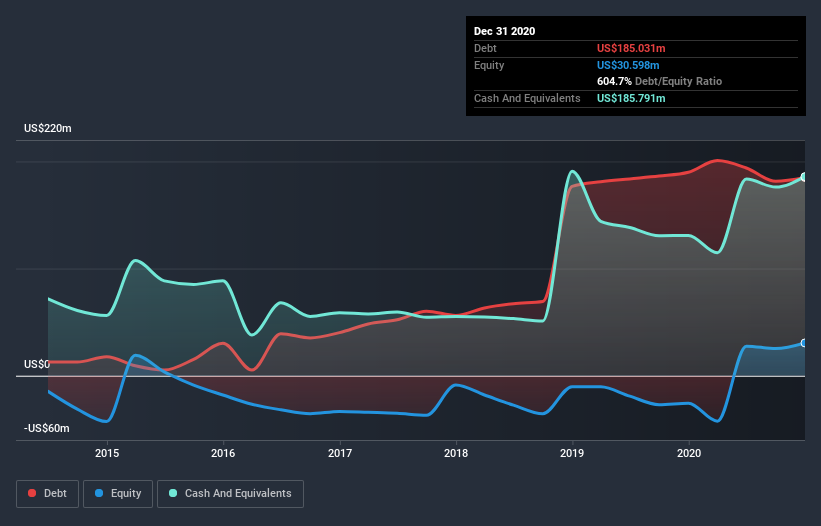

As you can see below, Benefitfocus had US$185.0m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have US$185.8m in cash offsetting this, leading to net cash of US$760.0k.

A Look At Benefitfocus' Liabilities

According to the last reported balance sheet, Benefitfocus had liabilities of US$61.3m due within 12 months, and liabilities of US$270.5m due beyond 12 months. Offsetting this, it had US$185.8m in cash and US$37.3m in receivables that were due within 12 months. So its liabilities total US$108.6m more than the combination of its cash and short-term receivables.

Benefitfocus has a market capitalization of US$452.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Benefitfocus also has more cash than debt, so we're pretty confident it can manage its debt safely.

We also note that Benefitfocus improved its EBIT from a last year's loss to a positive US$3.3m. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Benefitfocus's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Benefitfocus has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Benefitfocus actually produced more free cash flow than EBIT over the last year. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

Although Benefitfocus's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$760.0k. The cherry on top was that in converted 446% of that EBIT to free cash flow, bringing in US$15m. So we are not troubled with Benefitfocus's debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Benefitfocus .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Benefitfocus or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Benefitfocus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:BNFT

Benefitfocus

Benefitfocus, Inc. provides cloud-based benefits management technology solutions for employers and health plans in the United States.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

SIrios Resources (SOI) is significantly undervalued on a risk-adjusted basis.

BSX after Penumbra ?

Procter & Gamble - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!