- United States

- /

- Software

- /

- NasdaqGM:BNFT

Is Benefitfocus (NASDAQ:BNFT) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Benefitfocus, Inc. (NASDAQ:BNFT) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Benefitfocus

What Is Benefitfocus's Debt?

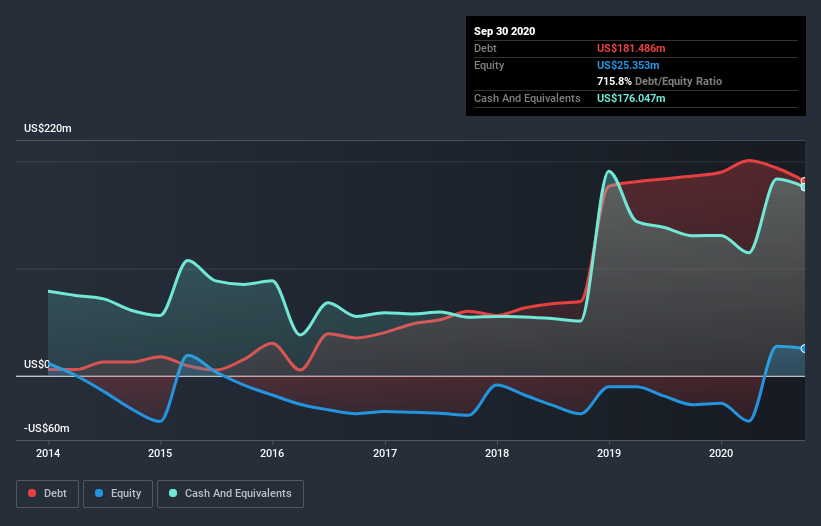

As you can see below, Benefitfocus had US$181.5m of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have US$176.0m in cash offsetting this, leading to net debt of about US$5.44m.

How Healthy Is Benefitfocus's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Benefitfocus had liabilities of US$60.9m due within 12 months and liabilities of US$270.5m due beyond that. Offsetting these obligations, it had cash of US$176.0m as well as receivables valued at US$36.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$118.6m.

This deficit isn't so bad because Benefitfocus is worth US$454.7m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Carrying virtually no net debt, Benefitfocus has a very light debt load indeed. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Benefitfocus can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Benefitfocus's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, Benefitfocus had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost US$3.8m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of US$33m. So we do think this stock is quite risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Benefitfocus you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Benefitfocus or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Benefitfocus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:BNFT

Benefitfocus

Benefitfocus, Inc. provides cloud-based benefits management technology solutions for employers and health plans in the United States.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks