- United States

- /

- Software

- /

- NasdaqCM:BLIN

Lacklustre Performance Is Driving Bridgeline Digital, Inc.'s (NASDAQ:BLIN) 26% Price Drop

Bridgeline Digital, Inc. (NASDAQ:BLIN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 5.4% over that longer period.

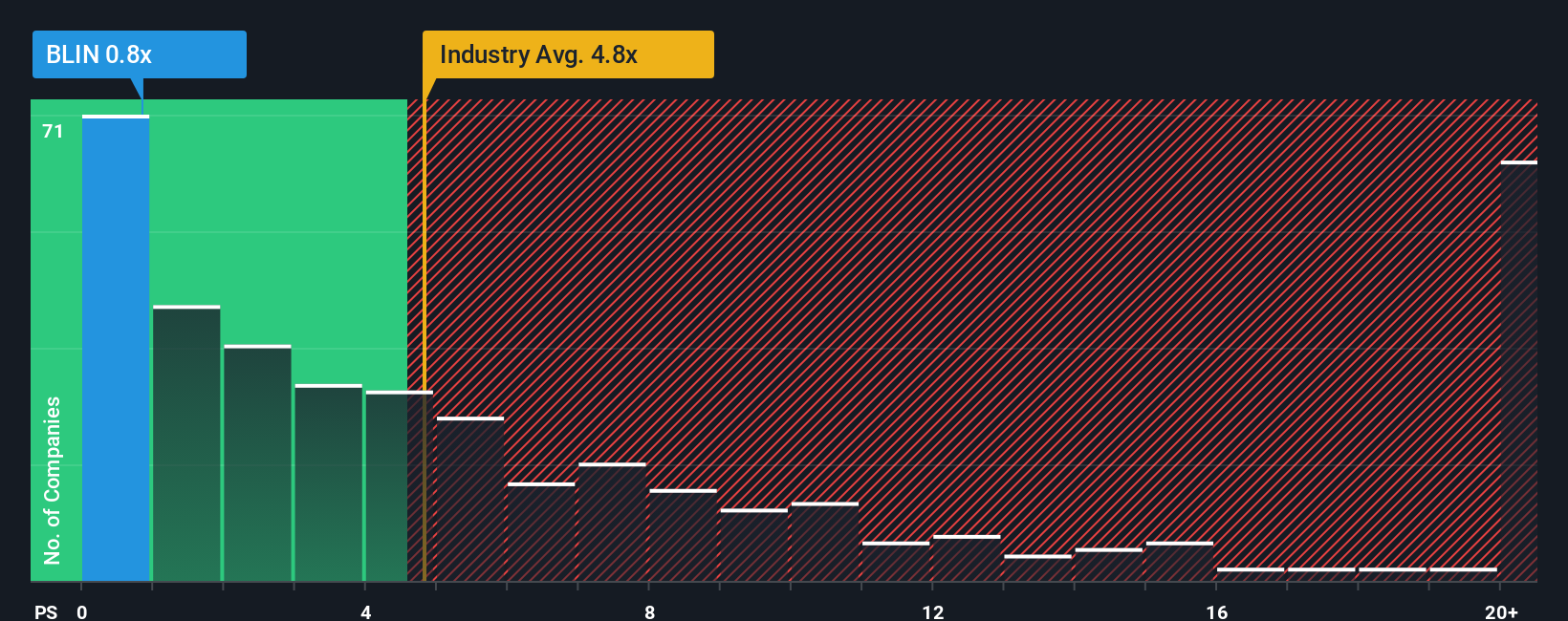

Following the heavy fall in price, Bridgeline Digital may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.8x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.8x and even P/S higher than 11x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Bridgeline Digital

How Bridgeline Digital Has Been Performing

Bridgeline Digital could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bridgeline Digital.Is There Any Revenue Growth Forecasted For Bridgeline Digital?

The only time you'd be truly comfortable seeing a P/S as depressed as Bridgeline Digital's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 8.0% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the only analyst following the company. That's shaping up to be materially lower than the 20% growth forecast for the broader industry.

In light of this, it's understandable that Bridgeline Digital's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Bridgeline Digital's P/S Mean For Investors?

Shares in Bridgeline Digital have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Bridgeline Digital's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Bridgeline Digital (1 is potentially serious!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bridgeline Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BLIN

Bridgeline Digital

Operates as a marketing technology company in the United States, Canada, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives