Stock Analysis

- United States

- /

- Professional Services

- /

- NYSE:FVRR

Three US Growth Companies With High Insider Ownership And Minimum 10% Revenue Growth

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating market conditions, with the Dow reaching new highs and tech stocks facing declines, investors are keenly observing trends and shifts across various sectors. In such a landscape, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 33.6% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

We'll examine a selection from our screener results.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. operates as a provider of cloud-native data management software across regions including North America, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately $1.92 billion.

Operations: The company generates revenue primarily from its software and programming segment, totaling approximately $286.79 million.

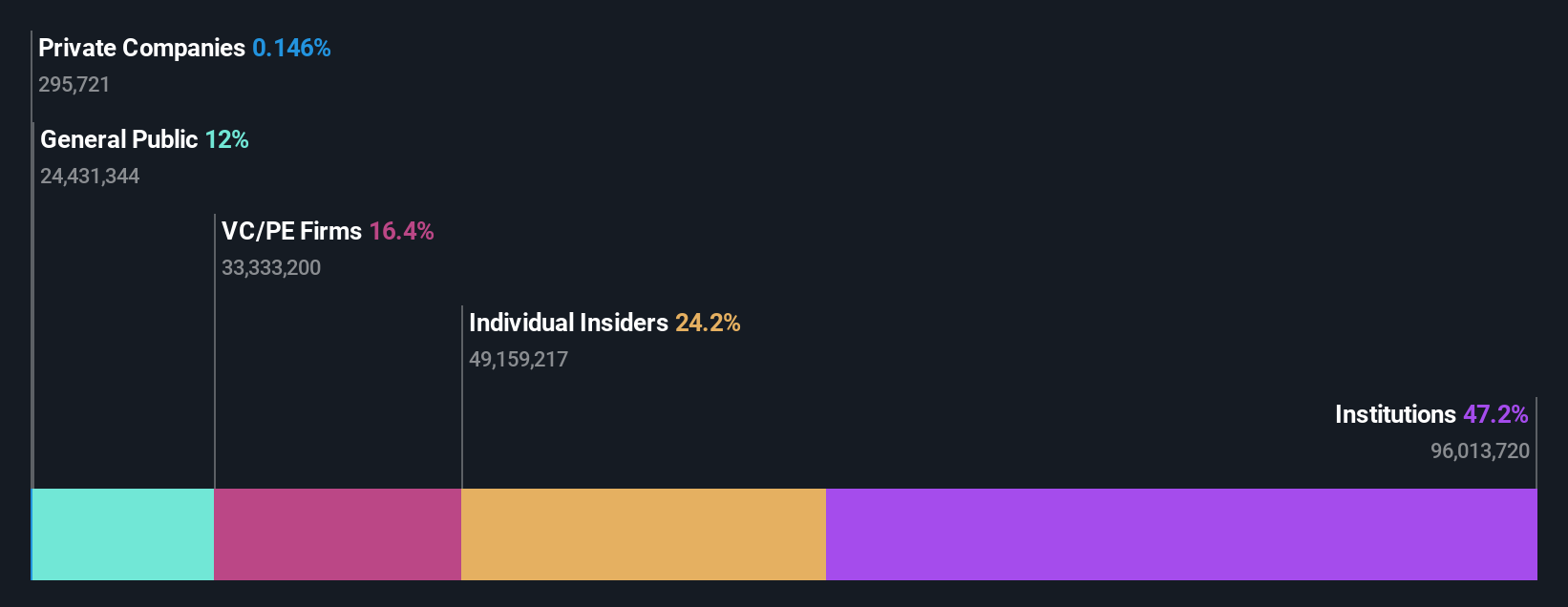

Insider Ownership: 37.2%

Revenue Growth Forecast: 16.5% p.a.

AvePoint, recently dropped from multiple Russell indexes but added to the Russell 2000 Growth-Defensive Index, shows a mixed financial scenario. Despite a net loss reduction in Q1 2024 to US$1.72 million from US$9.2 million year-over-year and a positive revenue forecast growth of 16.5% annually, challenges remain with its low forecasted return on equity at 14.7%. Insider activities are balanced with no substantial buying or selling over the past three months, reflecting cautious optimism among insiders about the company's growth trajectory amidst operational adjustments and market repositioning efforts.

- Dive into the specifics of AvePoint here with our thorough growth forecast report.

- The valuation report we've compiled suggests that AvePoint's current price could be inflated.

Fiverr International (NYSE:FVRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace with a market capitalization of approximately $909.50 million.

Operations: The company generates its revenue primarily from the internet software and services segment, totaling $366.94 million.

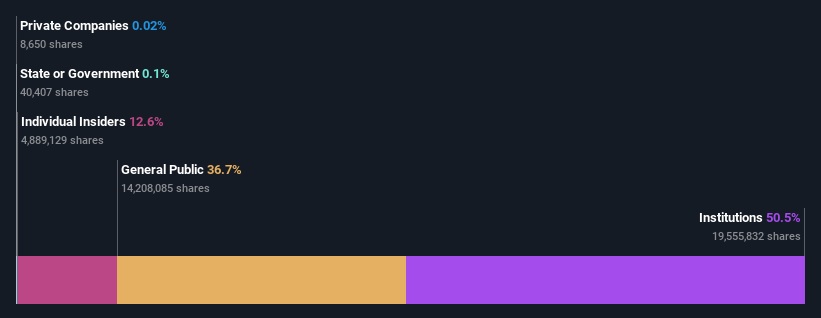

Insider Ownership: 12.6%

Revenue Growth Forecast: 10.2% p.a.

Fiverr International, having recently transitioned to profitability in Q1 2024, reported a net income of US$0.788 million, a significant improvement from a net loss of US$4.27 million the previous year. With revenues expected to grow by 5%-7% annually, the company's market performance is bolstered by robust earnings growth projections at 53.64% per year, outpacing the US market forecast of 14.8%. Despite trading at 69.9% below its estimated fair value and experiencing shareholder dilution over the past year, Fiverr's high forecasted Return on Equity (20.9%) suggests strong future profitability potential.

- Get an in-depth perspective on Fiverr International's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Fiverr International's share price might be too optimistic.

ZKH Group (NYSE:ZKH)

Simply Wall St Growth Rating: ★★★★★★

Overview: ZKH Group Limited is a company based in the People's Republic of China that operates a trading and service platform for maintenance, repair, and operating (MRO) products, including spare parts and chemicals, with a market capitalization of approximately $0.61 billion.

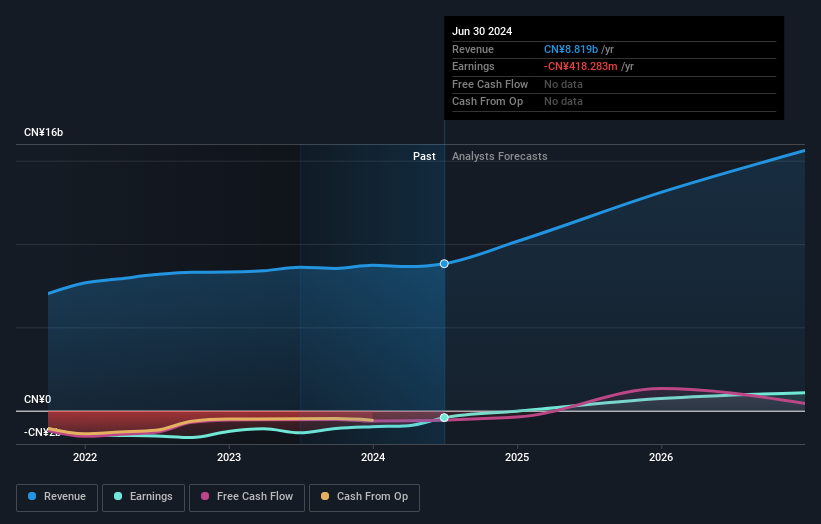

Operations: The company generates CN¥8.64 billion in revenue primarily from its business-to-business trading and services of industrial products.

Insider Ownership: 17.7%

Revenue Growth Forecast: 21.8% p.a.

ZKH Group, amidst a volatile market, has announced a $50 million share repurchase, signaling confidence by management. Despite recent financial struggles with a net loss reported in Q1 2024, ZKH is poised for significant growth with revenue expected to increase by 21.8% annually. The company's strategic moves and high insider ownership suggest potential for substantial value creation as it approaches profitability within the next three years, supported by robust earnings growth forecasts of 104.4% per year.

- Navigate through the intricacies of ZKH Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of ZKH Group shares in the market.

Turning Ideas Into Actions

- Navigate through the entire inventory of 181 Fast Growing US Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Fiverr International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FVRR

High growth potential with acceptable track record.