- United States

- /

- Software

- /

- NasdaqGS:AVPT

Revenues Not Telling The Story For AvePoint, Inc. (NASDAQ:AVPT) After Shares Rise 37%

Despite an already strong run, AvePoint, Inc. (NASDAQ:AVPT) shares have been powering on, with a gain of 37% in the last thirty days. The last 30 days bring the annual gain to a very sharp 99%.

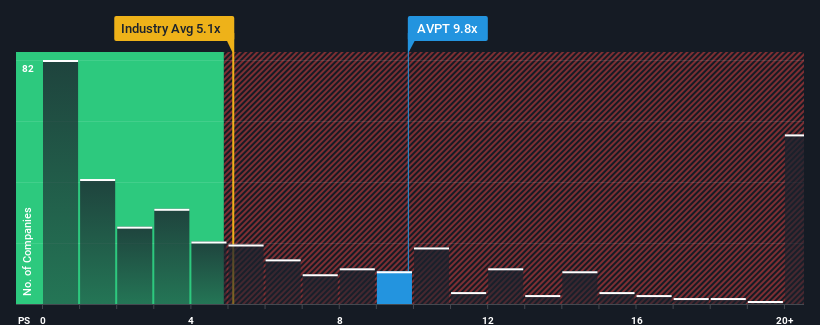

After such a large jump in price, AvePoint's price-to-sales (or "P/S") ratio of 9.8x might make it look like a strong sell right now compared to other companies in the Software industry in the United States, where around half of the companies have P/S ratios below 5.1x and even P/S below 1.8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for AvePoint

How AvePoint Has Been Performing

Recent times have been advantageous for AvePoint as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on AvePoint will help you uncover what's on the horizon.How Is AvePoint's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as AvePoint's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. The latest three year period has also seen an excellent 72% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 21% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be similar to the 20% per year growth forecast for the broader industry.

With this information, we find it interesting that AvePoint is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On AvePoint's P/S

The strong share price surge has lead to AvePoint's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given AvePoint's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for AvePoint you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives