- United States

- /

- Software

- /

- NasdaqGS:AVPT

A Fresh Look at AvePoint (AVPT) Valuation Following Strategic Partnership With Microsoft Channel Group

Reviewed by Simply Wall St

AvePoint (AVPT) has just announced a global partnership with the International Association of Microsoft Channel Partners, or IAMCP. This collaboration is designed to extend AvePoint’s global footprint and give members access to its technology and enablement programs.

See our latest analysis for AvePoint.

Following AvePoint's announcement, the stock has faced some short-term pressure, with a recent pullback including a 6.88% drop over the past month and a 23.49% dip in the last 90 days. However, the long-term picture looks much brighter. AvePoint boasts a one-year total shareholder return of 13.65% and an impressive 271% over the past three years, highlighting substantial growth momentum beneath the recent volatility.

If a dynamic partnership like this has you rethinking your strategy, it might be the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and strong revenue growth in play, investors may wonder whether AvePoint now offers a compelling entry point for the long term or if the market has already priced in all of its future upside.

Most Popular Narrative: 34.2% Undervalued

With AvePoint’s most followed narrative suggesting fair value is notably higher than the latest closing price, valuation bulls may see significant embedded upside. The stage is set for a closer look at what powers this viewpoint and whether the narrative's foundation holds up.

The accelerating enterprise adoption of AI tools like Microsoft Copilot, alongside increasing security and data governance challenges, is positioning AvePoint's data management and governance solutions as mission-critical, driving robust customer expansions and higher spending per customer. This is a catalyst for sustained revenue growth and stronger net retention rates.

Curious what bold growth projections underpin such a steep discount to fair value? The narrative’s numbers are built on rapid margin expansion and future profit levels that few competitors could plausibly achieve. Want to know which explosive trends and financial levers analysts are betting on for AvePoint? See what truly drives this eye-catching price target.

Result: Fair Value of $21.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on Microsoft and slower than expected multi-cloud expansion could challenge AvePoint’s long-term growth narrative if these risks materialize.

Find out about the key risks to this AvePoint narrative.

Another View: Risk in the Multiples

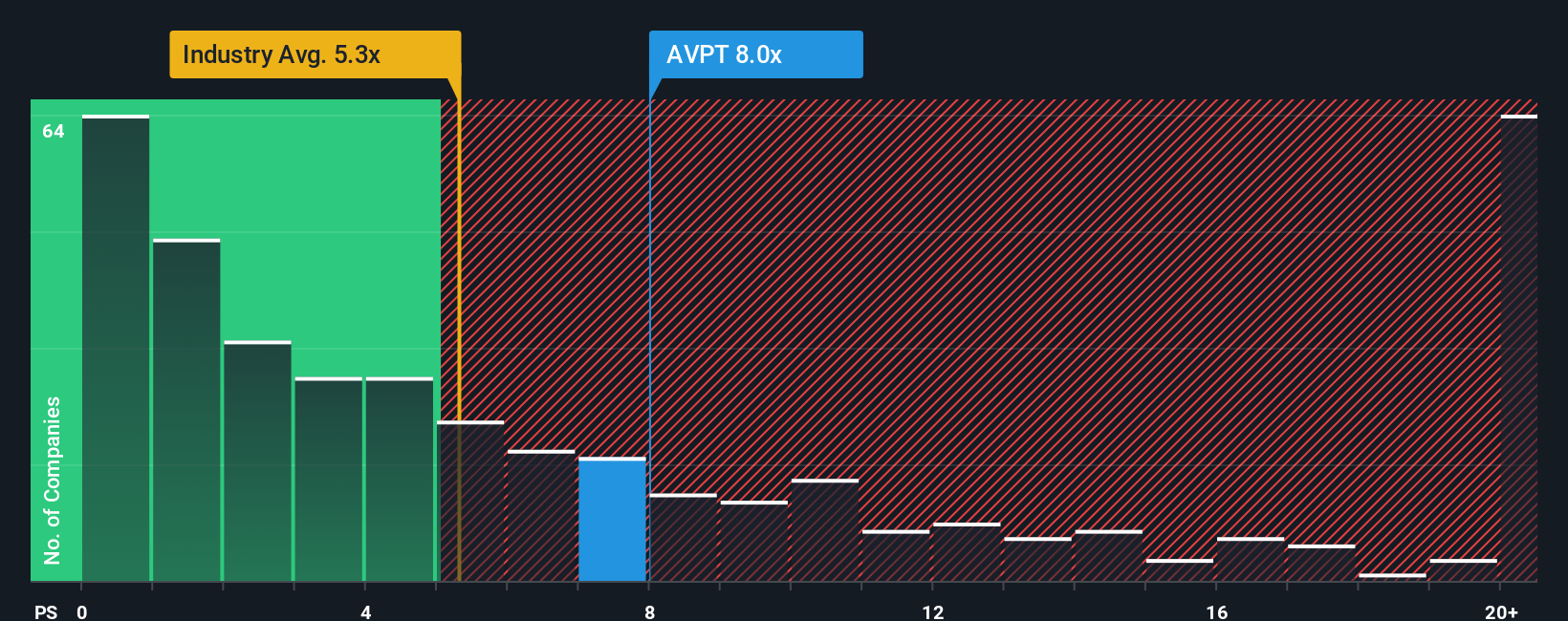

Looking through the lens of price-to-sales ratios offers a more cautious note. AvePoint trades at 8 times sales, which is high compared to both US Software peers (5x) and the industry average (5.3x). That gap suggests some valuation risk if growth does not keep pace. Should investors bank on the market holding such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AvePoint Narrative

If you see the story differently or want to dig into the numbers yourself, you can chart your own course and build a narrative in just a few minutes. Do it your way

A great starting point for your AvePoint research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your next opportunity might already be gaining momentum. Act now to benefit from trends investors are talking about, and don’t let fresh ideas pass you by.

- Capture the rewards of cost-effective companies by checking out these 840 undervalued stocks based on cash flows with strong fundamentals and potential for upward price movements.

- Tap into the surge in artificial intelligence and see which innovators stand out among these 27 AI penny stocks, setting benchmarks in emerging tech.

- Unlock income potential with these 22 dividend stocks with yields > 3% delivering solid yields above 3% to strengthen your portfolio's stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives