- United States

- /

- Software

- /

- NasdaqGS:AUR

What Do Recent Autonomous Driving Updates Mean for Aurora Innovation's 2025 Valuation?

Reviewed by Bailey Pemberton

- Ever wondered if Aurora Innovation is truly a hidden gem or just another name on the Nasdaq? If you have even a passing curiosity about finding value in fast-evolving tech stocks, you’ll want to read on.

- Despite some eye-catching long-term gains, with the stock up 141.7% over the past three years, recent momentum has been rough, with shares sliding 17.1% in just the last week and down 30.7% year-to-date.

- These moves come on the heels of notable updates in the autonomous driving sector and increased attention to regulatory progress. Both factors have reshaped market sentiment. News of strategic partnerships and fresh product milestones have kept Aurora in headlines, fueling both optimism and debate about what’s next.

- Aurora’s current valuation score stands at 4 out of 6, suggesting there are plenty of angles to consider. We’re about to break down the most popular valuation approaches and why there might be an even smarter way to judge if this stock deserves a spot on your radar.

Find out why Aurora Innovation's -23.0% return over the last year is lagging behind its peers.

Approach 1: Aurora Innovation Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. This approach aims to answer the fundamental question of what Aurora Innovation’s shares are truly worth, based on the money it can generate in the future.

Currently, Aurora Innovation’s Free Cash Flow stands at -$614.5 million, reflecting the heavy investments often seen in firms developing autonomous driving technology. Analyst forecasts suggest that this negative cash flow will persist in the near term, reaching -$728.6 million in 2026, but then sharply improve and turn positive by 2029 with a projected Free Cash Flow of $312.7 million. Looking further out, projections extrapolated by Simply Wall St indicate Free Cash Flow could exceed $1.2 billion within ten years as the business scales.

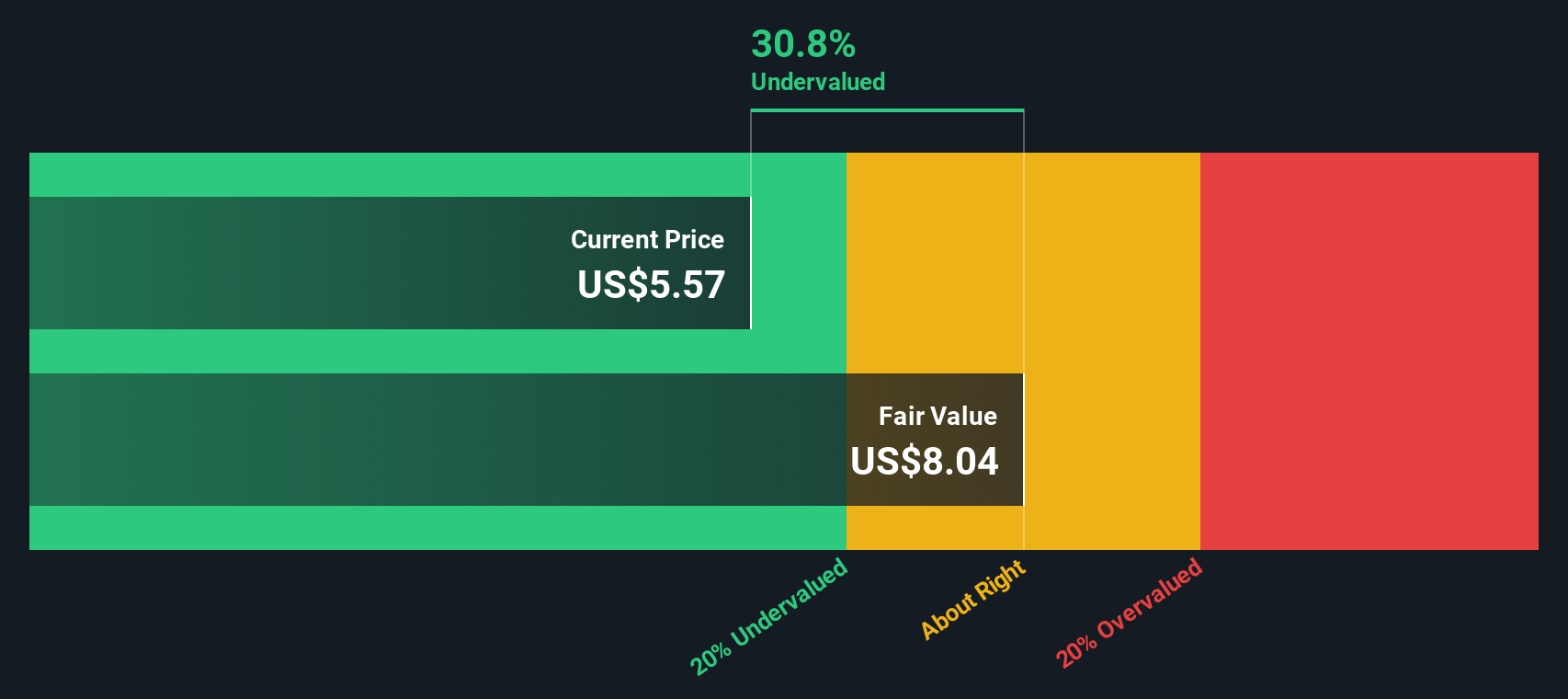

Based on this two-stage DCF analysis, Aurora Innovation’s intrinsic value per share is calculated at $6.24. With the current trading price significantly below this estimate and an implied discount of 32.3%, DCF analysis suggests the stock is undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Aurora Innovation is undervalued by 32.3%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Aurora Innovation Price vs Book

The Price-to-Book (P/B) ratio is a widely used valuation method for companies like Aurora Innovation, especially when the business is not yet profitable or has negative earnings. Unlike earnings-based multiples, the P/B ratio compares the market value of the company’s equity to its book value. This makes it a useful yardstick for early-stage or growth companies that are burning cash while building future assets.

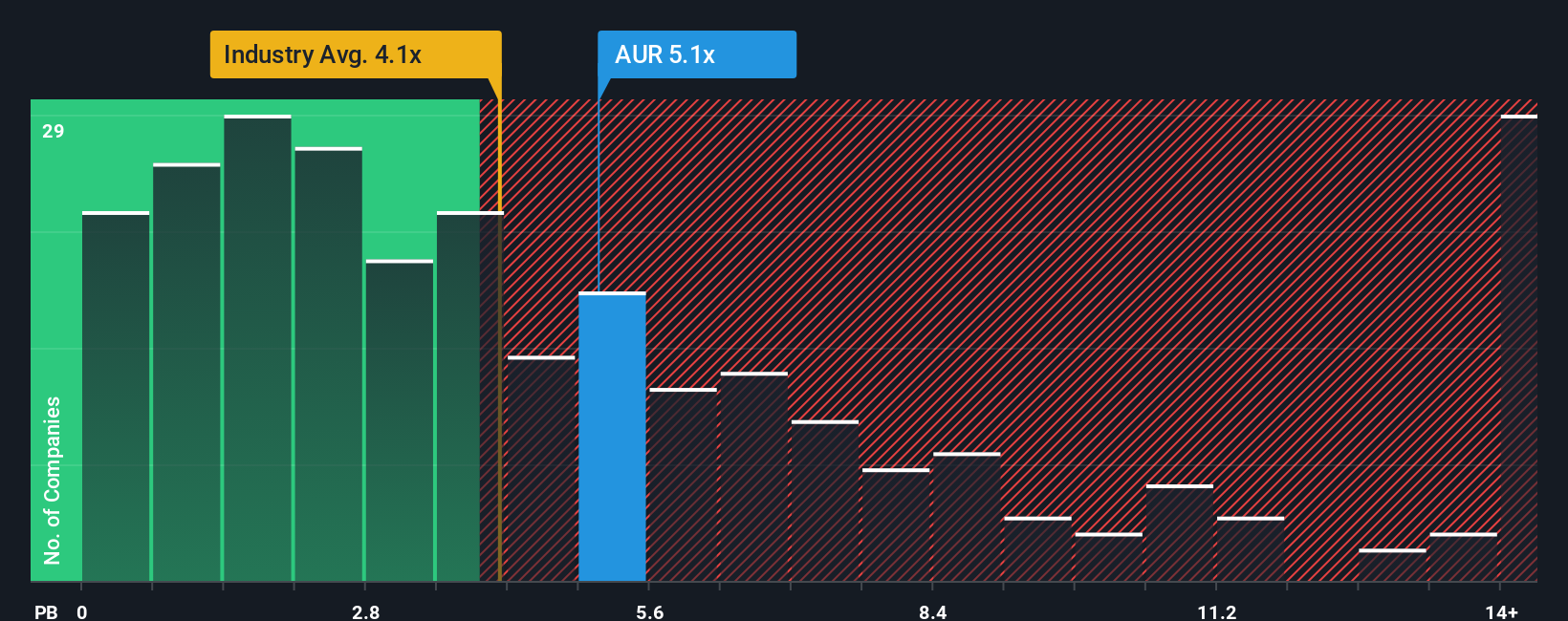

Growth prospects, risk profile, and profitability all influence what counts as a “normal” P/B ratio. Typically, higher growth and lower risk support a premium multiple, while uncertain or slower-growing companies command lower P/B figures. Aurora Innovation’s current P/B ratio stands at 3.6x. This is just below the software industry average of 3.8x and is notably lower than the peer average of 7.9x, suggesting investors are assigning a more conservative value to the company’s assets compared to its peers.

Simply Wall St’s unique "Fair Ratio" takes a more nuanced approach by calibrating the expected P/B multiple for Aurora Innovation using factors such as the company’s growth pipeline, industry positioning, profit margin outlook, and specific risks. Unlike simple industry or peer comparisons, the Fair Ratio provides a more tailored sense of what the market should reasonably pay for Aurora’s equity given its unique circumstances.

In this case, Aurora’s actual P/B multiple and Fair Ratio are closely aligned. This indicates the market is appropriately pricing the stock relative to its risks and opportunities, so investors may want to look for clearer catalysts or company-specific developments before expecting a major valuation re-rate.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aurora Innovation Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your story and outlook on a company, where you set your own assumptions about fair value, future revenue, profit margins, and more. Narratives help connect the dots from your personal take on Aurora Innovation’s business outlook to a tailored financial forecast, and then to a custom estimate of fair value, all grounded in your research and perspective.

Narratives are easily accessible on Simply Wall St’s Community page, where millions of investors share and update their own views. By comparing your Narrative’s fair value with Aurora’s current price, you get clear, actionable insights that can tip the scales on your investment decisions. In addition, Narratives automatically update as new news, financial results, or industry shifts come in, so your view stays fresh and relevant.

For instance, one investor’s Narrative for Aurora might see its fair value at $10.20 based on high growth expectations, while another’s could be as conservative as $3.85 with a more cautious outlook, demonstrating just how varied perspectives can be.

Do you think there's more to the story for Aurora Innovation? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives