- United States

- /

- Software

- /

- NasdaqGS:AUR

Aurora Innovation (AUR): Assessing Valuation as Driverless Freight Operations Expand and Commercial Milestones Accelerate

Reviewed by Simply Wall St

Aurora Innovation (AUR) saw its stock draw investor attention after announcing a rapid expansion of its driverless freight operations. This includes a new Fort Worth to El Paso route as well as new hardware upgrades.

See our latest analysis for Aurora Innovation.

Recent excitement around Aurora Innovation isn’t just about its new routes and hardware; investors have started to notice the company’s push toward scaled commercialization and recurring service revenue. Over the past year, while the 1-year total shareholder return is only slightly negative at -1.83%, the three-year total return stands out at a robust 155%. This shows that long-term optimism remains intact even as the share price has retreated year-to-date. With momentum from key operational wins, the stock’s narrative is shifting toward renewed growth potential amid a rapidly evolving industry landscape.

If Aurora’s latest breakthrough has you curious about what else is shaking up the world of autonomous tech, take the next step and explore See the full list for free.

Given the excitement around Aurora’s momentum and future plans, investors are now faced with a key question: is the recent dip a genuine buying opportunity, or has the market already priced in the company’s next wave of growth?

Price-to-Book Ratio of 4.3x: Is it justified?

Aurora Innovation is trading at a price-to-book ratio of 4.3x, placing it above the US Software industry average of 3.8x. With the last close at $5.10, this signals a potentially stretched valuation relative to sector peers.

The price-to-book ratio compares a company's market price to its book value and reflects how much investors are willing to pay for each dollar of net assets. For technology companies like Aurora Innovation, book value is often less central than future growth. However, it still provides a check on excessive optimism, especially in an early-stage, unprofitable business.

This elevated multiple suggests the market is factoring in substantial expectations for Aurora Innovation's future prospects, possibly driven by ambitious growth forecasts rather than current fundamentals. When compared to the broader software industry, Aurora appears slightly expensive on this metric.

There is insufficient data to determine a fair price-to-book ratio target, so the current premium could shift if market sentiment or company progress changes.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 4.3x (OVERVALUED)

However, slowing revenue growth and sustained net losses could challenge investor confidence if Aurora struggles to translate innovation into sustainable profitability.

Find out about the key risks to this Aurora Innovation narrative.

Another View: Discounted Cash Flow Suggests Upside

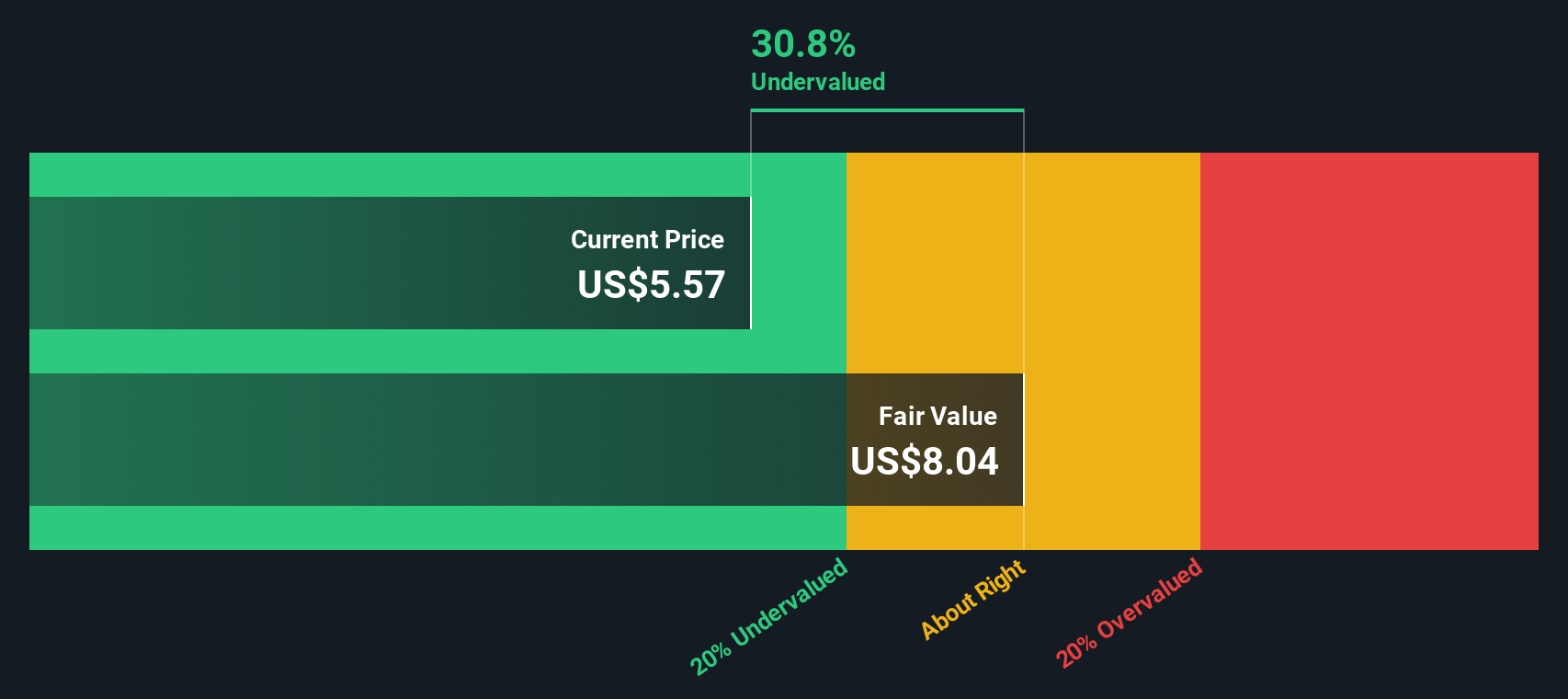

While the price-to-book ratio points to a premium valuation, our DCF model tells a different story. According to its estimates, Aurora Innovation is trading about 35% below its fair value of $7.86 per share. This suggests substantial upside if long-term cash flow materializes as projected. Is the market overlooking this hidden value, or are these forecasts too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aurora Innovation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aurora Innovation Narrative

If you’d rather dig into the numbers yourself or want a different viewpoint, you have the tools to craft your own perspective in minutes. Do it your way

A great starting point for your Aurora Innovation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let a great opportunity pass you by. Broaden your investing horizon with stock ideas handpicked for unique growth and value potential. Here are three you shouldn’t miss:

- Accelerate your search for high-yield opportunities by targeting companies with solid income potential through these 24 dividend stocks with yields > 3%. See who’s offering yields above 3% right now.

- Tap into businesses harnessing artificial intelligence by checking out these 26 AI penny stocks, where technology is driving powerful new trends and innovation.

- Zero in on value by reviewing these 848 undervalued stocks based on cash flows to spot stocks the market may be overlooking based on future cash flows and underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUR

Aurora Innovation

Operates as a self-driving technology company in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives