- United States

- /

- Software

- /

- NasdaqCM:APPS

Digital Turbine, Inc. (NasdaqCM:APPS) Retains Strong Financials Despite the Pullback

Although it might sound surprising, Digital Turbine ( NasdaqCM:APPS) has been around since 1998. After some changes , the breakthrough came as a mobile services platform that provides portal management, user interface, and content development and billing technology.

The company embedded itself deeply into the Android mobile market and is in good graces of carriers such as Verizon or AT&T, as well as corporations like Netflix or Amazon who want their apps pre-installed on Android phones.

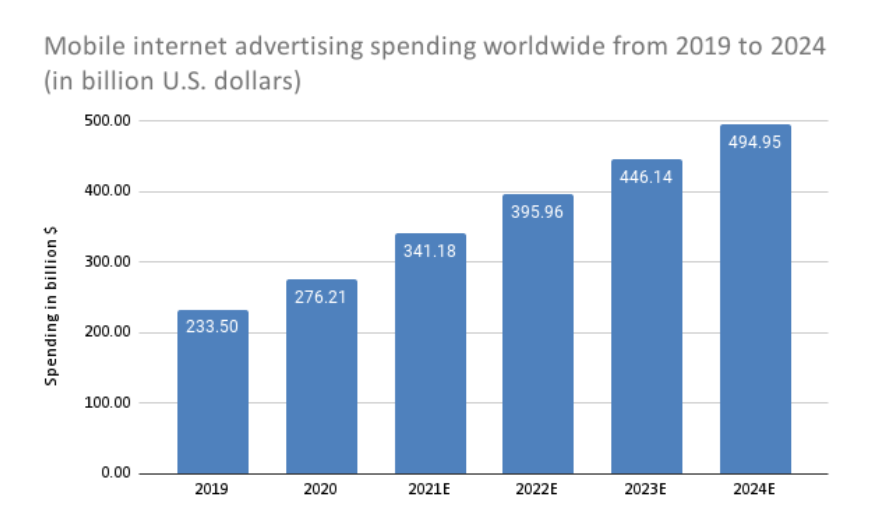

User reach exceeded 600 million, improving the revenue growth outlook with recent acquisitions of Fyber , AdColony and Appreciate. Expect leveraging the know-how to drive down the costs even more and expand into new markets.

Mobile internet advertising spending projections, Source: AdColony

After explosive growth in 2020, Digital Turbine slowed down in the recent 3 months with a 12% decline. Yet, its financials remain solid, and it wouldn’t be surprising to see the price continue outperforming the market in the long run. In this article, we decided to focus on Digital Turbine's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company with shareholder's equity.

See our latest analysis for Digital Turbine

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Digital Turbine is:

38% = US$55m ÷ US$145m (Based on the trailing twelve months to March 2021).

The 'return' is the income the business earned over the last year.Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.38 in profit.

Why Is ROE Important For Earnings Growth?

The ROE is a measure of a company's profitability.Based on how much of its profits the company chooses to reinvest or "retain," we can then evaluate a company's future ability to generate profits.Generally speaking, firms with a high return on equity and profit retention have a higher growth rate than firms that don't share these attributes.

A Side By Side Comparison of Digital Turbine's Earnings Growth And 38% ROE

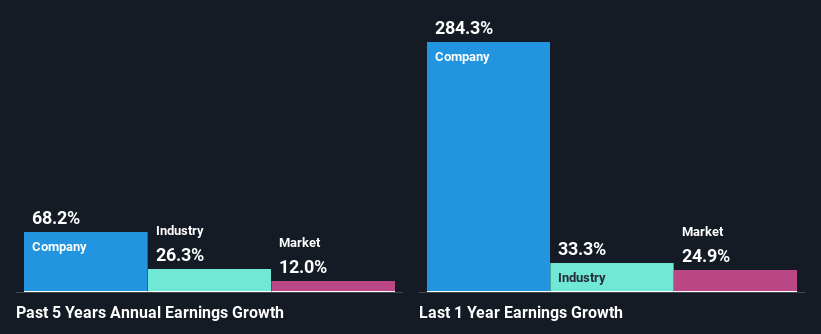

To begin with, Digital Turbine has a pretty high ROE.Additionally, the company's ROE is higher than the industry average of 13%, which is quite remarkable.As a result, Digital Turbine's exceptional 68% net income growth was seen over the past five years, which doesn't come as a surprise.

As a next step, we compared Digital Turbine's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 26%.

Earnings growth is a huge factor in stock valuation. Investors need to determine if the expected earnings growth, or the lack of it, is already built into the share price.Doing so will help them establish if the stock's future looks promising or ominous. Is Digital Turbine fairly valued compared to other companies? These 3 valuation measures might help you decide.

Digital Turbine remains a presence in 22 hedge funds’ portfolios at the end of the Q1 2021, therefore institutional interest in the stock remains high.

Conclusion

In total, we are pretty happy with Digital Turbine's performance.Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This, of course, has caused the company to see substantial growth in its earnings.Having said that, the company's earnings growth is expected to slow down, as forecast in the current analyst estimates.

To know more about the company's latest analysts' predictions, check out this visualization of analyst forecasts for the company.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqCM:APPS

Digital Turbine

Through its subsidiaries, operates a mobile growth platform for advertisers, publishers, carriers, and device original equipment manufacturers (OEMs).

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion