- United States

- /

- Software

- /

- NasdaqCM:APPS

Digital Turbine (APPS) Valuation: Assessing Upside After Q2 Growth and Raised Outlook

Reviewed by Simply Wall St

Digital Turbine (APPS) just delivered its second-quarter 2026 results, showing improvements that caught the attention of many investors. The company posted an 18% boost in revenue and upgraded its full-year outlook, which suggests ongoing momentum.

See our latest analysis for Digital Turbine.

Despite Digital Turbine’s upbeat earnings and refreshed outlook, volatility has been intense lately. The past week alone saw a sharp 17% drop in share price, following a stellar year-to-date gain of nearly 195%. Over the last 12 months, the company’s total shareholder return of 271% puts its recent rebound firmly in comeback territory, even as long-term investors remain underwater due to tough three- and five-year stretches. With momentum appearing to rebuild and recent news drawing fresh attention, the action is anything but dull.

If this kind of turnaround story has you interested in what else the market has to offer, it could be the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock’s recent rally and improved earnings backdrop, the debate is now whether Digital Turbine is still trading at a discount or if all the upside has already been factored in by the market. Is this a genuine buying opportunity, or are investors simply paying for future growth?

Most Popular Narrative: 40.7% Undervalued

Compared to the latest closing price, Digital Turbine’s fair value is set much higher in the most popular narrative. This points to considerable upside in the eyes of consensus forecasters. This perception stands in stark contrast to recent market volatility and offers a radically different angle for investors assessing the risk-reward profile.

Accelerating global smartphone penetration and device upgrade cycles, especially in North America, Europe, and Latin America, are increasing the install base for Digital Turbine's on-device software. This directly drives higher device volumes and supports future top line revenue growth.

Want to know what could really power this bullish outlook? Beneath the surface, the narrative bets on a revenue growth engine, narrowing losses, and a profit multiple more common to established software giants. Can these forecasts defy the market’s recent doubts? Dive in and find out what makes this fair value calculation so provocative.

Result: Fair Value of $8.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, especially if regulatory crackdowns intensify or if key partnerships and distribution channels weaken. These factors could quickly derail the bullish outlook.

Find out about the key risks to this Digital Turbine narrative.

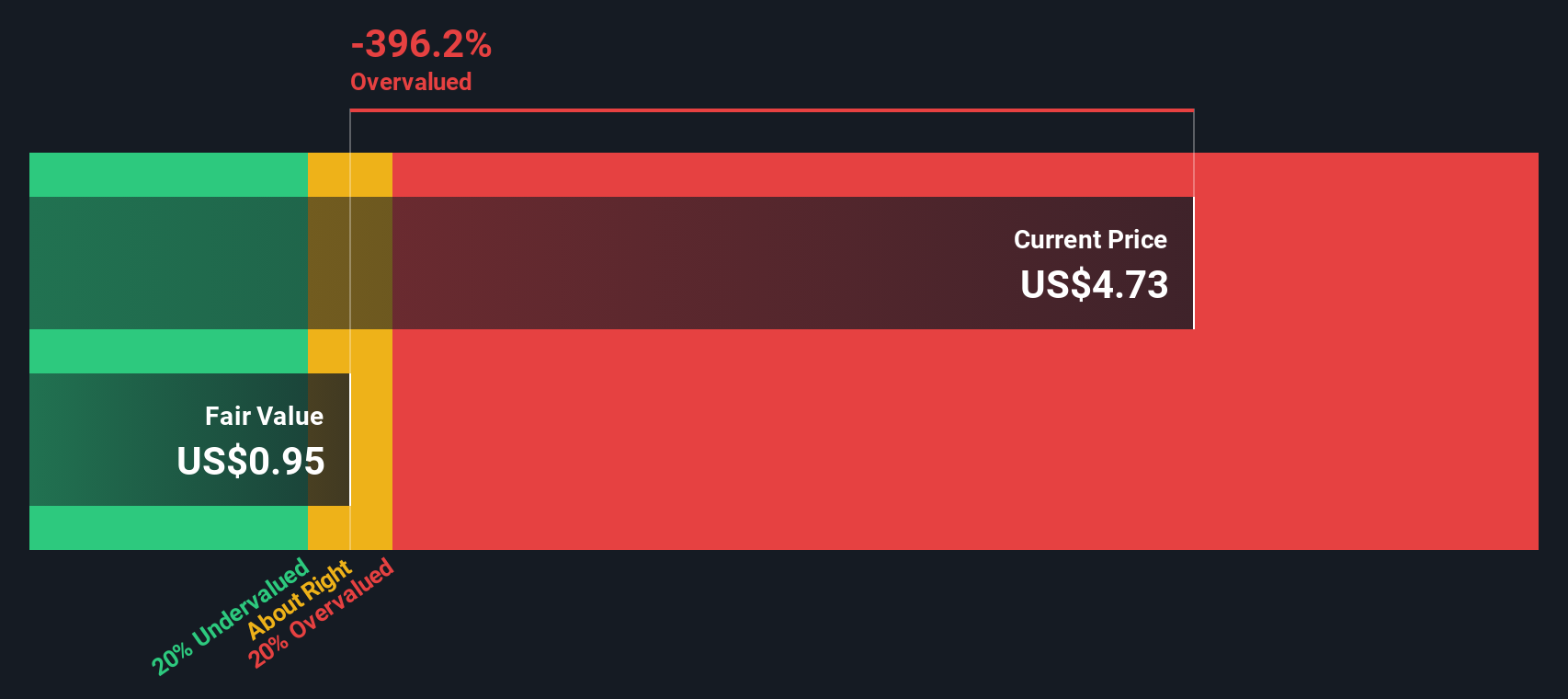

Another View: Discounted Cash Flow Model Raises New Questions

While many focus on Digital Turbine’s revenue and profit multiples to gauge value, our DCF model presents a much more conservative perspective. The SWS DCF model indicates that shares are actually trading far above fair value, pointing to a possible overvaluation using this method. Could the market’s optimism be getting ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Digital Turbine for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Digital Turbine Narrative

If you’re keen to dive deeper or have a different view, you can easily build your own take in just a few minutes. Do it your way

A great starting point for your Digital Turbine research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Expand your investment playbook and keep your momentum going by taking a closer look at other high-potential stocks the market may be overlooking right now.

- Tap into companies redefining digital payments and security by checking out these 82 cryptocurrency and blockchain stocks before their stories make the headlines.

- Spot breakthrough healthcare innovators harnessing artificial intelligence with these 31 healthcare AI stocks and get ahead of the next medical tech surge.

- Unlock businesses trading at attractive prices and poised for gains by reviewing these 885 undervalued stocks based on cash flows while the opportunity window is still open.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:APPS

Digital Turbine

Through its subsidiaries, operates a mobile growth platform for advertisers, publishers, carriers, and device original equipment manufacturers (OEMs).

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives