- United States

- /

- Software

- /

- NasdaqGM:APPN

Appian (APPN) Valuation in Focus After Gartner Leadership Recognition in AI-Powered Automation

Reviewed by Simply Wall St

Appian (APPN) was just recognized as a Leader in the 2025 Gartner Magic Quadrant for Business Orchestration and Automation Technologies, an endorsement that highlights its position in the evolving landscape of enterprise automation.

See our latest analysis for Appian.

Appian's recent industry recognition came on the heels of a modest 7.2% gain in its share price over the past 90 days. However, the 1-year total shareholder return remains in negative territory at -6.9%. While momentum has built up in the short term, the longer view underscores challenges that keep the company trading below previous highs.

If Appian’s push into automation sparks your curiosity, you might want to see which other tech innovators are making headlines. See the full list for free.

Yet with shares still below their recent peaks and growth metrics on the rise, the key question is whether Appian is now trading at a discount or if the market has already factored in all of its future potential.

Most Popular Narrative: 8% Undervalued

With Appian’s most followed narrative estimating fair value above its current closing price, investors have reason to pay close attention to the company’s strategic direction and market catalysts.

Broad enterprise demand for application modernization and workflow automation is accelerating, with AI seen as a catalyst that dramatically lowers modernization costs and complexity. This positions Appian's platform for increased adoption, larger deal sizes, and improved revenue growth over the coming years.

What is the real engine behind Appian’s valuation? High-impact earnings growth, an ambitious margin turnaround, and a profit multiple more often reserved for top performers are included in this narrative’s forecast. Want to see how analysts connect all the dots? The specifics may surprise you.

Result: Fair Value of $33.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing customer down-sells and aggressive moves by larger competitors could quickly challenge Appian’s path to sustained revenue growth and improved margins.

Find out about the key risks to this Appian narrative.

Another View: Discounted Cash Flow Perspective

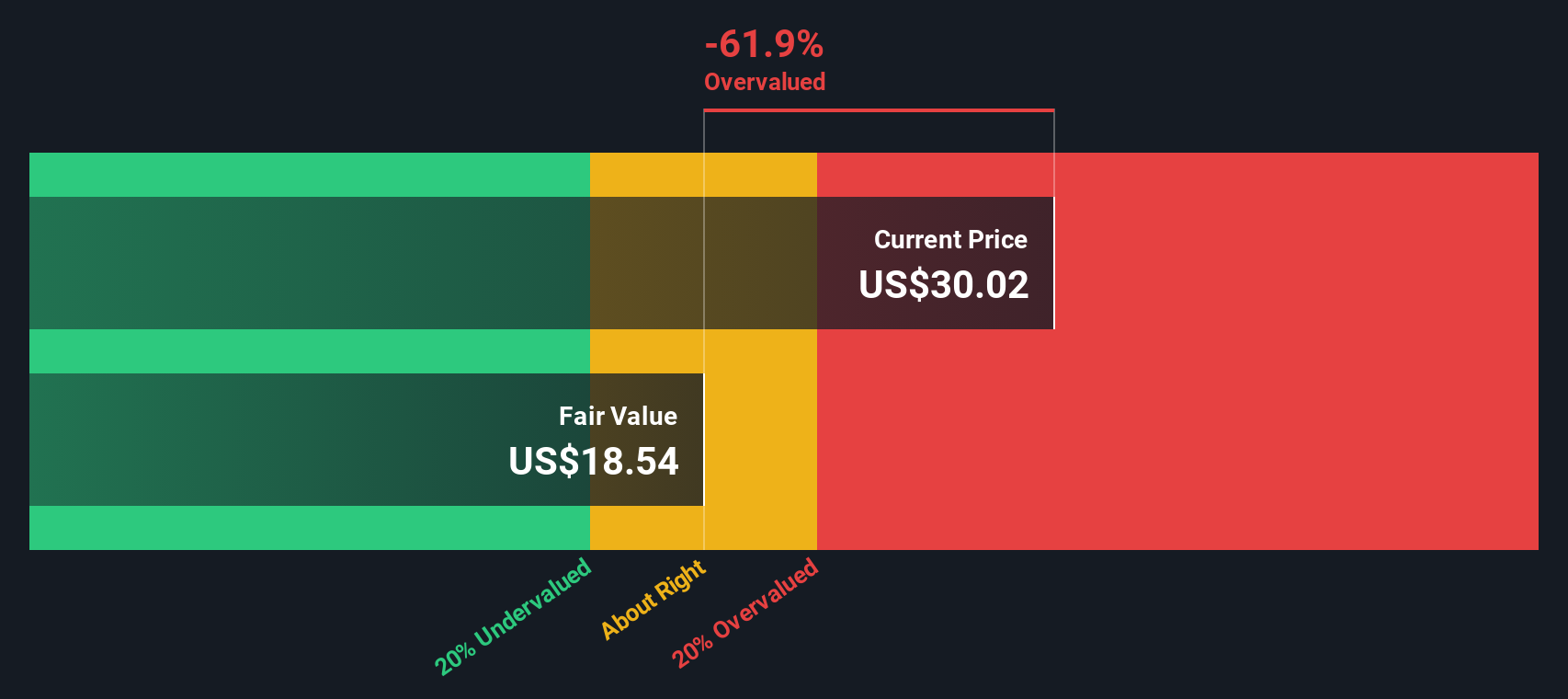

While analysts suggest Appian could be undervalued based on future earnings and industry multiples, our SWS DCF model tells a different story. According to this approach, Appian’s shares trade well above their estimated fair value, which could signal possible overvaluation if growth projections disappoint. Could the market be missing new risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Appian for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Appian Narrative

If you want to dive deeper or challenge these conclusions, you can run the numbers yourself and shape your own outlook for Appian in just a few minutes. Do it your way

A great starting point for your Appian research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next market winner might be just a click away. Don't miss this chance to target promising stocks and uncover opportunities others will overlook. Act now!

- Zero in on stable returns and income by targeting these 20 dividend stocks with yields > 3% boasting yields over 3% and strong cash flows.

- Seize the momentum in artificial intelligence by tracking these 26 AI penny stocks that are redefining what’s possible in automation and smart technology.

- Access massive value upside when you screen for these 867 undervalued stocks based on cash flows trading below their intrinsic worth and primed for potential gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPN

Appian

Operates as a software company in the United States, Australia, Canada, France, Germany, India, Italy, Japan, Mexico, the Netherlands, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives