- United States

- /

- Software

- /

- NasdaqGS:APP

Will AppLovin's (APP) Array Exit Refocus the Spotlight on Its Core AI Ad Platform?

- Earlier this month, AppLovin shut down its Array app distribution tool following allegations and regulatory concerns that the software enabled some apps to be downloaded on user devices without consent, prompting investigations and scrutiny from authorities including the SEC.

- Despite the controversy, analysts and investors have focused on AppLovin’s core advertising technology and AI-driven Axon platform, viewing the removal of Array as alleviating risk and highlighting the company's future growth potential in digital advertising and e-commerce.

- We'll explore how the discontinuation of Array amid regulatory scrutiny impacts AppLovin's investment narrative and outlook for its core platform.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

AppLovin Investment Narrative Recap

To own AppLovin, investors need confidence in its AI-powered Axon platform driving long-term growth in digital advertising and e-commerce, while also recognizing the risks of regulatory scrutiny over data practices. The decision to discontinue Array following consent concerns and ongoing SEC investigations heightens regulatory focus but does not appear to materially impact the biggest near-term catalyst: international and vertical expansion of the Axon Ads Manager. The company's core product rollout remains the central story, although regulatory uncertainty hangs over the outlook.

Most relevant to these events is AppLovin's recent launch of the Axon Ads Manager, a self-service tool initially available via referral. This freshly announced platform, powered by AI for data-driven ad targeting, aims to open new revenue streams and expand beyond gaming into e-commerce, aligning closely with the core growth catalyst many investors are watching.

However, beneath strong product momentum, investors should be aware that intensifying regulatory oversight following Array’s shutdown could...

Read the full narrative on AppLovin (it's free!)

AppLovin's narrative projects $10.5 billion revenue and $6.2 billion earnings by 2028. This requires 22.2% yearly revenue growth and a $3.7 billion earnings increase from $2.5 billion today.

Uncover how AppLovin's forecasts yield a $613.59 fair value, in line with its current price.

Exploring Other Perspectives

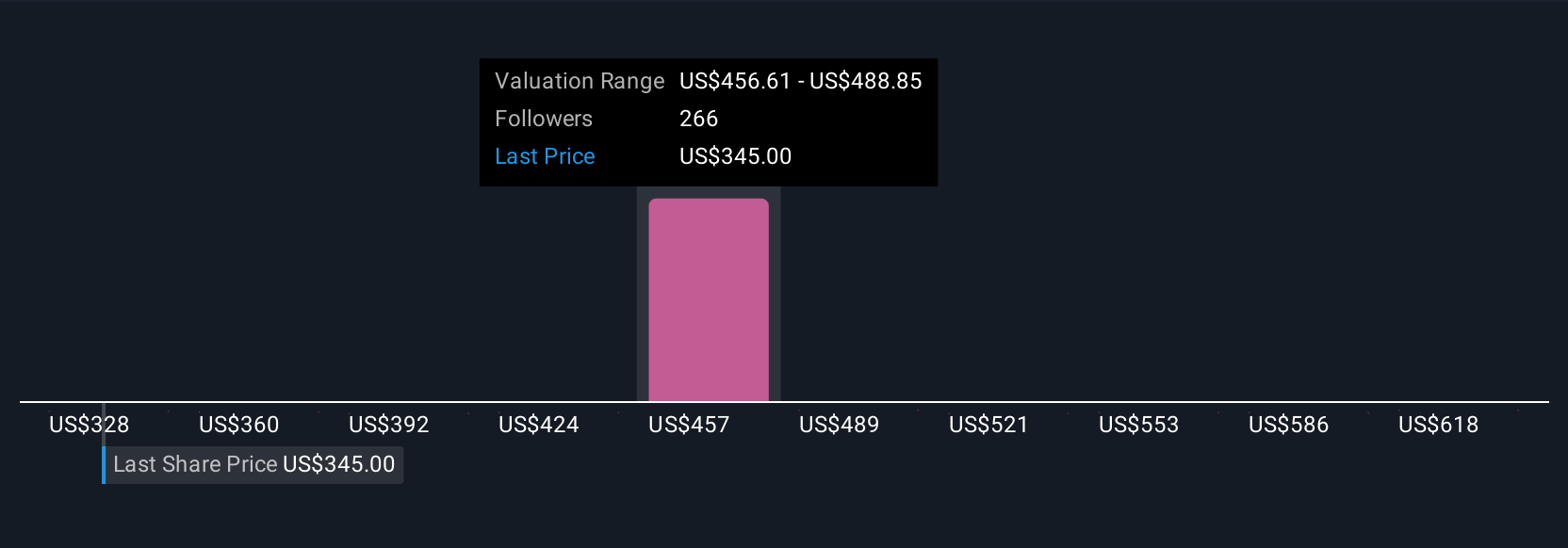

Simply Wall St Community members submitted 25 fair value estimates for AppLovin, ranging from US$318 to US$663 per share. As regulatory scrutiny increases, your outlook on AppLovin’s data practices and platform expansion could shape your expectations for future performance, consider the full spectrum of community insights before deciding.

Explore 25 other fair value estimates on AppLovin - why the stock might be worth 47% less than the current price!

Build Your Own AppLovin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free AppLovin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppLovin's overall financial health at a glance.

No Opportunity In AppLovin?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.