- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (APP) Is Up 16.4% After S&P 500 Inclusion Announcement—Has The Bull Case Changed?

Reviewed by Simply Wall St

- S&P Dow Jones Indices recently announced that AppLovin will be added to the S&P 500 index, joining prior to the start of trading on September 22, 2025 and replacing MarketAxess Holdings.

- This milestone follows AppLovin's shift toward AI-driven advertising technologies and increased focus on e-commerce, reinforcing its positioning in a rapidly evolving digital advertising landscape.

- We’ll explore how AppLovin’s upcoming S&P 500 inclusion may influence analyst views on its future growth and market positioning.

Find companies with promising cash flow potential yet trading below their fair value.

AppLovin Investment Narrative Recap

To be an AppLovin shareholder today, you need to believe that machine learning-powered ad tech and aggressive expansion into e-commerce will add resilience and scale to the business, especially as it faces regulatory and competition headwinds. The S&P 500 inclusion could be a short-term catalyst for valuation and liquidity, but it does not lessen the ongoing risk that global data privacy regulations could meaningfully curb future growth or profitability.

Among AppLovin’s recent announcements, its robust Q2 2025 results, which saw revenue surge to US$1,258.75 million and net income reach US$819.53 million, shine brightest. These record earnings and margin expansion are proof points for the business’s current momentum and play directly into the company’s efforts to broaden its advertiser and publisher base, reinforcing the narrative behind recent optimistic analyst outlooks and short-term enthusiasm around the S&P 500 announcement.

But in contrast, investors should be aware that a single major change in global privacy law or platform policy could...

Read the full narrative on AppLovin (it's free!)

AppLovin's narrative projects $10.5 billion in revenue and $6.2 billion in earnings by 2028. This requires 22.2% yearly revenue growth and a $3.7 billion earnings increase from $2.5 billion today.

Uncover how AppLovin's forecasts yield a $499.14 fair value, a 12% downside to its current price.

Exploring Other Perspectives

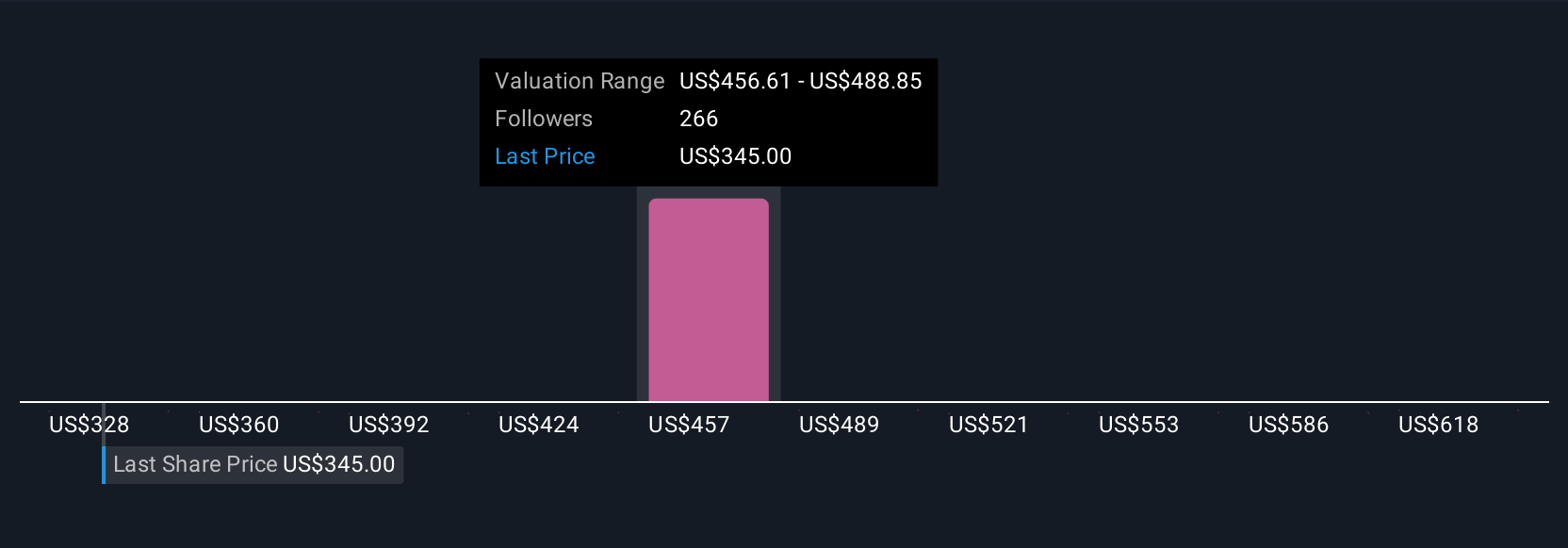

Simply Wall St Community members provided 22 fair value estimates for AppLovin stock, ranging widely from US$334.05 to US$650. With earnings growth closely tied to ongoing AI advancements and expanding advertiser access, you can see just how much investor outlook varies on future returns and risks, explore several viewpoints to get a full picture.

Explore 22 other fair value estimates on AppLovin - why the stock might be worth 41% less than the current price!

Build Your Own AppLovin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AppLovin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppLovin's overall financial health at a glance.

No Opportunity In AppLovin?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion