- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (APP): Evaluating Valuation After Strong Q3 Results and Ongoing Buybacks

Reviewed by Simply Wall St

AppLovin (APP) grabbed attention after releasing third quarter earnings that showed sharp gains in revenue and net income compared with last year. The company also issued updated revenue guidance and continued its share repurchase activity.

See our latest analysis for AppLovin.

AppLovin’s upbeat earnings release and ongoing buybacks come after a period of strong momentum, with a 27% share price return in the past 90 days and a remarkable 91.6% total shareholder return over the past year. While there was a brief pullback in the last month, the bigger picture shows confidence building among investors as the company’s growth story accelerates.

If AppLovin’s breakout caught your attention, you might want to broaden your search and discover fast growing stocks with high insider ownership.

With shares already up more than 90% over the past year, investors are left to consider whether AppLovin still trades at a compelling value or if the market has already priced in its stellar growth prospects.

Most Popular Narrative: 14.2% Undervalued

AppLovin's fair value, according to the most popular narrative, sits well above the last close. This sets up a case for ongoing valuation optimism as the company continues to expand and improve profitability. The current price shows a significant gap from this calculated fair value, drawing focus to the underlying assumptions powering this outlook.

Expanded rollout of the self-service AXON ads manager and Shopify integration is expected to open AppLovin's platform to a massive new base of small and mid-sized advertisers globally, dramatically increasing advertiser count and driving sustained uplift in topline revenue.

What secret powers this lofty valuation? Buried assumptions about future revenue surges, expanding profit margins, and a bold profit multiple could rewrite AppLovin’s financial playbook. Want to discover which ambitious projections drive this bullish narrative and why analysts are betting on a breakout? Unlock the full story behind these headline numbers.

Result: Fair Value of $649.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened regulatory pressures or a slowdown in mobile gaming could seriously challenge AppLovin’s standout growth trajectory and bullish valuation outlook.

Find out about the key risks to this AppLovin narrative.

Another View: High Earnings Multiple Raises Eyebrows

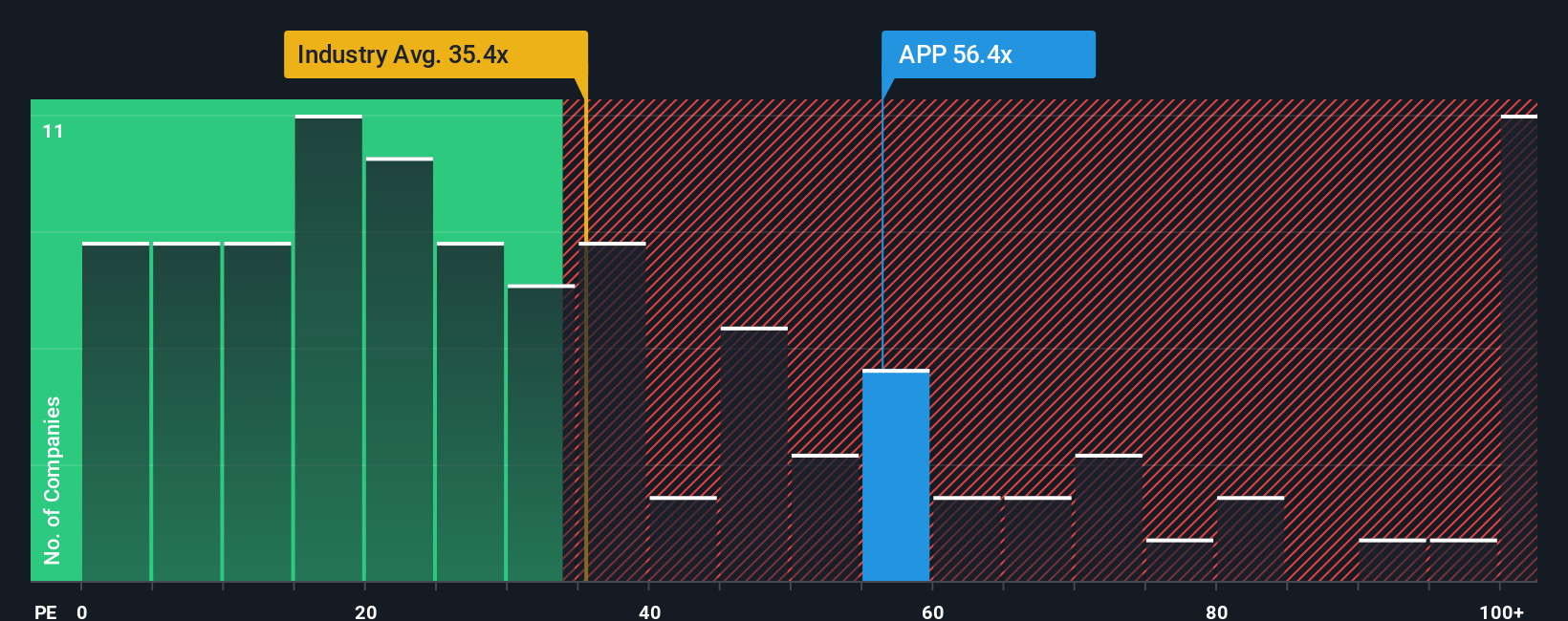

While the fair value calculation suggests AppLovin is undervalued, its current earnings multiple of 64.6× stands well above the US software sector's 31.5× and also exceeds peers averaging 45.8×. The fair ratio for AppLovin is estimated at 59.7×, which suggests that the market may have already priced in significant future growth. This premium raises the question: does it reflect justified optimism, or could it leave investors exposed if expectations change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppLovin Narrative

If you see things differently or want to dig deeper, you can walk through the numbers yourself and shape your own story in just a few minutes with Do it your way.

A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. There are unique stocks packed with potential waiting to be found. Search outside the headlines and get inspired for your next smart move.

- Fuel your growth strategy by starting with these 878 undervalued stocks based on cash flows, where you’ll spot companies trading below their true worth.

- Unlock future healthcare breakthroughs by checking out these 31 healthcare AI stocks and see which innovators are bringing AI to medicine.

- Boost your portfolio with passive income picks by scanning these 16 dividend stocks with yields > 3% for reliable stocks yielding above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives