- United States

- /

- IT

- /

- NasdaqGS:APLD

These Analysts Just Made An Downgrade To Their Applied Digital Corporation (NASDAQ:APLD) EPS Forecasts

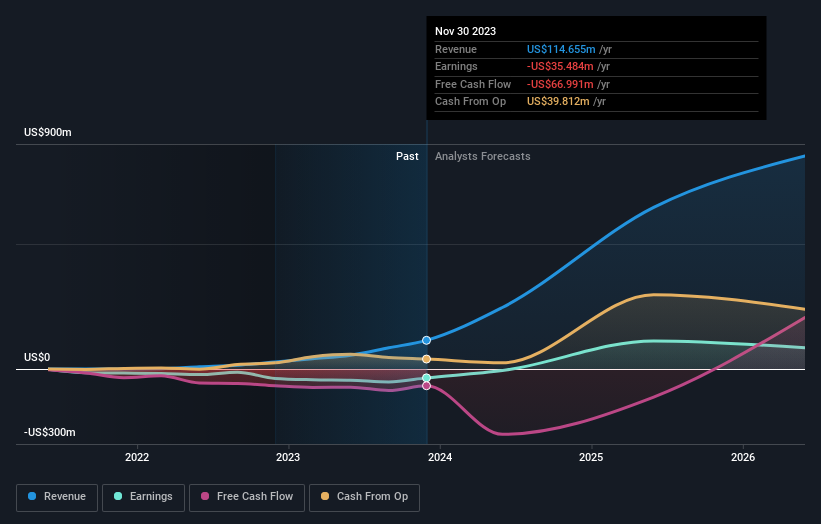

Market forces rained on the parade of Applied Digital Corporation (NASDAQ:APLD) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

After this downgrade, Applied Digital's six analysts are now forecasting revenues of US$246m in 2024. This would be a huge 115% improvement in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 80% to US$0.058. Before this latest update, the analysts had been forecasting revenues of US$349m and earnings per share (EPS) of US$0.29 in 2024. There looks to have been a major change in sentiment regarding Applied Digital's prospects, with a sizeable cut to revenues and the analysts now forecasting a loss instead of a profit.

Check out our latest analysis for Applied Digital

The consensus price target was broadly unchanged at US$14.71, perhaps implicitly signalling that the weaker earnings outlook is not expected to have a long-term impact on the valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We can infer from the latest estimates that forecasts expect a continuation of Applied Digital'shistorical trends, as the 4x annualised revenue growth to the end of 2024 is roughly in line with the 312% annual revenue growth over the past year. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 10.0% per year. So although Applied Digital is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts are expecting Applied Digital to become unprofitable this year. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Applied Digital.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Applied Digital, including dilutive stock issuance over the past year. Learn more, and discover the 3 other concerns we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion