- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital Corporation (NASDAQ:APLD) Stocks Shoot Up 25% But Its P/S Still Looks Reasonable

Those holding Applied Digital Corporation (NASDAQ:APLD) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 53% share price decline over the last year.

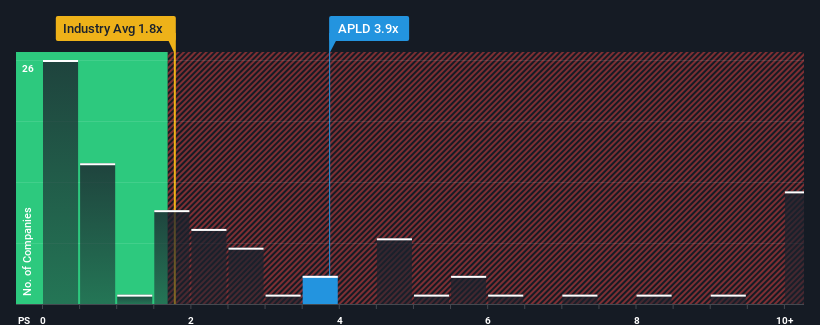

Following the firm bounce in price, you could be forgiven for thinking Applied Digital is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.9x, considering almost half the companies in the United States' IT industry have P/S ratios below 1.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Applied Digital

How Has Applied Digital Performed Recently?

With revenue growth that's superior to most other companies of late, Applied Digital has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Applied Digital's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Applied Digital's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 66% as estimated by the five analysts watching the company. With the industry only predicted to deliver 8.3%, the company is positioned for a stronger revenue result.

With this information, we can see why Applied Digital is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The strong share price surge has lead to Applied Digital's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Applied Digital's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Applied Digital that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions and cloud services high-performance computing (HPC) and artificial intelligence industries in North America.

Low with limited growth.

Similar Companies

Market Insights

Community Narratives