- United States

- /

- Construction

- /

- NasdaqGM:BWMN

Bowman Consulting Group And 2 Other Growth Leaders With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences modest gains amid ongoing trade discussions and anticipation of economic data, investors are closely watching for signs of stability and growth potential. In such a climate, companies with high insider ownership can be particularly appealing as they often indicate strong confidence in the business's future prospects by those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Similarweb (SMWB) | 14.9% | 69.8% |

| Prairie Operating (PROP) | 34.2% | 71.1% |

| Hesai Group (HSAI) | 21.3% | 45.5% |

| FTC Solar (FTCI) | 27.9% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Duolingo (DUOL) | 14.3% | 39.9% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.7% | 24.1% |

| Astera Labs (ALAB) | 15.1% | 44.4% |

Here we highlight a subset of our preferred stocks from the screener.

Bowman Consulting Group (BWMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bowman Consulting Group Ltd. offers engineering, technical, and technology-enhanced consulting services across the United States with a market cap of $440.13 million.

Operations: The company's revenue is primarily derived from providing engineering and related professional services, totaling $444.59 million.

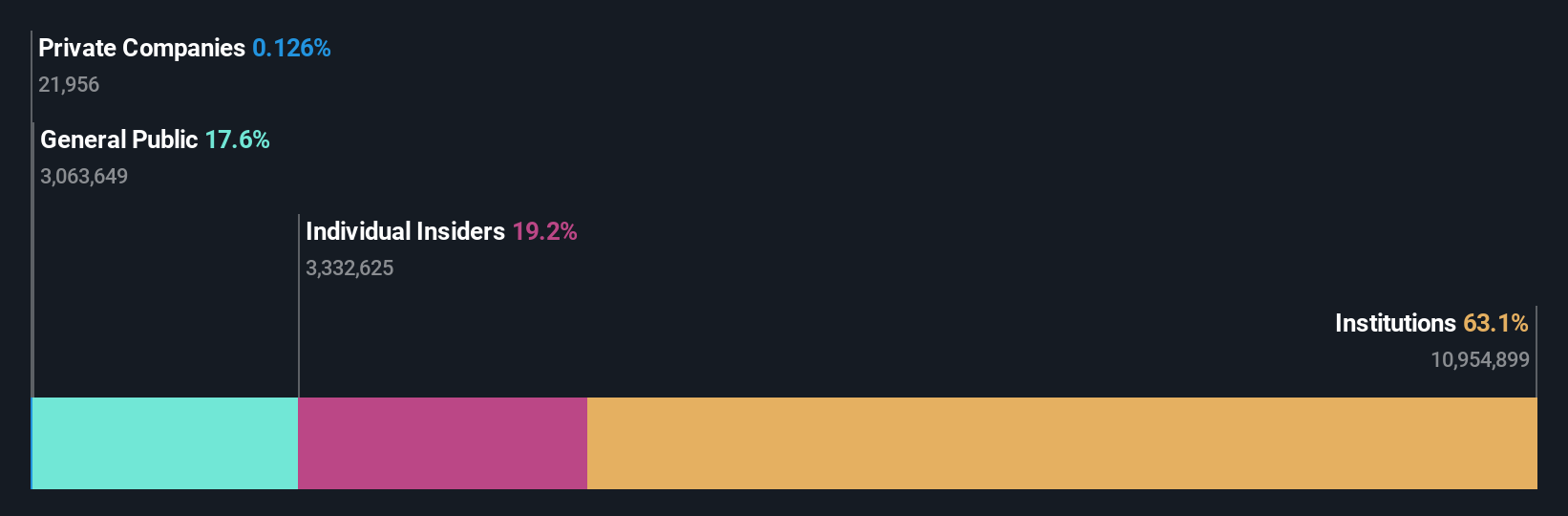

Insider Ownership: 19.7%

Earnings Growth Forecast: 80.2% p.a.

Bowman Consulting Group is experiencing robust growth, with earnings forecasted to rise significantly by 80.2% annually, outpacing the US market's average. The company has secured substantial contracts worth millions in infrastructure projects across the US and expanded its credit agreement to support this growth. Despite a recent net loss, Bowman remains committed to strategic buybacks and has high insider ownership, which may align management's interests with shareholders'. Recent board changes could enhance governance amid these developments.

- Delve into the full analysis future growth report here for a deeper understanding of Bowman Consulting Group.

- Insights from our recent valuation report point to the potential undervaluation of Bowman Consulting Group shares in the market.

Agora (API)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, China, and internationally with a market cap of approximately $346 million.

Operations: The company generates revenue from its Internet Telephone segment, amounting to $133.50 million.

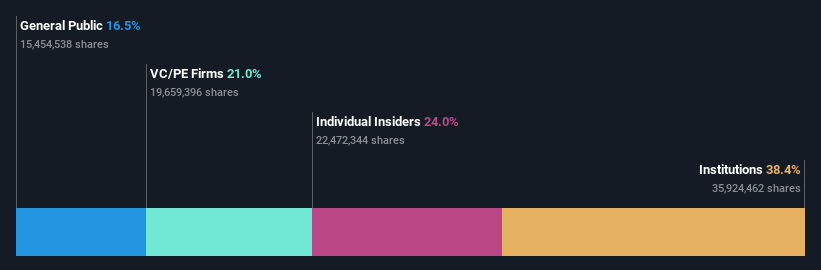

Insider Ownership: 24%

Earnings Growth Forecast: 146.4% p.a.

Agora, Inc. has shown promising financial performance, reporting a net income of US$0.407 million for Q1 2025 compared to a significant loss the previous year. Despite revenue growth being modest at US$33.27 million, Agora's forecasted profitability over the next three years is above average market growth. The company maintains high insider ownership, potentially aligning management with shareholder interests as they navigate market conditions and prepare for future revenue increases between US$33 million and US$35 million in Q2 2025.

- Dive into the specifics of Agora here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Agora's current price could be inflated.

JinkoSolar Holding (JKS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JinkoSolar Holding Co., Ltd. and its subsidiaries are involved in the design, development, production, and marketing of photovoltaic products with a market cap of approximately $963.83 million.

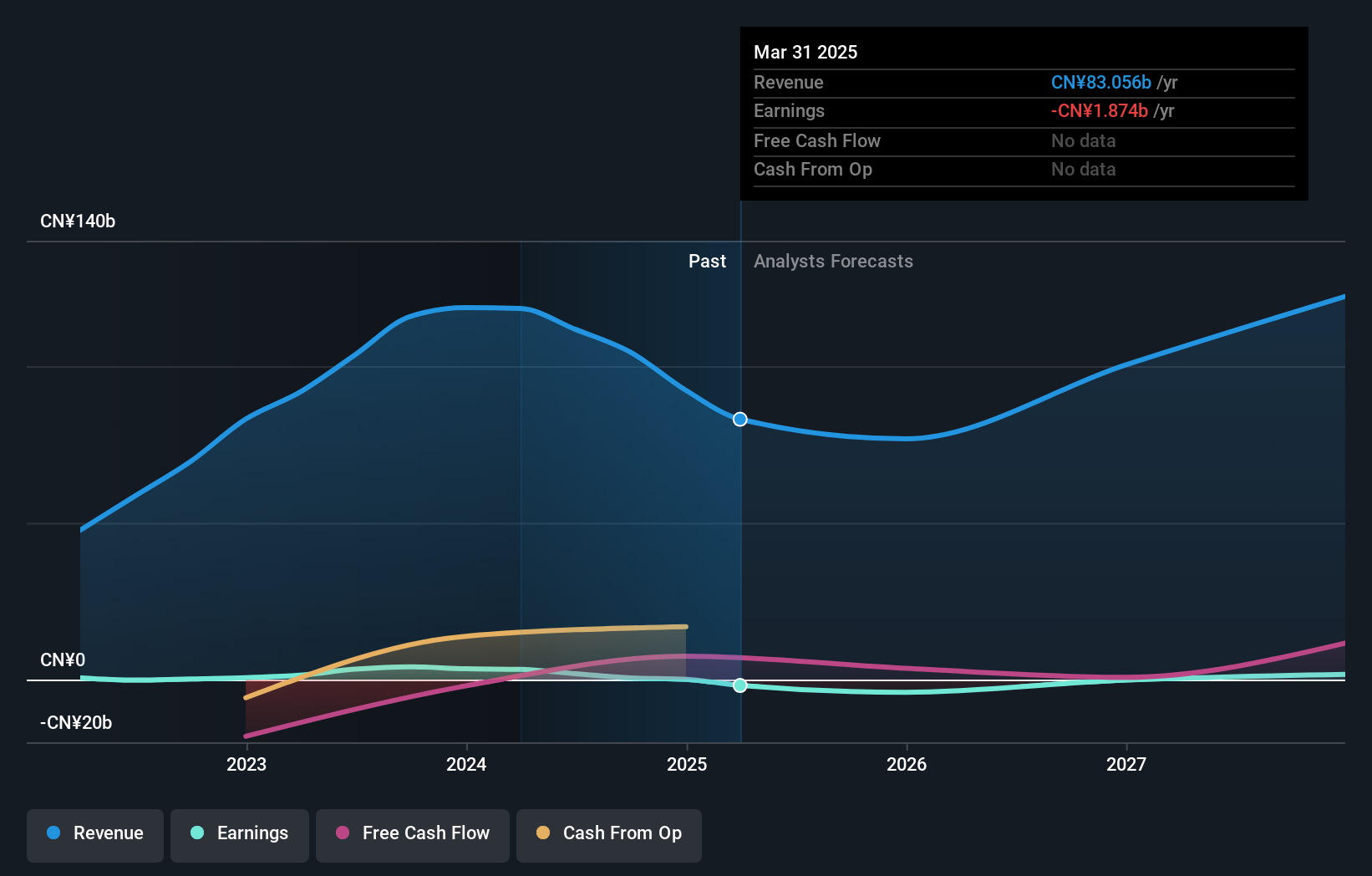

Operations: The company generates revenue primarily from its manufacturing segment, which accounted for CN¥83.06 billion.

Insider Ownership: 39.8%

Earnings Growth Forecast: 76.4% p.a.

JinkoSolar Holding faces challenges with recent financial performance, reporting a net loss of CNY 1.32 billion for Q1 2025, down from a net income the previous year. Despite this, the company is expected to become profitable in three years and shows potential for significant growth in module shipments, aiming for up to 100 GW by year-end. Trading at nearly its estimated fair value suggests good relative value compared to peers, though high debt levels remain a concern.

- Get an in-depth perspective on JinkoSolar Holding's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, JinkoSolar Holding's share price might be too pessimistic.

Where To Now?

- Discover the full array of 189 Fast Growing US Companies With High Insider Ownership right here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bowman Consulting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BWMN

Bowman Consulting Group

Provides engineering, technical, and technology enhanced consulting services in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion