Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies ANSYS, Inc. (NASDAQ:ANSS) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for ANSYS

What Is ANSYS's Net Debt?

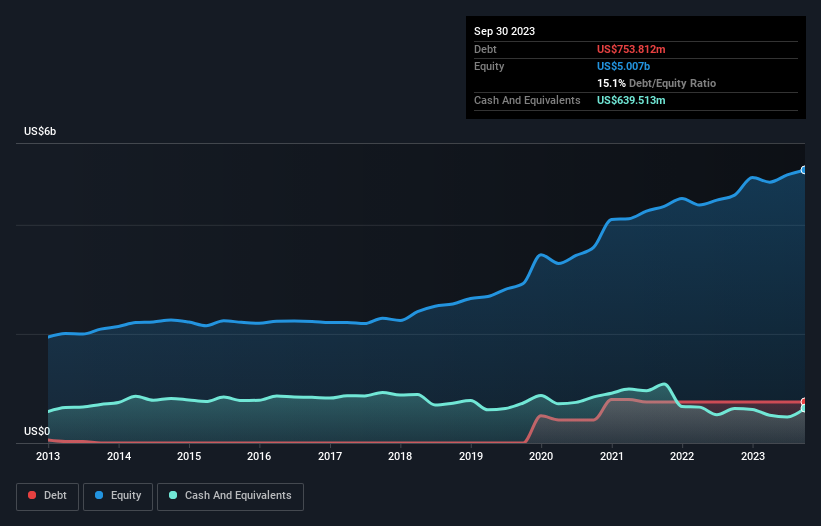

As you can see below, ANSYS had US$753.8m of debt, at September 2023, which is about the same as the year before. You can click the chart for greater detail. However, it also had US$639.5m in cash, and so its net debt is US$114.3m.

How Strong Is ANSYS' Balance Sheet?

The latest balance sheet data shows that ANSYS had liabilities of US$634.4m due within a year, and liabilities of US$1.03b falling due after that. On the other hand, it had cash of US$639.5m and US$847.1m worth of receivables due within a year. So its liabilities total US$180.2m more than the combination of its cash and short-term receivables.

Having regard to ANSYS' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$25.3b company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, ANSYS has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

ANSYS's net debt is only 0.17 times its EBITDA. And its EBIT covers its interest expense a whopping 20.4 times over. So we're pretty relaxed about its super-conservative use of debt. But the other side of the story is that ANSYS saw its EBIT decline by 2.4% over the last year. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if ANSYS can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, ANSYS actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

The good news is that ANSYS's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But truth be told we feel its EBIT growth rate does undermine this impression a bit. Looking at the bigger picture, we think ANSYS's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. We'd be motivated to research the stock further if we found out that ANSYS insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ANSS

ANSYS

Develops and markets engineering simulation software and services for engineers, designers, researchers, and students.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives