- United States

- /

- Software

- /

- NasdaqGS:ALTR

There's Reason For Concern Over Altair Engineering Inc.'s (NASDAQ:ALTR) Price

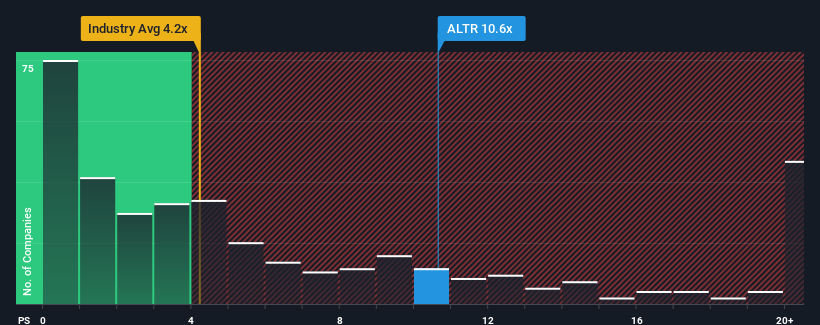

You may think that with a price-to-sales (or "P/S") ratio of 10.6x Altair Engineering Inc. (NASDAQ:ALTR) is a stock to avoid completely, seeing as almost half of all the Software companies in the United States have P/S ratios under 4.2x and even P/S lower than 1.7x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Altair Engineering

What Does Altair Engineering's P/S Mean For Shareholders?

Altair Engineering could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Altair Engineering will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Altair Engineering?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Altair Engineering's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.1% gain to the company's revenues. The latest three year period has also seen an excellent 30% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 8.7% each year as estimated by the eleven analysts watching the company. With the industry predicted to deliver 15% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Altair Engineering is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Altair Engineering's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Altair Engineering, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Altair Engineering that you need to be mindful of.

If you're unsure about the strength of Altair Engineering's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALTR

Altair Engineering

Provides software and cloud solutions in the areas of simulation, high-performance computing, data analytics, and artificial intelligence in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives