- United States

- /

- Software

- /

- NasdaqGS:ALKT

Will Earnings Miss and Investigation Challenge Alkami (ALKT) Leadership’s Credibility and Strategic Vision?

Reviewed by Sasha Jovanovic

- In late October 2025, Alkami Technology reported third-quarter financial results that fell short of consensus estimates for both earnings per share and revenue, and Pomerantz LLP began investigating potential securities fraud by the company and its leadership.

- Amid these challenges, a separate announcement highlighted a new partnership between Spiral and Alkami to add advanced savings and giving tools to Alkami's digital banking platform, with rapid early user adoption.

- We'll explore how the recent earnings miss and related investigation may reshape Alkami's investment narrative around governance and financial prospects.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Alkami Technology Investment Narrative Recap

To believe in Alkami Technology as a shareholder, you need confidence in the continuing shift toward digital banking and the company's ability to win more clients among regional banks and credit unions. The recent earnings miss and news of a securities fraud investigation could weigh on short-term sentiment, but they do not fundamentally alter the primary catalyst, that the ongoing digitization trend among financial institutions could keep driving recurring revenue growth. The biggest immediate risk now centers on the potential consequences of the legal investigation and management's response, as these could impact trust and valuation in the short term.

Among recent updates, Alkami's newly announced partnership with Spiral stands out for its relevance amid current questions regarding execution and growth potential. With rapid adoption reported at Texans Credit Union, this partnership may reinforce Alkami’s case for accelerating product innovation and client wins, key drivers for growth even as near-term earnings volatility remains in focus. But for investors, one question is how much sustained demand from these partnerships can help offset risks posed by regulatory or reputational setbacks...

Read the full narrative on Alkami Technology (it's free!)

Alkami Technology's narrative projects $743.3 million revenue and $62.2 million earnings by 2028. This requires 24.5% yearly revenue growth and a $100.7 million increase in earnings from the current $-38.5 million.

Uncover how Alkami Technology's forecasts yield a $32.56 fair value, a 51% upside to its current price.

Exploring Other Perspectives

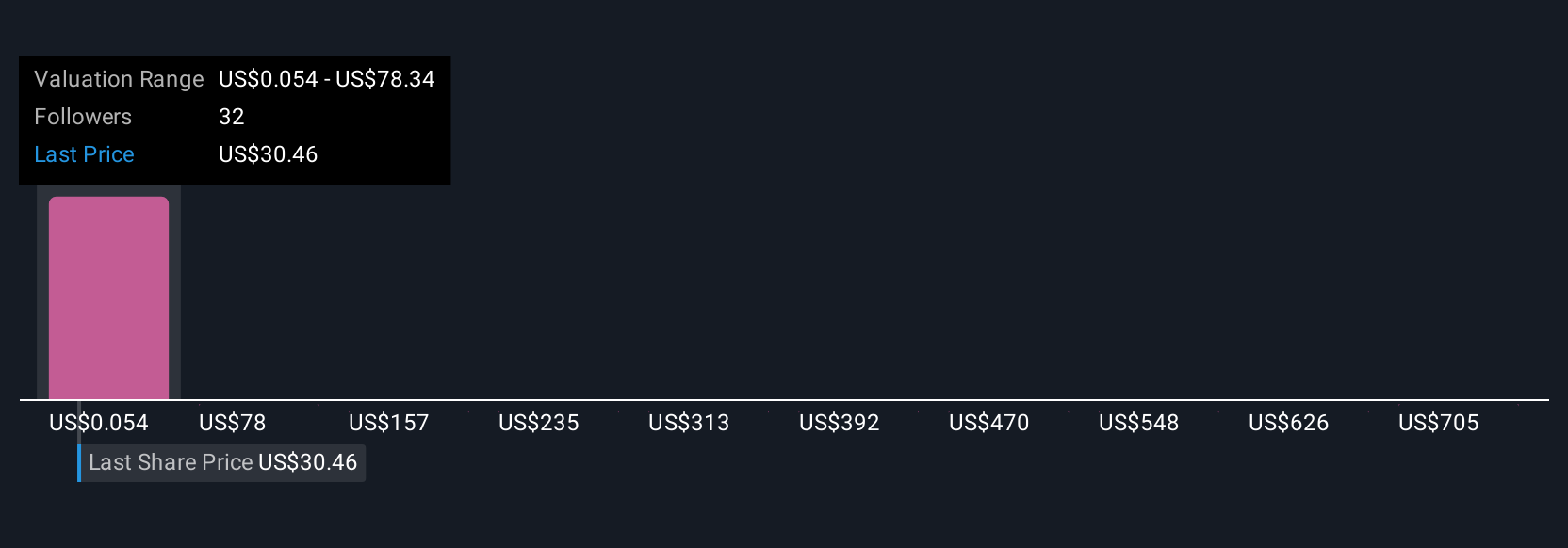

Simply Wall St Community members have posted 11 fair value estimates for Alkami ranging from US$16.54 to US$122.14. While many expect digital transformation to boost recurring revenues in coming years, you should be aware that ongoing legal and regulatory risks could quickly reshape market expectations and future outcomes.

Explore 11 other fair value estimates on Alkami Technology - why the stock might be worth over 5x more than the current price!

Build Your Own Alkami Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alkami Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alkami Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alkami Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives